84334

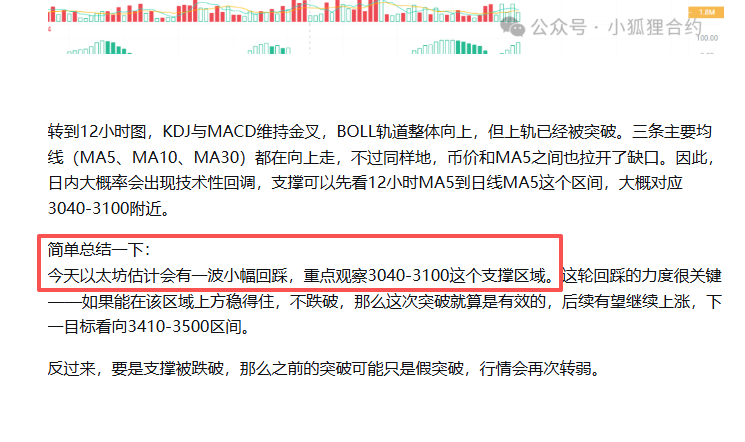

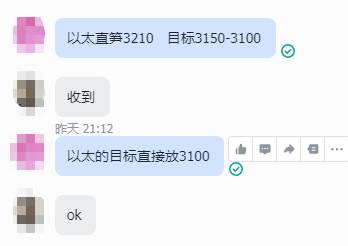

At the daily level, KDJ and MACD are still moving upward, but the BOLL band continues to narrow and move downward. In the main chart, MA5 and MA10 are oscillating upward, but MA30 is still pressing downward, and there is still a gap between the current price of ETH and the 5-day line, so in the short term, I think the technical correction has not been completed yet. The focus below is on the 3100-3040 range.  In the 12-hour chart, KDJ and MACD are also slowly rising, and BOLL is a little open on the upper track, but the overall upward momentum is not strong - it is estimated that the market will slow down as the weekend approaches, and there is a high probability that it will be out of the shock range early next week, and then go unilaterally. Each moving average on the main chart is rising slightly, but the K line has closed its upper shadow line, indicating that the bulls are beginning to be unable to keep up.  The 4-hour short-term is more obvious, KDJ bulls are shrinking, MACD is sticking to the high level and there are downward signs. Although BOLL is rising, the currency price has fallen back and is testing the middle track. Both MA5 and MA10 also turned to form suppression. It can be seen that the selling pressure at the 4-hour level is increasing, and it will continue to fluctuate downward during the day. To sum up: Today, the overall trend is still downward, with the first support looking at 3100-3040. Here is the key - if it is supported, it means that the breakthrough is effective, and the monthly line level gap will start to be filled later. The second target can be 3410-3500. ; If it cannot hold on, then it will continue to fall with heavy volume on the weekly line, and the next support will be the 2600-2500 range.  In yesterday's analysis, it was mentioned that you should step back first, and those who follow this wave will also get a lot of meat.  If you can't get results in the market for a long time, whether it's Xianshuo or Heyue, welcome to join us  |