17146

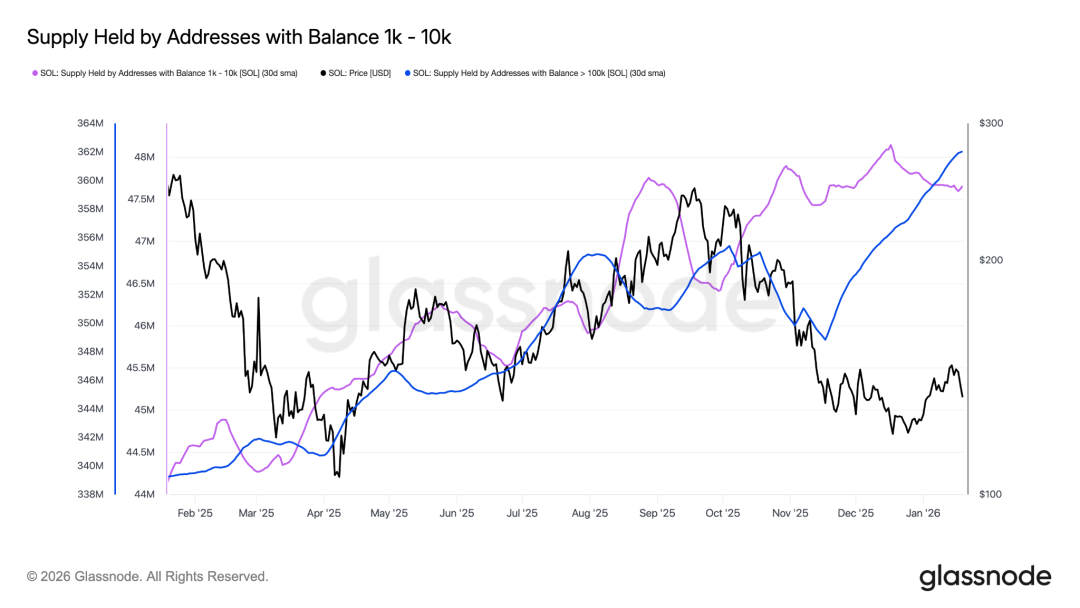

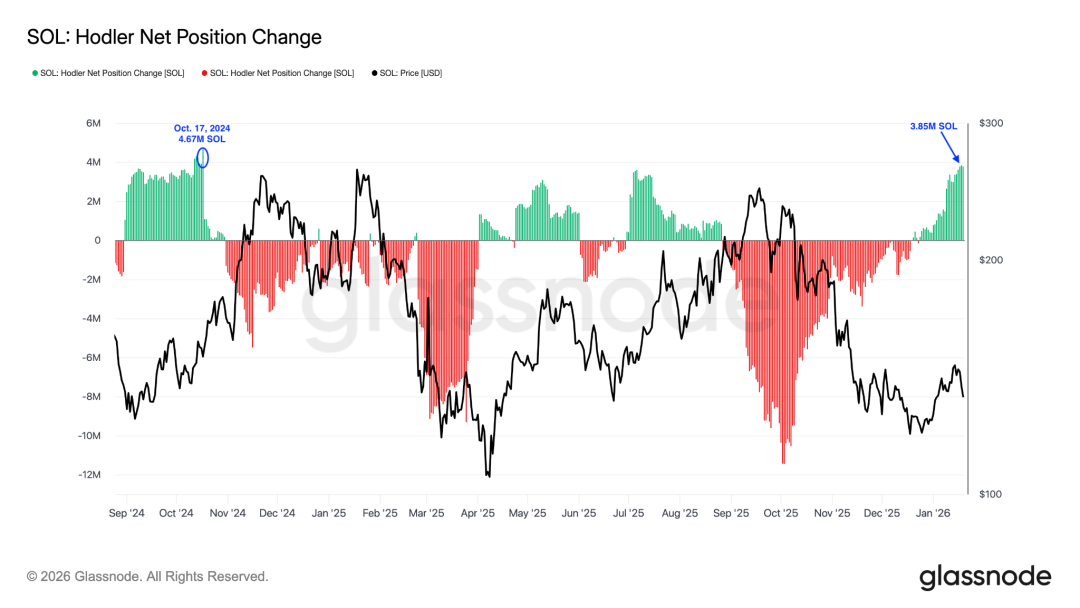

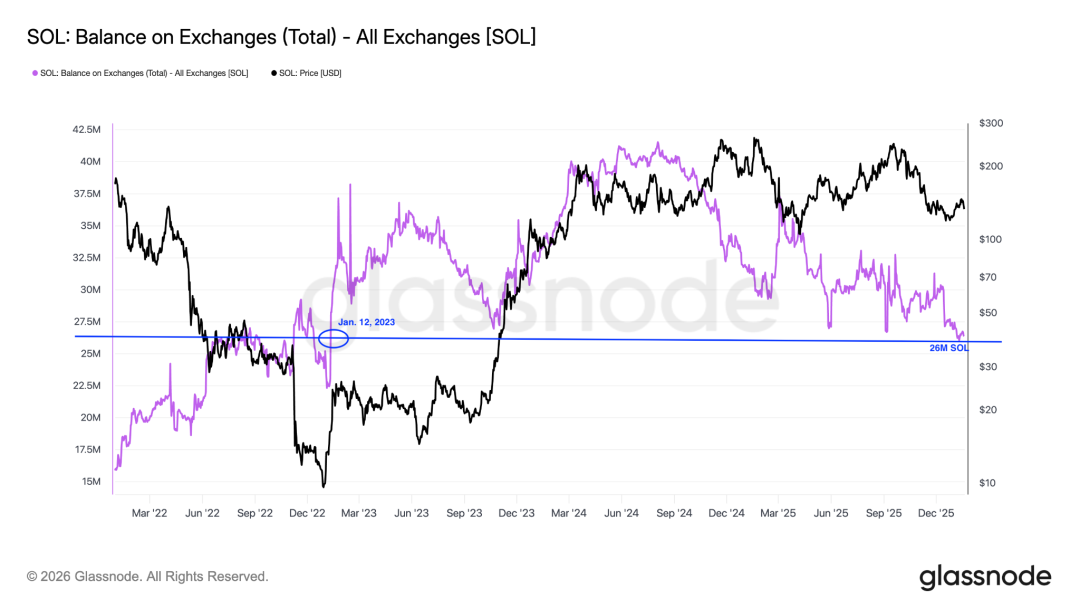

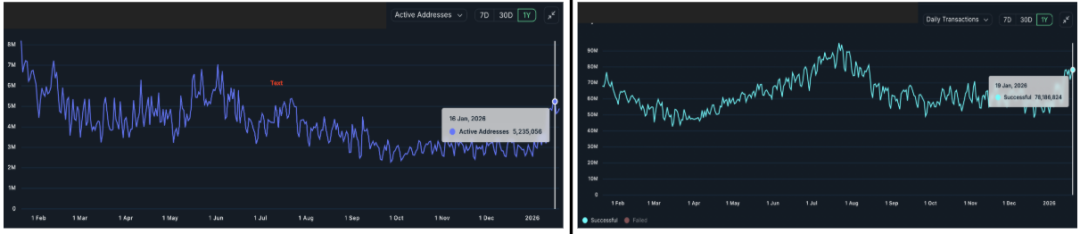

SOL price fell below $130 for the first time since January 2. However, on-chain data indicates that this top ten altcoin may usher in a strong rebound. The accumulation trend of SOL strengthensSOL whale investors remain confident in the prospects for further gains, and they are taking advantage of a price correction to $120 in late 2025 to aggressively increase their holdings of the token. Glassnode data shows that whale addresses holding between 1,000 and 10,000 coins have increased significantly since late November 2025, as shown in the chart below. These entities now hold approximately 48 million SOL, accounting for approximately 9% of the total circulating supply. Addresses holding at least 100,000 tokens now hold 362 million tokens, a significant increase from 347 million tokens on November 17, 2025, and account for 64% of the total supply.  Other data also confirms that the market has been in an accumulation phase, with long-term holders (LTH) buying pressure increasing significantly. Holder net position changes have remained consistently positive since the last week of December 2025 and climbed to a 15-month high of 3.85 million SOL on Sunday. Analysts pointed out that this shows that holders are re-accumulating SOL in anticipation of further price increases.  The last time LTH accumulation reached such a level was in October 2024, followed by a strong 95% rise in SOL prices. SOL supply on exchanges drops to two-year lowData from Glassnode shows that the supply of SOL on exchanges has decreased significantly since the end of November 2025. The chart below shows that the SOL balance on the exchange fell by 5 million to 26,058,693 on Wednesday, reaching its lowest level since January 12, 2023.  Decreasing balances on exchanges indicate a lack of willingness among holders to sell, further reinforcing the potential for upward price movement. Solana network activity shows signs of recoveryStrong on-chain indicators point to an active ecosystem, providing support for a possible parabolic rise in SOL in the coming weeks. Nansen data shows that the number of daily active addresses has increased by 51% in the past seven days, reaching a six-month high this week, surpassing 5 million. This reflects strong user engagement and demand for Solana’s decentralized applications and staking services. Average daily trading volume rose 20% over the same period, reaching 78 million transactions on Tuesday, a level not seen since mid-August 2025. This highlights the network’s scalability and growing adoption.  According to data from Token Terminal, Solana’s stablecoin supply has surged more than 15% in the past seven days to reach an all-time high of $15 billion. This indicates that cryptocurrency liquidity dynamics are changing, further enhancing the stability of the Solana ecosystem and attracting investor attention.  In a recent Platform " The increase in stablecoin supply shows that on-chain demand is surging, which increases the network’s utility, fee revenue, and adoption, further supporting the bullish trend in SOL prices. Golden Elephant was born for the continuous improvement of Web3 ecology! Golden Elephant, focusing on Web3 ecological system construction and operation! Pay attention to the golden elephant! Contact us! Receive information and join the group…… Please scan the code to add Xiang Xiaosuke  |