⚡Ripple obtains FCA license: breaking the ice on UK crypto payment compliance

On January 9, 2026, Ripple officially announced that its British subsidiary Ripple Markets UK Ltd successfully obtained the Electronic Money Institution (EMI) license and crypto asset registration license issued by the British Financial Conduct Authority (FCA). This marks a key step for the world's leading blockchain payments company to operate compliantly in the UK market, and also reveals a major upcoming shift in the UK's crypto regulatory framework.

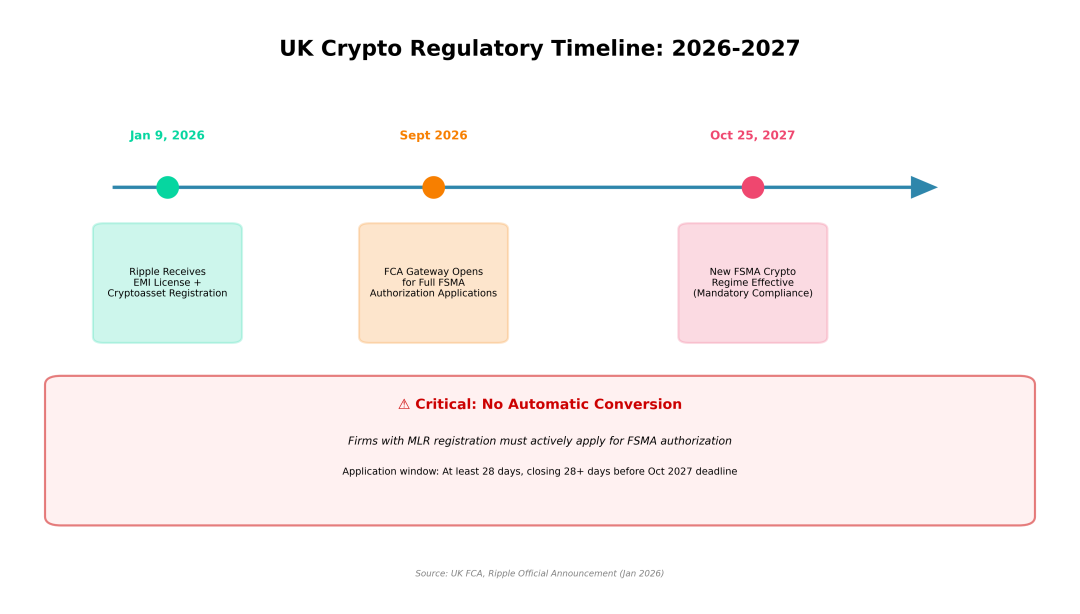

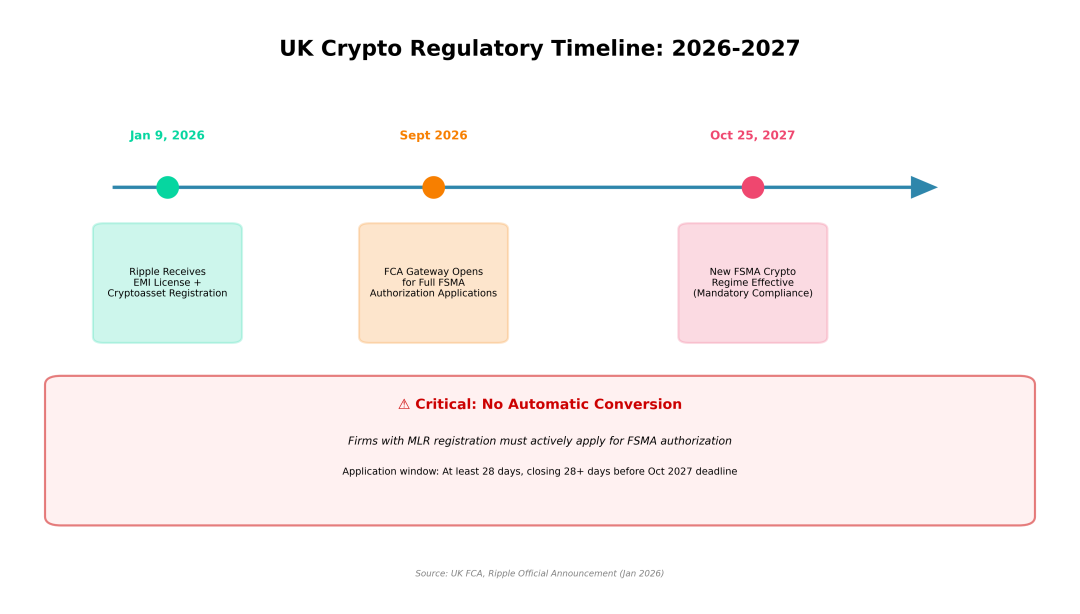

UK Crypto Regulatory Timeline 2026-2027

1. Regulatory Milestones: The Strategic Significance Behind Dual Licensing▸▸◆1.1 Approval details: EMI license + crypto asset registration

On January 9, 2026, the FCA official website showed that Ripple Markets UK Ltd has officially completed the following two core regulatory registrations:

Electronic Money Institution (EMI) License

- Scope of authorization: issuing electronic money, processing payments, managing customer funds

- Regulatory Framework: Comply with Electronic Money Regulations 2011

- Compliance requirements: capital adequacy, segregation of client funds, anti-money laundering (AML) and counter-financing of terrorism (CFT) controls

Cryptoasset Registration

- Registration basis: Money Laundering Regulations 2017

- Core obligations: Customer Due Diligence (CDD), Suspicious Activity Reporting (SAR), Transaction Monitoring

- Supervisory entity: FCA Anti-Money Laundering Supervision Department

Cassie Craddock, managing director of Ripple Europe, said in an official statement: "The FCA's strict compliance requirements are highly consistent with Ripple's commitment to adhering to regulation. Receiving FCA approval is a key moment in Ripple’s development journey, allowing us to provide digital asset infrastructure to UK institutional clients. "

◆1.2 Strategic significance: London as a global compliance pivot

Ripple has set up its largest office outside the United States in London since 2016 and continues to increase personnel investment. The strategic significance of this approval is reflected in:

Compliance first-mover advantage

- The UK is one of the most stringent financial regulatory jurisdictions in the world, and the FCA license has international credibility.

- Provide a "regulatory passport" effect for Ripple to enter other European markets

- After settling the lawsuit with the US SEC, strengthening the global compliance image

Institutional business development

- Target customer groups: British banks, payment institutions, financial technology companies

- Service products: Ripple Payments (cross-border payments), custody services, RLUSD stable currency, Ripple Prime (multi-asset brokerage services)

- Technical advantages: low-cost, high-speed clearing capabilities based on XRP Ledger

Academic and Ecological Investment

- Over £5 million invested in UK universities through Universities Blockchain Research Initiative (UBRI)

- Cultivate compliance talents and promote regulatory technology (RegTech) research and development

Monica Long, President of Ripple, emphasized: "Finance is undergoing fundamental changes, and blockchain and digital assets have become critical infrastructure for the global economy, capable of releasing trillions of dollars of idle capital. "

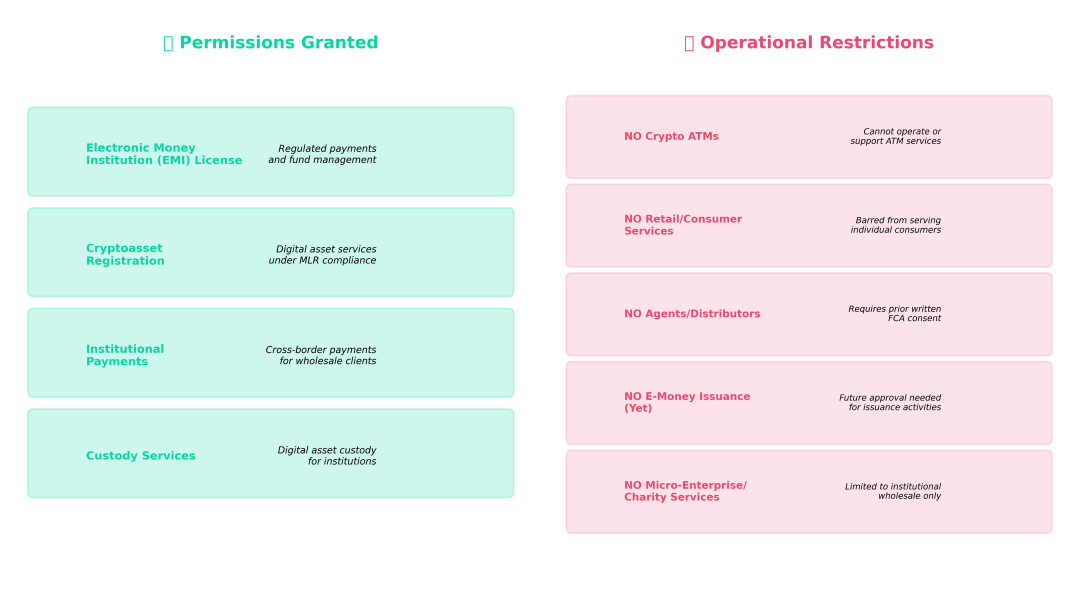

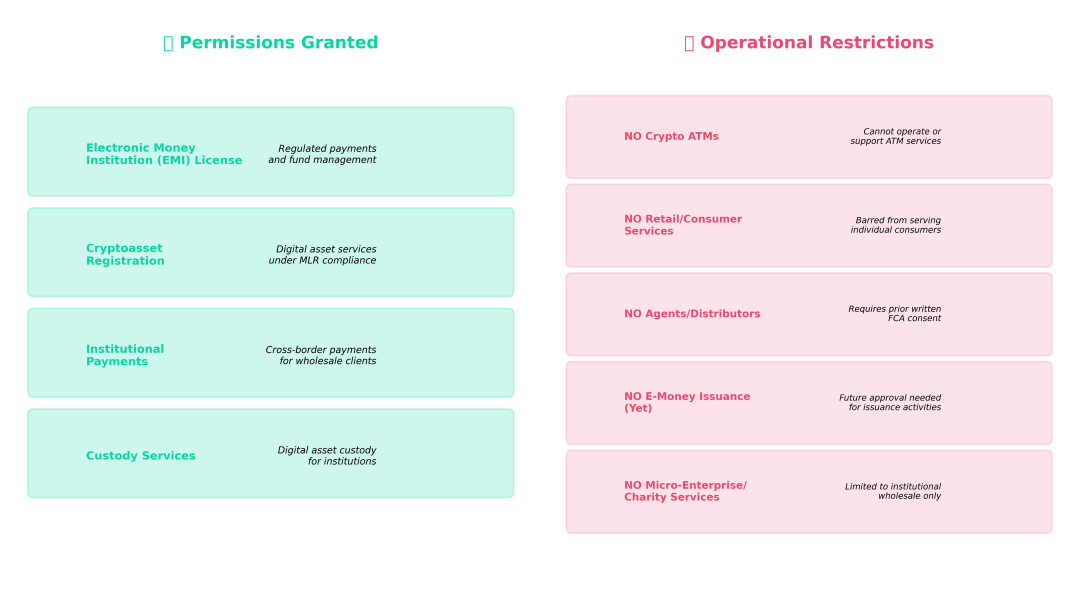

Ripple FCA Permissions vs Operational Restrictions

2. Strict restrictions: Approval does not equal "full license""▸▸◆2.1 Operation restricted area: "semi-permission exclusive to the organization""

Despite obtaining an EMI license and crypto asset registration, Ripple Markets UK currently operates under a severely restricted scope, essentially a "wholesale/institutional exclusive" license, with specific prohibitions including:

❌ Prohibited from operating or supporting cryptocurrency ATMs

- No provision or participation in physical withdrawal/deposit facilities

- Avoid direct exposure of retail users to crypto assets

❌ Prohibited from serving retail clients (Retail Clients)

- No payment or crypto services may be provided to individual consumers

- No services may be provided to micro-enterprises or charities

- Explicitly limited to wholesale markets and institutional clients

❌ No appointment of agents or distributors is allowed without FCA’s prior written consent.

- Need to declare to FCA and obtain approval on a case-by-case basis

- Strict control over third-party partner networks

❌ The issuance of electronic currency is currently prohibited

- Although it holds an EMI license, the actual issuance function requires further approval.

- Distinguishable from payment service processing permissions

❌ Providing payment services to consumers, micro-enterprises or charities is prohibited

- B2B scenario limited to institutional and wholesale customers

◆2.2 Regulatory logic: gradual "sandbox" approval

The FCA’s restrictive approval of Ripple reflects the UK’s basic philosophy on the regulation of crypto assets:

Prudent pilot and risk isolation

- Approval of institutional business first, observing operational compliance and system stability

- Minimize retail risk exposure and protect consumer rights

Dynamic supervision and gradual liberalization

- As Ripple's compliance record accumulates, it can apply to expand the scope of the license in the future.

- Reserve transition space for the new FSMA crypto regulatory regime in 2027

Prevent systemic risks

- Limit agent network expansion and avoid regulatory arbitrage

- Strictly control the flow of funds and ensure that anti-money laundering monitoring covers the entire chain

Industry analysts pointed out: "This 'semi-licensed' model is similar to a regulatory sandbox. The FCA tests Ripple's compliance capabilities through restrictive approval and explores the path for the entire industry. "

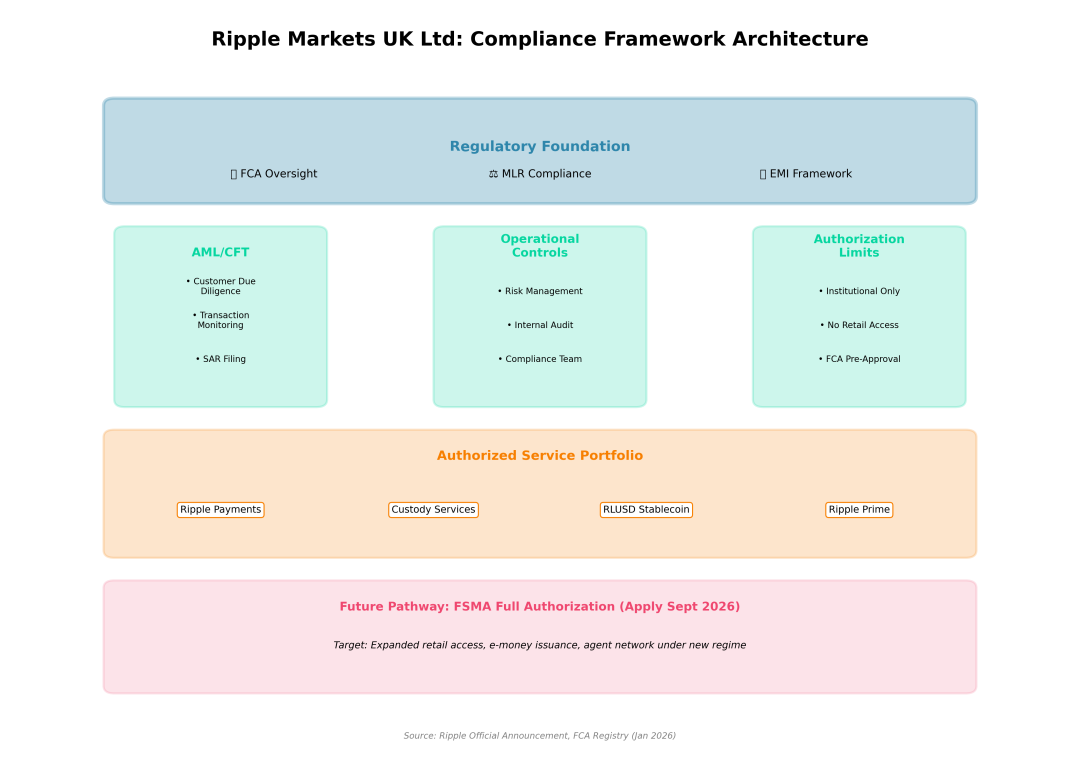

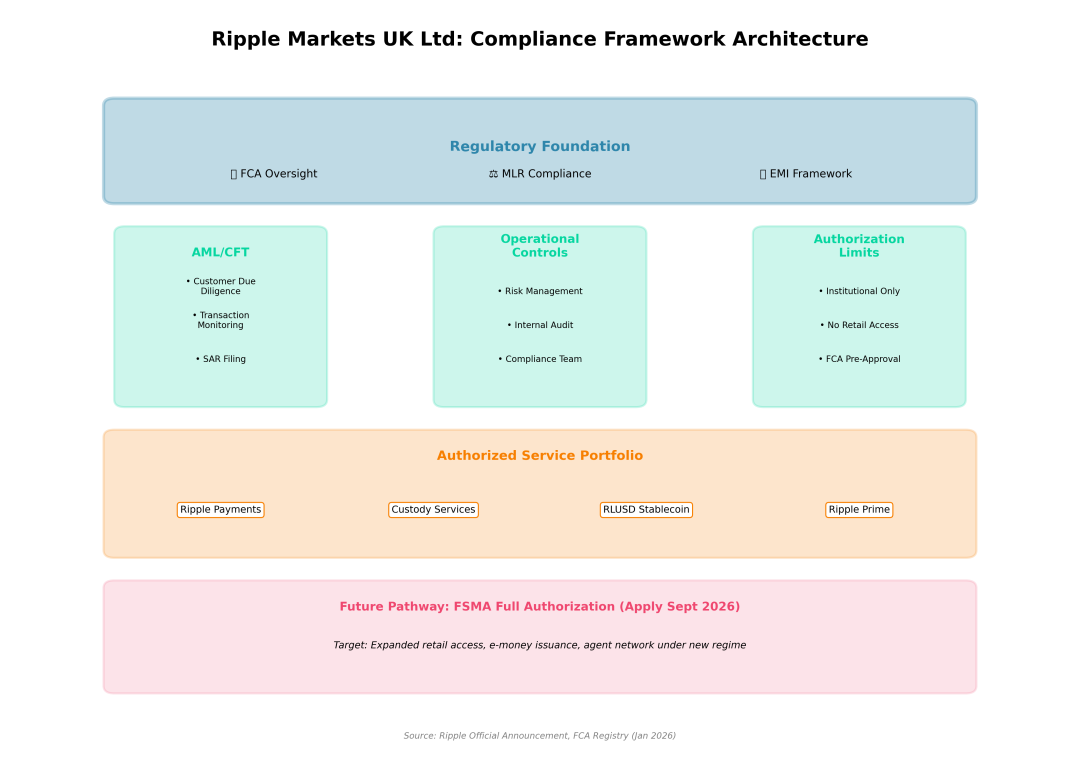

Ripple Markets UK Ltd Compliance Framework Architecture

3. New UK Crypto Regulatory Framework: 2026-2027 Transformation Roadmap▸▸◆3.1 Key time node: forced transition from MLR to FSMA

The timing of Ripple's approval coincides with a major transformation period in the UK's encryption regulatory framework. The FCA has announced a clear timetable:

September 2026: FSMA authorization application window opens

- All crypto asset service providers can begin applying for full authorization under the Financial Services and Markets Act 2000 (FSMA)

- Application window period: at least 28 days, and will close at least 28 days before the new system takes effect in October 2027

- The FCA will provide information sessions and pre-application support services

October 25, 2027: The new FSMA encryption regulatory regime comes into force

- All crypto asset service providers operating in the UK must hold an FSMA authorization

- Existing Money Laundering Regulations (MLR) registrations or payment services licenses will not automatically convert to FSMA authorizations

- Companies not authorized by FSMA will be banned from operating in the UK

Post-2027: Continuing Regulation and Market Access

- Companies that already have FSMA authorization need to update their existing license to cover encryption business

- Crypto companies that rely on third-party authorized companies for financial promotion must obtain direct FCA authorization

◆3.2 The deep logic of institutional transformation

From AML registration to full financial supervision

- The current MLR system mainly focuses on anti-money laundering and counter-terrorism financing, and does not adequately cover market conduct, consumer protection, and prudential supervision.

- The FSMA framework integrates crypto asset service providers into a complete financial regulatory system, covering:

- Capital Adequacy Requirements (Capital Adequacy)

- Conduct of Business Rules

- Consumer Protection

- Prudential Standards

Policy guidelines for mandatory re-application

- Avoid bad money driving out good money caused by "regulatory grandfather clause"

- Raise industry entry barriers and eliminate non-compliant or insufficiently capable operators

- Unify regulatory standards and eliminate loopholes in the existing dual-track system

international regulatory coordination

- Benchmarking with the EU MiCA Regulation (Markets in Crypto-Assets Regulation)

- Laying the institutional foundation for the UK to become a global crypto-finance center

British Treasury officials stated in the 2025 policy document: "The FSMA encryption regime will ensure that the UK becomes one of the safest and most innovative digital asset markets in the world. "

◆3.3 Ripple’s next step: apply again in 2026

For Ripple, the current EMI license and crypto asset registration are only transitional licenses. The key challenges are:

Preparations before September 2026

- Establish a complete FSMA compliance structure: governance structure, risk management, internal audit, compliance team

- Accumulate operational data: prove system stability, anti-money laundering effectiveness, customer due diligence quality

- Prepare application materials: business plan, financial forecast, risk assessment, compliance manual

Apply for FSMA full authorization

- Goals: Lift retail restrictions, allow the issuance of electronic money, expand agent network

- Competitive pressure: Competing with global exchanges such as Coinbase, Kraken, and Binance

- Differentiated advantages: B2B payment genes, institutional service experience, XRP Ledger technology underlying

Market structure after October 2027

- It is expected that there will be a large-scale reshuffle in the UK encryption market, with small and medium-sized operators exiting or being acquired

- Leading platforms (such as Ripple) are expected to gain market share through compliance advantages

Analysts predict: “Ripple’s London office and European team will invest a lot of resources in the next 18 months to prepare the FSMA application, which will be a decisive battle for its European strategy. "

4. Compliance Structure Analysis: How Ripple Meets FCA Requirements▸▸◆4.1 Anti-money laundering (AML) and counter-financing of terrorism (CFT) systems

As an EMI institution and crypto-asset registration entity under FCA supervision, Ripple Markets UK must establish a comprehensive AML/CFT control system:

Customer Due Diligence (CDD)

- Institutional client identity verification: company registration documents, beneficial owner (UBO) disclosure, director background check

- Enhanced Due Diligence (EDD): for customers in high-risk jurisdictions or politically exposed persons (PEP)

- Ongoing Monitoring: Regularly updating customer information and analyzing transaction behavior portraits

Transaction Monitoring & SAR

- Real-time transaction monitoring system: identify abnormal transaction patterns (such as rapid entry and exit, large splits)

- Sanctions list screening: real-time checks against OFAC, UN, EU, and UK sanctions lists

- Suspicious Activity Report (SAR): promptly report suspicious transactions to the UK National Crime Agency (NCA)

Record Keeping & Audit

- Keep transaction records for at least 5 years (in compliance with MLR requirements)

- Receive regular FCA on-site inspections and data audits

- Establish an independent compliance audit department

◆4.2 Capital isolation and prudential supervision

Client funds isolation (Safeguarding)

- EMI license requirements: Customer funds must be separated from the company's own funds and stored in separate accounts

- Investment restrictions: Client funds can only be invested in low-risk, high-liquid assets (such as government bonds, bank deposits)

- Bankruptcy protection: Even if Ripple goes bankrupt, customer funds are protected by law and will be returned first

capital adequacy requirements

- Minimum capital: EMI institutions need to hold a certain proportion of their own capital (depending on the scale of the business)

- Dynamic adjustment: As transaction volume grows, the FCA may increase capital requirements

Operational Resilience

- IT system redundancy backup, network security protection

- Business Continuity Plan (BCP), Disaster Recovery Drills

- Third Party Supplier Risk Management

◆4.3 Market conduct and consumer protection

Although not currently serving retail customers, Ripple is still required to comply with the FCA Market Conduct Code:

Treating Customers Fairly (TCF)

- Transparent fee structure, no hidden charges

- Clear terms of service and risk disclosure

- Efficient complaint handling mechanism

Financial promotion restrictions

- No misleading promotion of crypto assets to the public

- Strictly comply with FCA’s Financial Promotion Rules

Data protection

- Compliant with UK GDPR and Data Protection Act 2018

- Encrypted storage and transmission of customer privacy information

Cassie Craddock emphasized: "FCA's strict requirements are not an obstacle, but a touchstone of Ripple's global compliance strategy. We see the UK as the laboratory setting the highest standards of compliance. "

5. Market reaction: XRP price and industry impact▸▸◆5.1 XRP Price Mild Reaction

Although Ripple’s FCA approval is a major positive, the XRP price reaction has been relatively muted:

price performance

- After the news was announced: XRP rose about 0.7%-1% to a range of $2.09-2.11

- 24-hour trading volume: no significant increase in volume

- Correlation with Bitcoin: maintained around 0.75, not independently strengthening

Market interpretation

- Expected news: There are rumors in the market that Ripple will be approved by the UK as early as the end of 2025, and the news is priced in advance

- Restrictive Approvals: Investors note "institution-only" operating restrictions and see limited short-term business impact

- Macro suppression: The overall crypto market is under pressure in early 2026, and the uncertainty of the Federal Reserve policy suppresses risky assets.

technical analysis perspective

- XRP fluctuates between $2.00 and $2.20, FCA news fails to break key resistance level

- An upward trend needs to be formed with catalysts such as the progress of the US Ripple-SEC settlement and ETF applications.

Crypto analysts commented: "FCA approval is a long-term positive, but the short-term XRP trend depends more on the Fed's interest rate cut expectations and Bitcoin market sentiment. "

◆5.2 Industry Demonstration Effect

Ripple’s FCA approval has important demonstration significance for the entire crypto industry:

Compliance path verification

- Proof that large crypto companies can pass stringent FCA scrutiny

- Provide application experience reference for other exchanges (Coinbase, Kraken)

Improved regulatory standards

- FCA’s restrictive approval model may become a model for global regulators to follow

- Promote the industry's transformation from "technological innovation" to "compliance innovation"

Institutionalization trend accelerates

- Ripple’s institutional exclusive positioning is in line with the general trend of institutionalization in the crypto market

- The lines between traditional financial institutions and crypto companies are increasingly blurring

Reshaping the competitive landscape

- After FSMA becomes mandatory in 2027, the UK crypto market will form a "licensed oligopoly" pattern

- Small and medium-sized players face pressure to exit or be acquired

The head of the British FinTech Alliance said: "Ripple's approval marks a key node in the transformation of British encryption regulation from 'prohibition-grey area' to 'permission-strict regulation'. "

6. Global Compliance Landscape: International Coordinates of British FCA▸▸◆6.1 Comparison with major jurisdictions

United States: Decentralized regulation, litigation driven

- SEC maintains that most crypto assets are securities and promotes supervision through enforcement actions

- CFTC defines Bitcoin, etc. as commodities and governs the derivatives market

- Ripple partially wins SEC lawsuit in 2023 and reaches settlement in 2025

- Features: Overlapping powers of regulatory agencies and high policy uncertainty

EU: MiCA Unified Framework

- MiCA regulations will take full effect in 2024, establishing a unified EU encryption regulatory standard

- Covers crypto asset issuance, service providers, stablecoins, and market abuse

- Features: Legislation first, establishing comprehensive rules at one time

UK: FSMA adaptive regulation

- Incorporate crypto-assets through amendments to the existing FSMA Act rather than separate legislation

- Maintain regulatory flexibility and can dynamically adjust according to market developments

- Features: Gradual transition, phased implementation

Singapore: MAS Licensing System

- Digital Payment Token (DPT) services require MAS license

- Strict capital, technology and AML requirements

- Characteristics: High threshold, cautious

Hong Kong: VASP licensing system

- Security tokens are regulated by the SFC and trading requires a license.

- Retail investors will be allowed to trade approved tokens from 2024

- Features: Integration with traditional financial supervision

◆6.2 Britain’s competitive advantages and challenges

Advantages

- Legal stability: common law tradition, independent judiciary, property rights protection

- Financial infrastructure: London’s position as a global financial center

- Regulatory reputation: FCA’s credibility in international financial supervision

- Talent and innovation: Blockchain research at top universities such as Cambridge and Oxford

challenge

- Post-Brexit coordination: Losing the EU "passport" system and requiring separate coordination with the EU

- Market size: The UK domestic market is smaller than the United States or the European Union, and has limited appeal to global encryption companies

- Regulatory costs: Strict FSMA requirements may lead to excessive compliance costs, which are unbearable for small and medium-sized innovative enterprises.

The director of the Alternative Finance Research Center at the University of Cambridge pointed out: "The UK is trying to find a balance between 'strict regulation' and 'innovation-friendly', but excessive compliance thresholds may drive some innovations to more relaxed jurisdictions." "

◆6.3 Ripple’s Global Compliance Network

Ripple’s FCA approval is an important piece of the puzzle for its global compliance strategy:

Licensed jurisdiction

- United States: SEC settlement reached at the federal level, multiple states hold money service licenses (MSB)

- Singapore: MAS In-Principle Approval

- Japan: Virtual currency exchange license (acquired by Coincheck)

- Switzerland: Operating under the FINMA compliance framework

- UAE: Dubai VARA (Virtual Asset Regulatory Authority) registration

strategic considerations

- Minimize regulatory arbitrage: hold licenses in major markets to avoid compliance risk spillovers

- Institutional Trust Building: Demonstrate global compliance capabilities to banking and financial institution clients

- Business flexibility: Customize products based on license scope in different jurisdictions

future expansion

- License applications in emerging markets such as Brazil, India, and South Korea

- Cooperate with central bank digital currency (CBDC) projects in various countries

Ripple CEO Brad Garlinghouse once said: "Our goal is to become the most comprehensively regulated digital asset company in the world and use compliance to open the door to traditional financial institutions. "

7. Future Outlook: Key Variables in Ripple’s UK Strategy▸▸◆7.1 Success or failure factors of FSMA authorization application

technical factors

- Quality of operational data accumulated before September 2026

- False Alarm Rate and SAR Effectiveness of Transaction Monitoring Systems

- IT system stability and cybersecurity record

market factors

- Actual adoption rate among UK institutional clients (banks, payments companies, fintechs)

- Market acceptance of RLUSD stablecoin in the UK

- Competitiveness with traditional payment networks (SWIFT, CHAPS)

competitive factors

- FSMA application progress of Coinbase, Kraken and other exchanges

- Digital asset business layout of traditional financial institutions (such as HSBC and Barclays)

- Compliant payment solutions for other public chains (Stellar, Algorand)

policy factors

- The British government’s overall attitude towards the encryption industry (whether there is an incentive policy)

- FCA’s approval speed and standards in 2026-2027

- International regulatory harmonization (such as mutual recognition with EU MiCA)

◆7.2 Potential risks and countermeasures

regulatory risk

- Risk: FCA raises the approval threshold during the FSMA transition period and rejects applications for retail business expansion

- Response: Focus on institutional business and indirectly serve retail through the B2B2C model (cooperating banks serve as the front end)

market risk

- Risk: XRP price fluctuates significantly, affecting customer confidence, and cross-border payment demand is lower than expected

- Response: Promote RLUSD stable currency, reduce dependence on XRP price; expand non-encrypted payment channels

technology risk

- Risk: Major security vulnerability or network outage in XRP Ledger

- Response: Multi-chain strategy, supporting cross-border payments on other blockchains (such as Ethereum, Solana)

Competing risks

- Risk: Traditional banks seize the low-cost cross-border payment market through SWIFT upgrades (such as SWIFT Go)

- Response: Emphasize the advantages of instant settlement of blockchain and complement SWIFT rather than replace it.

◆7.3 The key time window of 2026-2027

Q1-Q2 2026: Operation verification period

- Test the market feedback of Ripple Payments, RLUSD, and Ripple Prime under institutional exclusive restrictions

- Establish benchmark customer cases (such as working with British payment companies or emerging banks)

- Optimize compliance processes and prepare for FSMA review

Q3 2026: FSMA application sprint

- Submit materials as soon as possible after FCA opens the application window in September

- Strive to become the first encryption company authorized by FSMA and set an industry benchmark

Q1-Q3 2027: Approval and adjustment

- Cooperate with FCA review, provide supplementary materials and on-site inspection

- Adjust business model and risk control based on FCA feedback

Q4 2027: New system takes effect

- On October 25, the FSMA encryption system came into effect, and Ripple officially operated under full authorization.

- Launch of retail business, agent network, electronic currency issuance (if approved)

Analysts predict: "If Ripple can successfully pass the 2026 FSMA application, its UK business is expected to contribute 10%-15% of global revenue in 2028, becoming the third largest market after the United States and Asia-Pacific." "

8. Inspiration for the encryption industry▸▸◆8.1 Compliance becomes core competitiveness

Ripple’s FCA approval once again proves that in the mature stage of the encryption industry, compliance capabilities are replacing technological innovation as core competitiveness.

From technology-driven to compliance-driven

- Early years (2010-2017): Technological innovation (Bitcoin, Ethereum) attracts users and investment

- Mid-term (2018-2023): Application scenarios (DeFi, NFT) drive market prosperity

- Maturity period (2024-): Regulatory compliance determines market access and institutional adoption

Multiple dimensions of compliance capabilities

- Legal team: Understand the regulatory requirements of various countries and design compliance structures

- Technical Capabilities: Transaction Monitoring, Sanctions Screening, Data Security

- Financial strength: meet capital requirements and bear compliance costs

- Government Relations: Communicate with regulatory agencies and participate in rule formulation

The dilemma of small and medium-sized startups

- Compliance costs (legal, technical, capital) have become a high threshold

- Forced choice: move to unregulated jurisdictions (regulatory arbitrage) or be acquired by a large company

◆8.2 Institutionalization and differentiation of retail market

Ripple’s “Institutional Exclusive” Approval Reveals Structural Divergence in the Crypto Market Going forward:

Institutional market: high compliance, low volatility

- Participants: banks, asset management companies, hedge funds, corporate finance departments

- Products: Stablecoin payment, custody services, compliance transactions, derivatives

- Regulation: strict licensing, prudential supervision, consumer protection

Retail market: flexible innovation, high risk

- Participants: individual investors, native crypto users

- Products: DeFi, NFT, Meme coins, high-risk transactions

- Regulation: Relatively loose (but gradually tightened)

future trends

- The institutional market has grown steadily within the compliance framework and has become the "mainstream" of the crypto industry"

- The retail market remains innovative but faces stricter investor protection requirements

- The two are connected through "compliance channels" (such as licensed exchanges), but the boundaries are increasingly clear

◆8.3 Competition in the cross-border payment industry is intensifying

Ripple's core business - cross-border payments - is becoming the application scenario with the most commercial potential for blockchain, but competition is fierce:

Traditional players upgrade

- SWIFT: Launch of SWIFT Go (low-amount high-speed payment) and SWIFT gpi (real-time tracking)

- Bank alliance: JPM Coin by JPMorgan Chase, Citi Token Services by Citigroup

Crypto native players

- Ripple(XRP/RLUSD)、Stellar(XLM)、Circle(USDC)

- Stable currency payment (Tether USDT, USDC)

New forces in financial technology

- Emerging payment companies such as Wise and Revolut

- Wholesale/Retail Applications of Central Bank Digital Currency (CBDC)

Ripple’s differentiation

- Technical advantages: XRP Ledger’s 3-5 second settlement speed and low cost (<0.01 USD per transaction)

- Compliance Network: Global multi-jurisdictional license coverage

- Institutional relations: experience in cooperation with 300+ financial institutions

challenge

- SWIFT’s network effects and bank inertia

- Market penetration rate of stablecoins (USDC/USDT)

- CBDC squeeze on private cross-border payment solutions

Conclusion: Breaking the ice on compliance, the journey is long▸▸

Ripple obtained the FCA's EMI license and crypto-asset registration, marking an important milestone for its compliance operations in the UK market. However, this is only the beginning of a long journey: the "institution-exclusive" restrictive approval means that Ripple must prove its compliance capabilities and market value by September 2026 before it can obtain full authorization under the new FSMA regime in 2027.

For the entire encryption industry, Ripple’s case reveals three major trends in future development:

- Compliance becomes the threshold for survival: No matter how advanced the technology, companies that do not meet regulatory requirements will be excluded from the mainstream market

- Institutional and retail market differentiation: Compliant institutional markets and flexible retail markets will follow different rules

- Global regulatory coordination is accelerating: UK FSMA, EU MiCA, US legislative attempts, major jurisdictions are converging regulatory standards

Cassie Craddock said in an interview: "Obtaining FCA approval is not the end, but the starting point for Ripple to establish digital asset infrastructure in the UK. We will prove with the highest compliance standards that blockchain technology can be safely and efficiently integrated into the traditional financial system. "

In the first year of crypto regulation in 2026, Ripple’s UK practices will provide valuable compliance standards for global crypto companies. The icebreakers have set out, but the ice ahead is still thick - only those companies that truly understand the nature of compliance and have long-term strategic patience can occupy a place in the crypto-financial landscape of the new era.

Summary of key data

| project | Details |

|---|

| Approval date | January 9, 2026 | | License type | EMI License + Crypto Asset Registration (MLR) | | Authorization scope | Exclusive for institutional/wholesale customers | | Prohibited matters | Crypto ATMs, retail services, unapproved agents, electronic currency issuance | | next key node | September 2026 (FSMA application window opens) | | Mandatory compliance date | October 25, 2027 (FSMA system takes effect) | | XRP price reaction | +0.7%-1% → 2.11 | | Ripple UK invests | London office (2016-), UBRI investment > £5 million |

Sources:

- Coindesk: Ripple Wins UK Regulatory Approval From Financial Conduct Authority[1]

- Ripple Official: Ripple Receives FCA Permissions to Scale Ripple Payments in the UK[2]

- Finance Magnates: Ripple Gets FCA Green Light for UK Payments via Local Unit but with Tight Limits[3]

- UK FCA Sets 2026 Window for Crypto License Applications[4]

- Ripple Gets Electronic Money Institutions (EMI) License in the UK[5]

- The Market Periodical: UK Regulator Sets September 2026 Launch for Crypto Licensing Regime[6]

This article was written by an AI anti-money laundering compliance analyst based on public information. It is for professional reference only and does not constitute investment advice. Cryptoasset investment involves high risks, and regulatory policies continue to change. Please make prudent decisions.

◆Reference link

[1]Coindesk: Ripple Wins UK Regulatory Approval From Financial Conduct Authority: https://www.coindesk.com/policy/2026/01/09/ripple-wins-uk-regulatory-approval-from-financial-conduct-authority

[2]Ripple Official: Ripple Receives FCA Permissions to Scale Ripple Payments in the UK: https://ripple.com/ripple-press/ripple-receives-fca-permissions-to-scale-ripple-payments-in-the-uk/

[3]Finance Magnates: Ripple Gets FCA Green Light for UK Payments via Local Unit but with Tight Limits: https://www.tradingview.com/news/financemagnates:273b68c11094b:0-ripple-gets-fca-green-light-for-uk-payments-via-local-unit-but-with-tight-limits/

[4]UK FCA Sets 2026 Window for Crypto License Applications: https://www.coinspeaker.com/uk-regulator-fca-announces-2026-timeline-for-crypto-license-applications/

[5]Ripple Gets Electronic Money Institutions (EMI) License in the UK: https://thecryptobasic.com/2026/01/09/ripple-gets-electronic-money-institutions-emi-license-in-the-uk/

[6]The Market Periodical: UK Regulator Sets September 2026 Launch for Crypto Licensing Regime: https://themarketperiodical.com/2026/01/10/crypto-news-uk-regulator-sets-september-2026-launch-for-crypto-licensing-regime/

|