63368

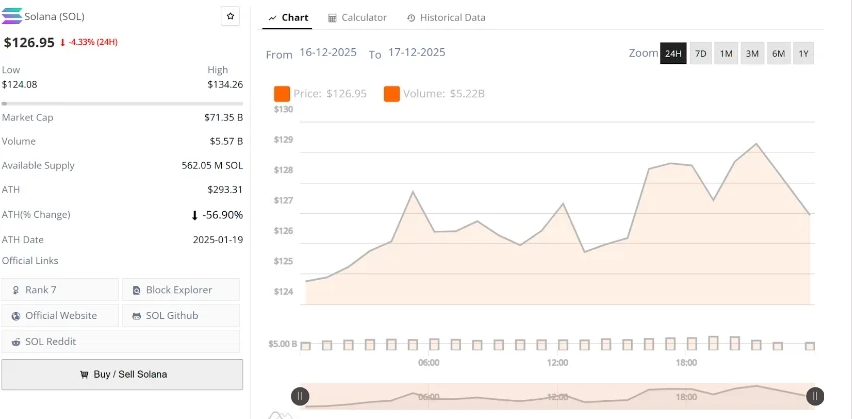

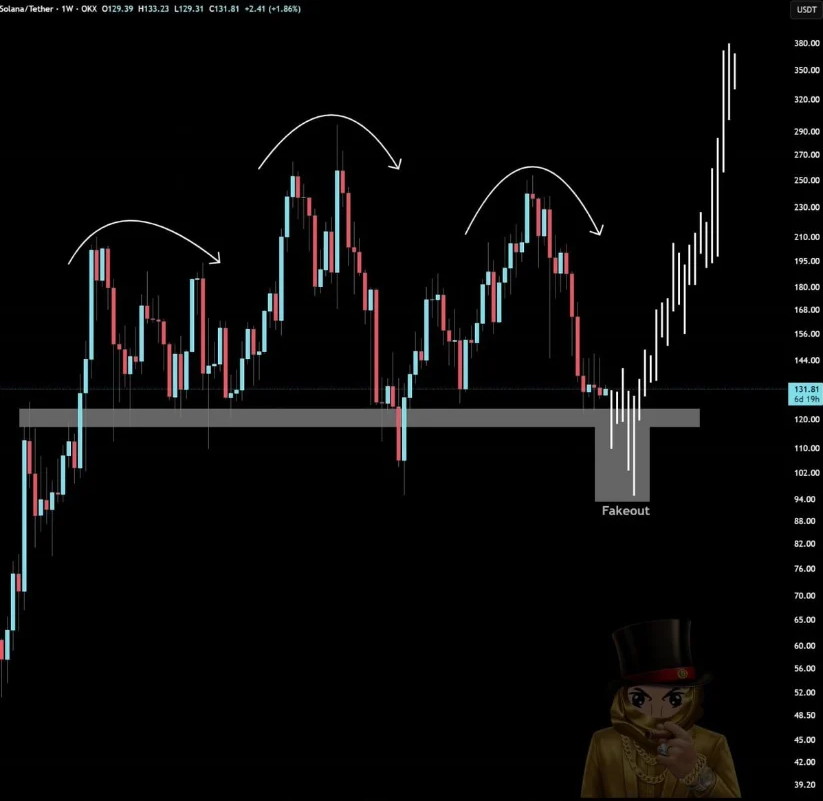

The aviation situation changes rapidly, and the specific entry and exit positions are determined in real time. Just follow the trend if the position is broken! No matter how confident you are, please strictly implement the stop-profit and stop-shoot strategy! That’s all for today! Follow me and don’t get lost! Bull market spot passwords and layout strategies can be shared for free.Solana price is consolidating above the key $120 support area with tight price action and conflicting technical signals as traders focus on whether a breakout or reversal is next.After a lengthy correction period, Solana price is consolidating near key demand areas, with price action showing tightening in the $120 to $130 range.  According to data from Brave New Coin, Solana is trading close to $126.95. SOL fell slightly on the day, but still held the long-term support range that has repeatedly defined the mid-term market structure. As prices narrow within the range, traders are increasingly concerned about whether SOL can continue to hold key support levels. Price range compression brings the $120-$130 price range into focus. A chart of ChiefraT Solana continues to follow a clear horizontal range with price between $120 and $125. The $145-146 range limits upside as demand continues. Prices have fallen back to the lower range multiple times in recent weeks without subsequent selling, further cementing this area as a key support level.  This repeated justification suggests that sellers are grappling with... Rallying Strong After Breaking Below $120 Still, buyers have remained active enough to prevent the price from completely breaking out of the current range. Until SOL clearly moves out of the current range, the market will remain neutral and volatile. As head and shoulders strategies become more clear, the risk of false advertising increases. The Alja Boom report highlights a key behavioral dynamic developing on the Solana chart: the emergence of a clearly visible bearish head and shoulders structure. Elya believes that instead of taking this as an inevitable downward signal, it is better to point out that overly obvious patterns are often false breakthroughs designed to force out late sellers.  His view suggests that any brief move below the neckline could serve as an opportunity for a liquidity grab and could set the stage for subsequent moves. A sharp reversal once the selling pressure disappears. This is consistent with SOL's failure to expand its losses after multiple tests in the same demand area. In the short term, there are downside risks to prices near $129 to $132. From a short-term trading perspective, CryptoTony maintains its bearish view on Solana as long as prices fail to get back on track. The $129-$132 resistance band on his chart highlights this area as a key rejection area where previous rebound attempts have been blocked on multiple occasions. Tony believes that if the price is effectively pulled back from this level, downward pressure will still exist, and $120-122 will still be the main downward target. A break below this support could accelerate the sell-off, targeting the $112-$108 liquidity zone, which coincides with the previous consolidation lows. Until SOL is able to convert $132 into support, he remains adamant that prices will continue to fall rather than rebound.  SOL fell below EMA200, and the weekly structure weakened On higher time frames, analysis from trader Koala reinforces the structurally bearish view. His weekly chart shows Solana closing below its 200-week moving average, which historically is often seen as the dividing line between bull and bear markets.  Solana's chart shows that $120-118 is the last significant weekly support level before prices drop to the macro demand zone of $89-101. He believes this area will be the next major landing zone if the selling pressure continues. In his broader forecast, Koala noted that a full market reset could eventually pull SOL into the $30-$50 area, but stressed that these levels would only be possible if macroeconomic weakness persists. Solana Price Prediction: Key Price Levels to WatchWith bearish pressure dominating both high and low time frames, Solana’s price prediction scenario hinges on a narrow set of technical levels: Immediate resistance:

Main support:

As long as Solana's price remains below $132, downside risks will continue to outweigh upside potential. Bulls will need a strong rally above $145 to break the bearish pattern. SummarizeSolana price is no longer in neutral territory; It is at a technical inflection point and is in control of the bears. The price's repeated setbacks near resistance, coupled with last week's close below the 200-day moving average, indicate that sellers still dominate the overall trend. Unless SOL can forcefully reassert key resistance, Solana's price prediction model favors further declines, especially if $120 fails to hold value. For now, Solana remains on the defensive, with its rebound seen as a reactive reaction rather than a trend shift. The aviation situation changes rapidly, and the specific entry and exit positions are determined in real time. Just follow the trend if the position is broken! No matter how confident you are, please strictly implement the stop-profit and stop-shoot strategy! That’s all for today! Follow me and don’t get lost! Bull market spot passwords and layout strategies can be shared for free. |