93576

|

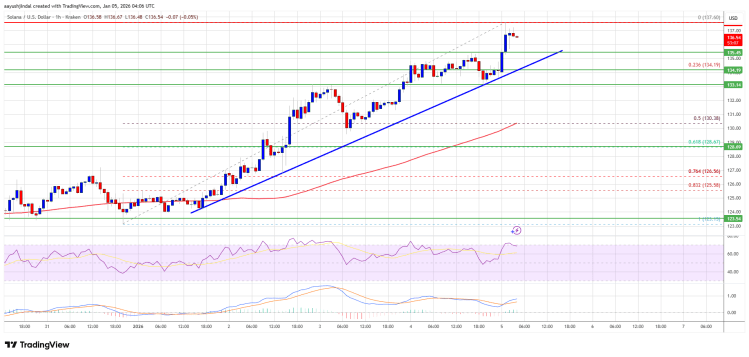

👆Follow me to share Web3 cutting-edge news every day👆Jinqun +Q: 3846328374 The price of Solana (SOL) started a new round of gains above $130 and is currently consolidating above $132. It is expected to further climb to $138 or even higher. Previously, the SOL exchange rate against the US dollar successfully broke through the key levels of US$130 and US$132, and the current price continued to stand above US$132 and the 100 hour simple moving average, indicating a clear short-term upward momentum. Trend review: Steady upward trend after stabilization, technical form is solidLooking back at recent trends, SOL started a steady upward trend after stabilizing above $125, keeping pace with Bitcoin and Ethereum. The price then smoothly climbed above $130, entering a short-term upward channel, and even broke through the resistance level of $132. The bulls successfully pushed the price above $135. Currently, the price is consolidating above the 23.6% Fibonacci retracement level of the uptrend from the $123 low to $138 high, and the technical formation is relatively solid. Enter skirt +Q: 3846328374 Support and resistance: rising trend line escort, multiple resistance levels to be broken throughFrom the hourly chart, SOL/USD is forming an upward trend line, with support locked near $135. In terms of resistance, near US$138 is the primary resistance in the near future, and subsequent key resistances are US$140, US$145 and US$150. If it can successfully stand above the $145 resistance zone, it is expected to lay the foundation for a subsequent steady rise, and further rises may point to $155.  (Data source: TradingView) Enter skirt +Q: 3846328374 Downside risk: The callback support is clear, and the decline may continue if the key level is lost.In terms of downside risks, if SOL fails to break through key resistance, it may start a correction trend. Initial support is at $134 (near the uptrend line), with first major support at $130 (50% Fibonacci retracement of the $123-$138 advance) ; If it falls below the $130 mark, it may test the $128 support zone. Once the closing price falls below $128, it may fall further to around $120 in the short term. Technical Indicators: Many indicators are bullish, buying momentum is sufficientTechnical indicators simultaneously released bullish signals: the hourly MACD indicator accelerated upward in the bullish zone, and the RSI indicator remained above the 50 level, clearly showing that the current market has sufficient buying momentum to provide support for short-term gains. That’s it for today’s article. I don’t know what to do in the bull market. Welcome to join the skirt+V: sun568298 for free.  |