46769

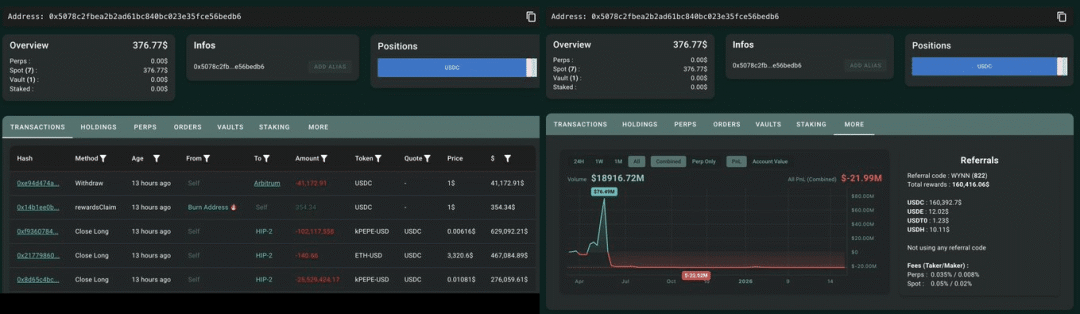

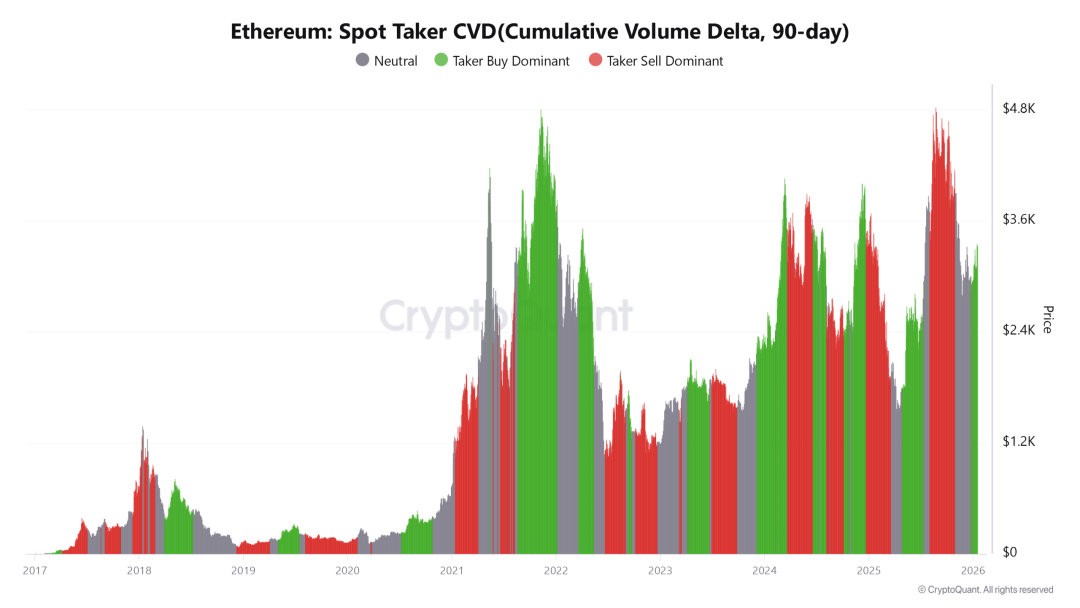

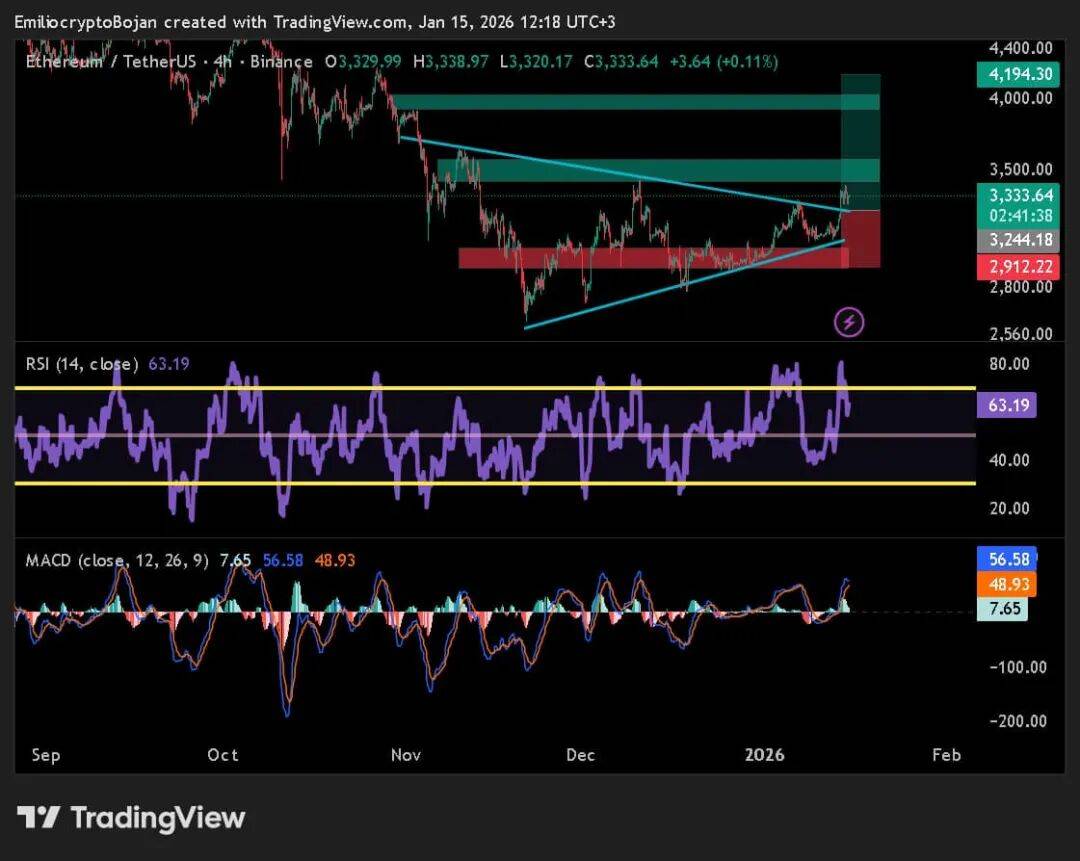

👆Follow me to share Web3 cutting-edge news every day👆Jinqun +Q: 3846328374 1. ETH has a strong start to the year, driven by both institutional and technical aspects.Ethereum (ETH) has had a stellar start to the year, with year-to-date growth exceeding 12.73%, highlighting its price advantage. The continued influx of institutional funds coupled with improving technical indicators further ignited market optimism. However, as ETH tests the key resistance level and the positions are adjusted by well-known large players in the circle, market differences begin to emerge: Can ETH break through the resistance and continue its upward trend, or will it rise higher and fall back to start a correction? 2. The liquidation of positions by large investors caused heated discussions, and the market interpretation was polarized.The actions of James Wynn, a well-known cryptocurrency tycoon, caused waves in the Twitter crypto community - he not only cleared all long positions in ETH and PEPE, but also withdrew funds from the Hyperliquid platform.  (Data source: X) This move left traders in a dilemma: Is Winn's departure an early warning signal of an imminent market correction, or is it just a personal profit-taking behavior? Especially considering that his past large transactions often ended in losses, many traders began to hesitate whether to follow the trend and cut profits, or to continue to hold positions and ride the bull market express. Enter skirt +Q: 3846328374 3. The dominance of buying orders has increased, and the power of bulls is still accumulating.From a financial perspective, since the beginning of 2026, ETH’s take-buy dominance rate has continued to rise.  (Data source: CryptoQuant) One indicator directly reflects the strength of market demand. A rising value means that the number of buyers outnumbers sellers, and the overall short-term market sentiment is bullish. The continued release of buying power has provided solid support for the price of ETH and also made the market look forward to its short-term rise. Enter skirt +Q: 3846328374 4. US$3,450 has become a battleground for bulls and bears, and the technical side sends a cautious signalAs of press time, the price of ETH has stabilized at US$3,333, having successfully exceeded the US$3,300 mark before. If it can effectively stand above the resistance level of $3,450, it is expected to launch an attack on $4,000 in the future. Technical indicators show a trend of differentiation: MACD indicator performs strongly, releasing a bull signal; However, the RSI indicator reading reached 63.19, approaching the overbought range, sending a cautious signal.  (Data source: TradingView) For bulls, the key range of $3,200-3,400 must be maintained if the upward trend is to be maintained. Once ETH fails to break through the resistance level of $3,450, it is likely to pull back downwards to find support. In the short term, traders may wish to wait patiently and wait for clear signals of breakthrough or reversal before making decisions. That’s it for today’s article. I don’t know what to do in the bull market. Welcome to join the skirt+V: sun568298 for free.  |