59958

|

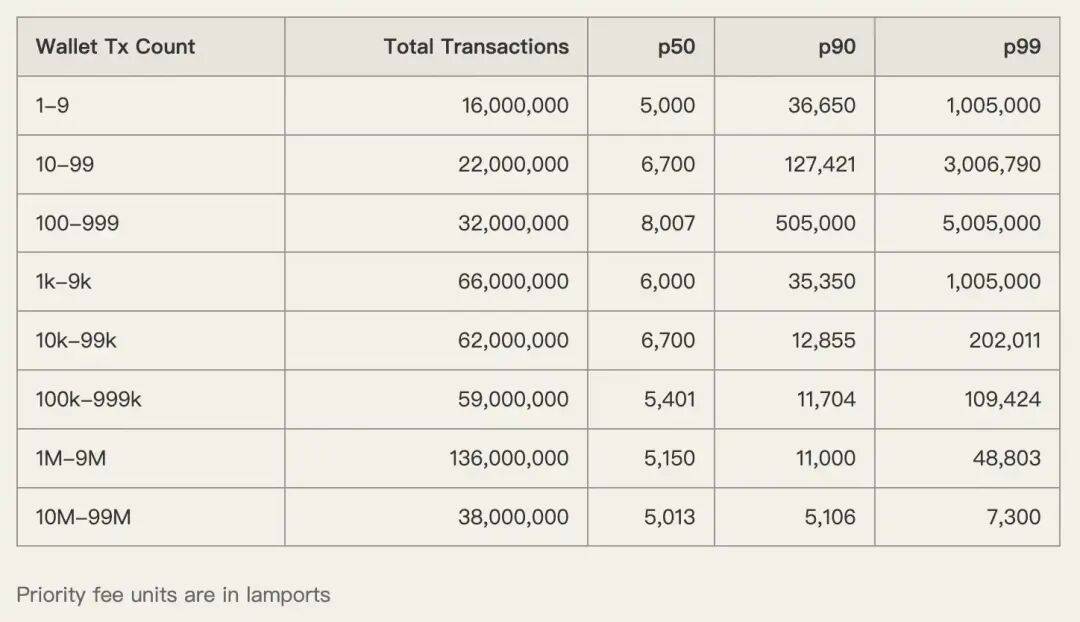

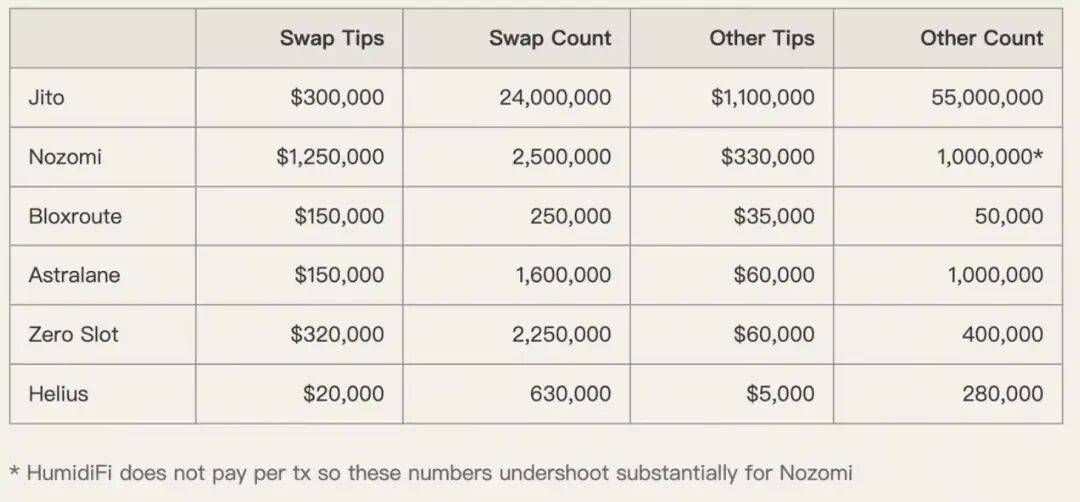

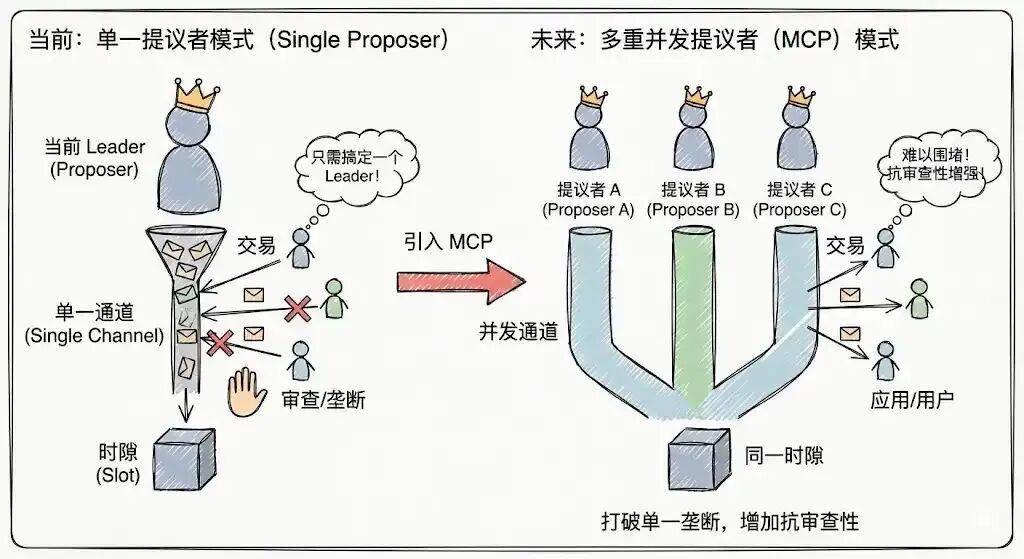

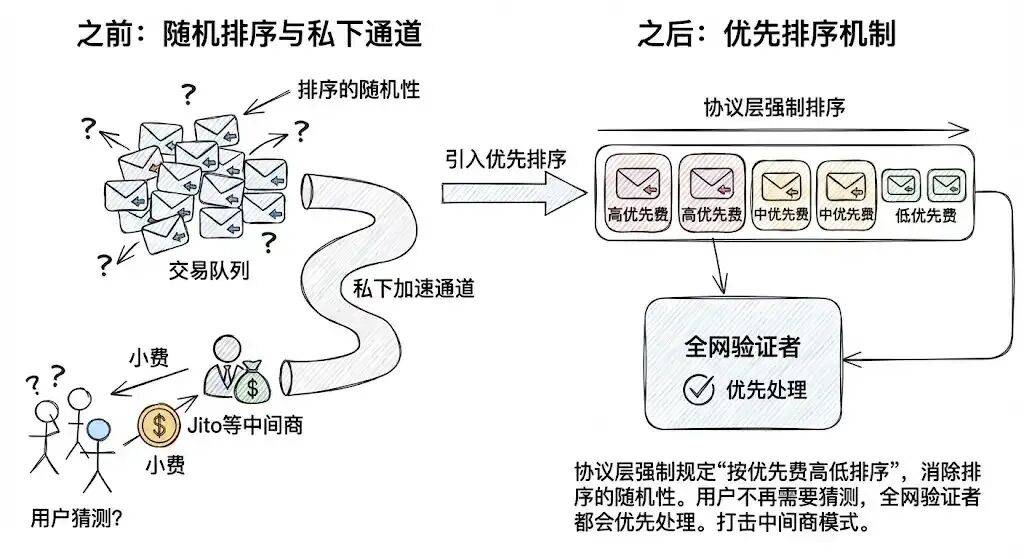

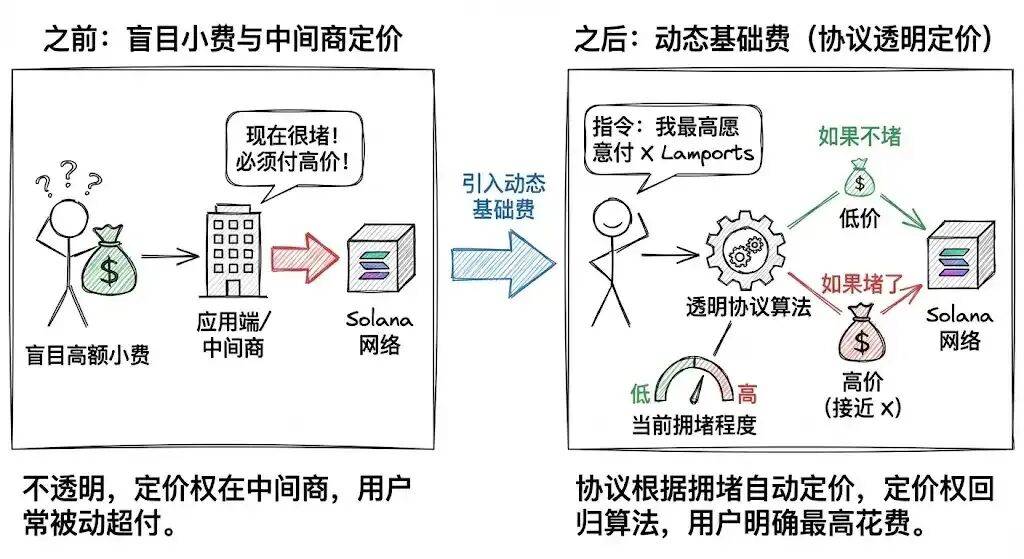

A few years ago, an article titled "Payment for Order Flow on Solana" revealed the dark corner of Solana's fee market and aroused phenomenal attention in English Twitter. PFOF (payment for order flow) has long been a mature business model in traditional finance. It is through this model that Robinhood became the leader in "zero commission trading" and quickly broke out from many established brokers. This strategy not only made Robinhood a lot of money, but also forced industry giants such as Charles Schwab and E-Trade to follow suit, changing the landscape of the U.S. retail brokerage business. In 2021 alone, Robinhood raked in nearly $1 billion in revenue through PFOF, accounting for half of its total revenue that year.; Even in 2025, its PFOF revenue in a single quarter will still reach hundreds of millions of dollars. This shows the huge profits behind this business model. In traditional markets, market makers extremely favor orders from retail investors. The reason is simple. Retail orders are often considered "non-toxic". They are often based on emotions or immediate needs and do not contain accurate predictions of future price changes. By taking these orders, market makers can securely earn the bid-ask spread without having to worry about becoming the counterparty of informed traders (such as large institutional investors). Based on this demand, brokerages (such as Robinhood) package users' order flows and sell them in bulk to market-making giants like Citadel, thereby receiving huge rebates. Supervision in traditional financial markets protects retail investors to a certain extent. The SEC's "National Market System Supervision Regulations" mandate that even orders that are packaged and sold must be executed at no worse than the best price in the market. However, in the unregulated on-chain world, applications are taking advantage of information asymmetry to induce users to pay priority fees and tips that far exceed actual on-chain requirements, and quietly retain these premiums. This behavior is essentially a "hidden tax" that imposes huge profits on unsuspecting users. Traffic monetizationFor those applications that have mastered a large number of user entrances, the means of monetizing traffic are far more abundant than you think. Front-end applications and wallets can decide where users’ transactions go, how they are completed, and even how quickly they are uploaded to the chain. Every "junction" in the life cycle of a transaction hides the business experience of "wiping away" the user value. “Sell” users to market makersLike Robinhood, apps on Solana can sell "access" to market makers. RFQ (request for quotation) is a direct manifestation of this logic. Different from traditional AMM, RFQ allows users (or applications) to directly inquire and complete transactions with specific market makers. On Solana, aggregators such as Jupiter have integrated this pattern (JupiterZ). In this system, the application can charge connection fees to these market makers, or more directly, package and sell batches of retail order flows. As the price difference on the chain continues to narrow, the author predicts that this kind of "selling heads" business will become more and more common. In addition, some kind of alliance of interests is forming between DEXs and aggregators. Prop AMMs (proprietary market makers) and DEX rely heavily on the traffic brought by aggregators, and aggregators are fully capable of charging these liquidity providers and returning part of the profits to front-end applications in the form of "rebates." For example, when the Phantom wallet routes a user's transaction to Jupiter, the underlying liquidity provider (such as HumidiFi or Meteora) may pay Jupiter for the right to execute the transaction. After Jupiter receives this "channel fee", it returns part of it to Phantom. Although this conjecture has not been publicly confirmed, the author believes that driven by interests, this "hidden rule of profit sharing" within the industry chain is almost a natural phenomenon. Vampire market price listWhen the user clicks "Confirm" and signs in the wallet, the transaction is essentially a "Market Order" with slippage parameters. For the application side, there are two ways to process this order: Healthy route: Sell the "Backrun" (trailing arbitrage) opportunities generated by transactions to professional trading companies, and everyone shares the profits. The so-called Backrun means that after the user's buy order in DEX1 pushes up the token price in DEX1, the arbitrage robot then buys in DEX2 in the same block (without affecting the user's buying price in DEX1) and sells in DEX1. Vicious route: Assist clippers (sandwich arbitrageurs) to attack their own users and push up the user’s transaction price. Even taking a benign route does not mean that the application side has a conscience. In order to maximize the value of "trailing arbitrage", the application side has the motivation to deliberately slow down the speed of transactions on the chain. Driven by profits, the application may also deliberately route users to pools with poor liquidity, thereby artificially creating greater price fluctuations and arbitrage space. According to reports, some well-known front-end applications on Solana are doing this. Who took your tip?If the above methods still have some technical barriers, then the black-box operation on "transaction fees" can be said to be "no show at all." On Solana, the fees users pay are actually divided into two parts: - Priority fee: This is a fee within the protocol and is paid directly to the validator. - Transaction tip: This is a SOL transferred to any address, usually paid to a "Landing Service" like Jito. The service provider then decides how much to distribute to the verifier and how much to rebate to the application. Why do you need a landing service provider? Since the Solana network communicates extremely complexly when it is congested, ordinary transaction broadcasts can easily fail. Implemented service providers play the role of "VIP channel". They promise users the successful on-chain transaction through specialized optimized links. Solana's complex block builder market (Builder Market) and fragmented routing system gave birth to this special role and also created an excellent rent-seeking space for the application side. Applications often induce users to pay high tips to "guarantee", and then share the premium with local service providers. Transaction flow and fee landscapeLet's look at a set of data. During the week from December 1 to 8, 2025, Solana generated 450 million transactions across the entire network. Among them, Jito’s implementation service has processed 80 million transactions and occupies a dominant position (93.5% builder market share). Among these transactions, the vast majority are transaction-related swaps, oracle updates, and market maker operations. In this huge traffic pool, users often pay high fees in order to "seek speed". But is all this money really used to accelerate? Not really. Data shows that wallets with low activity (usually retail investors) pay ridiculously high priority fees. Considering that the block was not filled at that time, these users were obviously overcharged. The application uses users' fear of "transaction failure" to induce users to set extremely high tips, and then pockets this premium through an agreement with the landing service provider. Negative Typical AxiomIn order to demonstrate this "harvesting" mode more intuitively, the author conducted an in-depth case study of Axiom, the head application on Solana. Axiom generates the highest transaction fees on the entire network, not only because it has more users, but also because it rips off customers the most. Data shows that the median priority fee (p50) paid by Axiom users is as high as 1,005,000 lamports. For comparison, HFT wallets only pay out around 5,000 to 6,000 lamports. There is a gap of 200 times.  The same is true when it comes to tips. Axiom users tip far more than the market average on landing services such as Nozomi and Zero Slot. The application side takes advantage of users' extreme sensitivity to "speed" and completes double charging of users without any negative feedback.  The author bluntly speculates: “Most of the transaction fees paid by Axiom users eventually return to the pockets of the Axiom team. 」 Take back the power to set feesThe serious mismatch between user incentives and application incentives is the root cause of the current chaos. Users don’t know what a reasonable fee is, and applications are happy to maintain this chaos. To break this situation, we need to start with the underlying market structure. Solana's multiple concurrent proposers (MCP) and priority ordering mechanism (Priority Ordering), which are expected to be introduced around 2026, as well as the widely proposed dynamic base fee mechanism, may be the only way to solve the problem. Multiple Concurrent ProposersThe current Solana single proposer model is prone to forming a temporary monopoly. The application side only needs to get the current Leader to control the transaction packaging rights in a short period of time. After the introduction of MCP, multiple proposers work concurrently in each time slot (Slot), which significantly increases the cost of attack and monopoly, improves censorship resistance, and makes it difficult for applications to contain users by controlling a single node.  Priority OrderingBy enforcing "sorting by priority fee" at the protocol layer, the randomness of sorting (Jitter) is eliminated. This weakens the need for users to rely on private acceleration channels such as Jito just to "survive". For ordinary transactions, users no longer need to guess how much to tip. As long as they pay within the protocol, validators across the network will prioritize it based on deterministic rules.  Dynamic Base FeeThis is the most critical step. Solana is trying to introduce a concept similar to Ethereum’s Dynamic Base Fee. Users no longer tip blindly, but explicitly send instructions to the protocol: “I am willing to pay up to X Lamports for this transaction to be uploaded to the chain. 」 The protocol automatically prices based on current congestion levels. If there is no traffic jam, we will only charge a low price ; If it's blocked, the price will be higher. This mechanism takes the pricing power away from the applications and middlemen and returns it to the transparent protocol algorithm.  Meme brought prosperity to Solana, but it also laid down the root of the disease, leaving behind the impetuous profit-seeking gene. If Solana wants to truly realize the vision of ICM, it cannot allow the applications that control the front-end traffic and the protocols that control the infrastructure to work together and do whatever they want. As the saying goes, "Clean the house before treating guests." Only by upgrading the underlying technical architecture, using technical means to eradicate the soil of rent-seeking, and developing a fair, transparent market structure that puts user welfare first, can Solana truly have the confidence to integrate and compete with the traditional financial system. |