65278

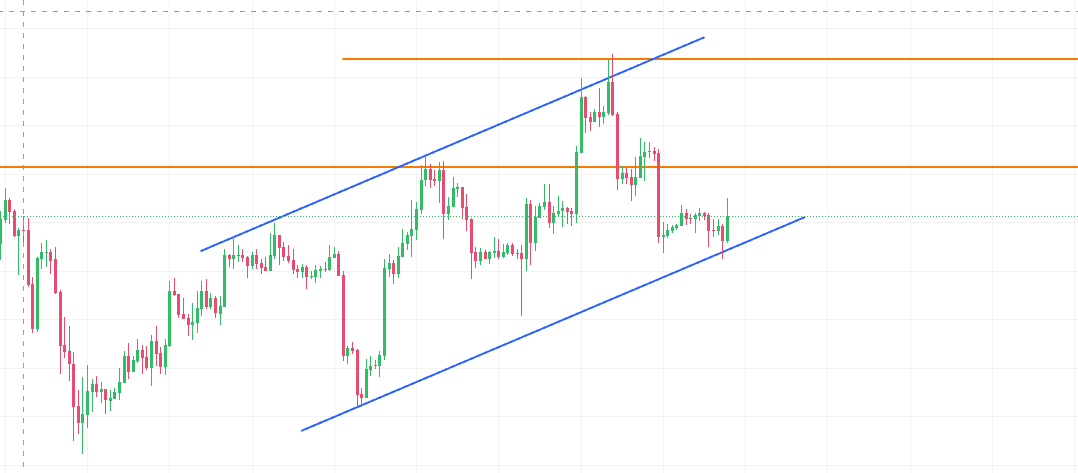

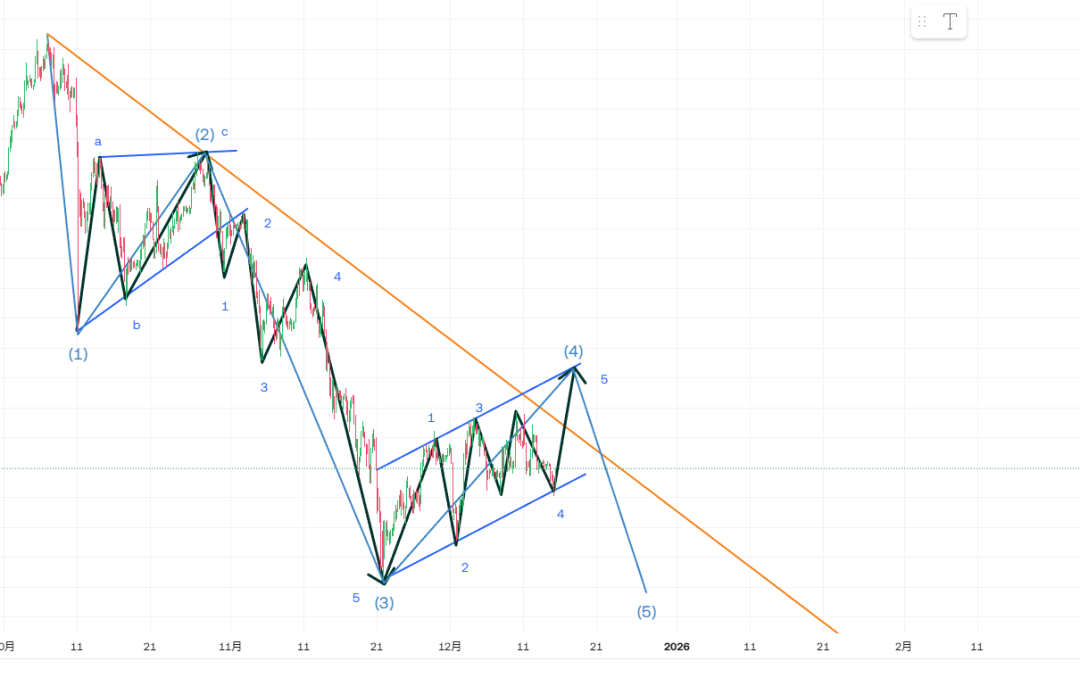

technical analysis ETH/Ethereum Last week it hit MA10 and fell back under pressure, finally closing above MA5. This week, it continued to test the upper suppression zone MA10 moving average. In the short term, it continued to fluctuate near the mid-rail. The pressure plate broke for the first time and went sideways at the weekend to suppress the zone 3140. The trend looks strong. Since the weekly closing line is not perfect, today we focus on the weekly level and choose one direction to sell when the trend hits the pressure zone. You can enter at a low level before reaching it.  Operation idea: Any amount below 3100, stop loss 3035  technical analysis BTC/Bitcoin The trend of the big pie is relatively good compared to the second pie. But the overall operation is weaker. The weekly line hit the high pressure zone and achieved a breakthrough, and finally closed in the negative direction, breaking the consecutive positive pattern twice, and continued to be under pressure at the 94,000 mark this week. In terms of trend, the big pie still adheres to the wave model and after falling 4-4, it is currently launching the last wave of 4-5 platform-shaped adjustment. As the weekly high lead cross signal is collected, the upward trend this week will face the cross high near 84,000, which will continue to be suppressed and cannot be broken. The short-term upper space is limited. Breaking the position opens up room for 4-5 upwards  Operation idea: Breaking through 90700, going back to 90700 and issuing a buy, targeting 91600 and 92400 Any amount below 88500, stop loss 87800  Message analysis Today, the cryptocurrency market experienced a general decline after a period of volatility. The following are the core developments based on the public information of the day. Bitcoin (BTC) Ethereum (ETH) Market background 1. The market’s expectations for the Federal Reserve to cut interest rates in January have significantly cooled down. 2. Standard Chartered and other institutions have significantly lowered their Bitcoin price forecasts. 3. This week will usher in the "Super Central Bank Week", and global monetary policy uncertainty will increase. 1. Dragged down by the overall sentiment of the market. 2. On-chain activity has declined significantly, and network demand has weakened. 3. Whale selling and losses of large investors have hit market sentiment. Market Impact In the cryptocurrency market, more than 115,000 people liquidated their positions within 24 hours, with the total liquidation amount exceeding US$270 million, of which bulls accounted for the majority. Transaction activity in application layers such as the NFT ecosystem has plummeted, indicating shrinking market demand. 1. Macro “headwinds” have become dominant: expectations of interest rate cuts have cooled and global central banks have The core reason why market sentiment has turned cold today largely comes from the macro level: Expectations of the Fed's "pivot" have been thrown cold water: Although the Fed just cut interest rates last week, Chairman Powell's stance on the follow-up path was not clear. According to the latest data from CME's "Fed Watch" tool, the market believes that the probability that the Federal Reserve will keep interest rates unchanged in January next year has surged to 75.6%, while the probability of cutting interest rates by 25 basis points has dropped to 24.4%. This sharp shift in expectations puts cryptocurrencies, as risk assets, at the forefront. “"Super Central Bank Week" brings uncertainty: This week (from December 18), many central banks around the world will announce intensive interest rate decisions. In particular, the market generally expects that the Bank of Japan may conduct a landmark interest rate hike, which is in contrast to the global interest rate cut cycle. This divergence and uncertainty in global monetary policy has prompted investors to wait and see, and risk aversion has increased. 2. Ethereum in on-chain data: weak demand and differentiation among large players Ethereum’s fundamentals are showing some negative signs worth watching today: Network activity has dropped to freezing point: Data show that the number of daily active addresses on the Ethereum network has dropped to approximately 327,000, the lowest level since May 2025. This is a contraction of more than 30% from the August high, indicating that real on-chain user engagement and block space demand are significantly weakening. Whale movements and market pressure: On the chain, the behavior of large position holders diverges and brings pressure. On the one hand, a well-known giant whale sold more than 7,600 ETH at an average price of about $3,129 in the past three days, cashing out about $23.85 million. On the other hand, some large investors that the market is paying attention to, such as Huang Licheng, known as "Big Brother Maji", have faced multiple liquidations due to rapid price declines and accumulated losses. At the same time, the transaction volume and number of buyers and sellers in the NFT market have plummeted, and ecological activity is sluggish. Together, these data paint a picture of insufficient short-term demand and weak market confidence. 3. Institutional views turn cautious Under the pressure of continued price adjustments, the optimism of some Wall Street institutions has also wavered. Jeff Kendrick, global head of digital asset research at Standard Chartered Bank, noted in the report that due to the recent sell-off, the bank has lowered its year-end target price for Bitcoin from $200,000 to $100,000 and postponed the long-term target of $500,000 from 2028 to 2030. The reason he gave is that the purchasing power of the “digital asset treasury”, an important buyer that previously supported the market, may have “come to an end.” Jeff Park, head of strategy at Bitwise Alpha, analyzed that there is structural selling pressure in the current market: early holders of Bitcoin continue to sell options, suppressing prices and volatility, while ETF spot purchases and call option demand are not enough to hedge this pressure. This makes Bitcoin more of a volatile trading asset in the near future. All in all, the market decline on December 15 was mainly triggered by a sudden shift in external macro expectations, while the weakness of data on the Ethereum chain revealed a lack of internal momentum. In the short term, the market's focus will be entirely on the policy signals of global central banks led by the Federal Reserve. |