20383

|

Solana is struggling to continue its gains due to declining on-chain activity, weakening demand for leveraged longs, and competition from newly launched spot altcoin ETFs, which jointly challenge Solana’s price rebound. Key takeaways:

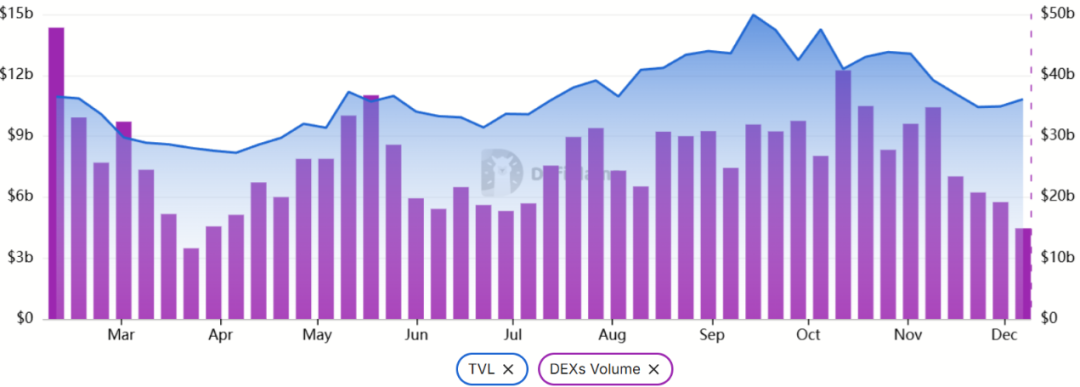

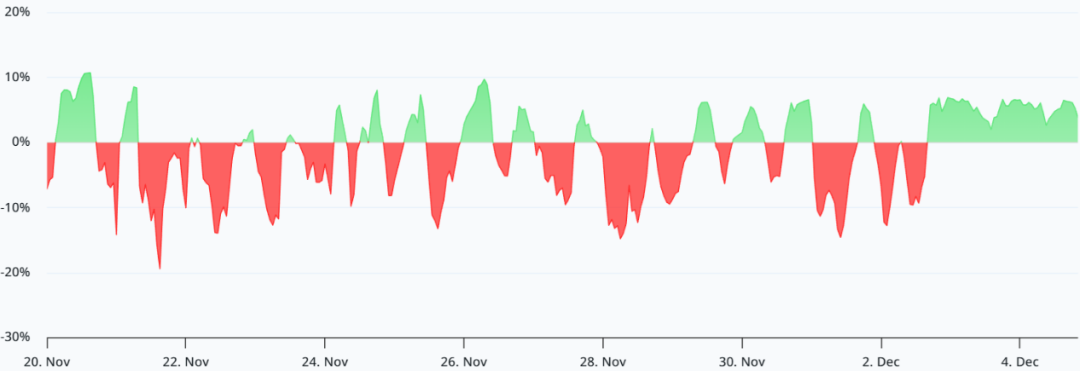

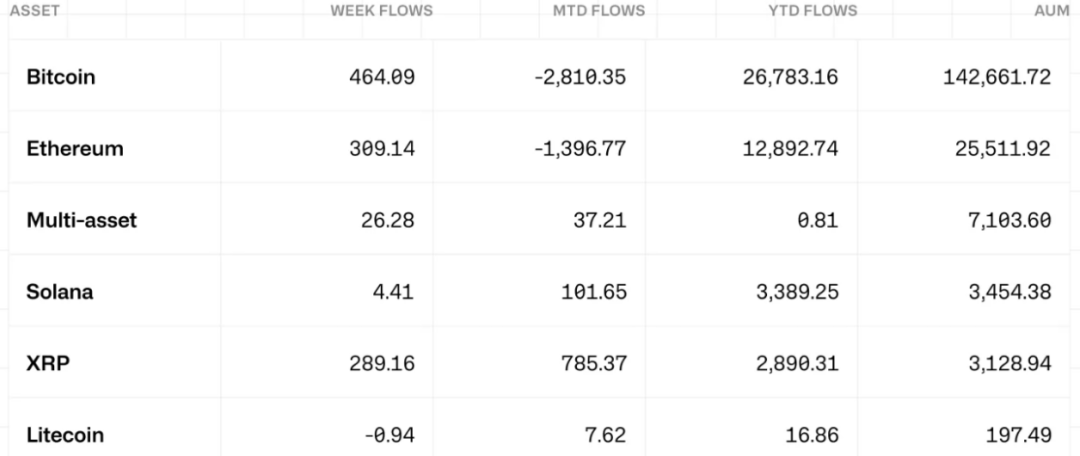

Solana fell 6% after encountering rejection at $147 on Thursday. Investors' risk appetite turned cautious following the release of weak U.S. job market data and sluggish consumer sentiment. Traders are worried that Solana’s return to the $200 mark may take longer than expected, especially after the liquidation of leveraged traders in October and November, while Solana network activity continues to decline.  Solana’s total value locked (TVL) fell to $10.8 billion from $13.3 billion two months ago. Several leading projects in the ecosystem, including Kamino, Jupiter, Jito and Drift, have all seen deposits decline by 20% or more. Adding further pressure, trading activity on the Solana decentralized exchange (DEX) has also fallen sharply. Despite this, Solana maintains its status as TVL's second-largest network. However, Ethereum still dominates, with deposits reaching $73.2 billion. Its second-tier ecosystem—including Base, Arbitrum, and Polygon—continues to attract considerable capital. Ethereum’s Fusaka upgrade on Wednesday improved scalability and wallet management, reducing the incentive for users to migrate funds to competing networks including Solana. Solana DEX trading volume reached $19.2 billion in the seven days ended November 30, down 40% from the $32 billion recorded four weeks ago. As activity on the chain decreases, investors worry that demand for Solana weakens, potentially creating a negative feedback loop with traders leaving the Solana ecosystem in search of better opportunities. For example, the newly launched first-layer blockchain Monad recorded a DEX trading volume of US$1.2 billion in its first week. Layoffs, tighter consumer credit add to pressure on Solana (SOL) sentimentSolana traders were also reacting to a report from global outplacement firm Challenger, Gray & Christmas that businesses cut 71,321 jobs in November, a level only seen twice since 2008. There is also more uncertainty in the area of consumer financing after several U.S. state attorneys general offices requested details from "buy now, pay later" service providers about consumers' ability to repay. A PayPal survey shows that half of shoppers plan to take out a personal loan during the holiday season, raising concerns about tightening credit conditions.  Demand for bullish leverage in SOL futures remains very low, with annualized funding rates at 4%, below the neutral 6% level. This weak belief stems in part from a lack of inflows into the Solana exchange-traded product. According to a Dec. 1 CoinShares report, Bitcoin, Ethereum, and XRP ETPs attracted a combined $1.06 billion in inflows during the same period.  Other altcoins, such as Ripple, Litecoin and Dogecoin, have recently been approved as spot ETFs in the United States, bringing new competition to institutional funds. More Solana competitors are expected to receive spot ETF approval in the coming months. Bearish momentum also reduces the likelihood that the public company will add to Solana reserves through additional issuances. For example, Forward Industries (FWDI US) holds 6.91 million Solana and is currently trading below its initial investment, according to CoinGecko data. Issuing additional issuances at a price that implies its Solana costs are below its reserve levels would dilute existing shareholders' claims on those positions. Solana’s path back to $200 is highly dependent on macro uncertainty easing, but Solana bears could be caught off guard as traders anticipate government stimulus, which could provide the catalyst needed for a broader altcoin rally. This article is for general information purposes only and does not constitute and should not be relied upon as legal or investment advice. The views and opinions stated in the article represent only the author's personal views and do not necessarily reflect or represent the views and positions of Cointelegraph. |