58880

|

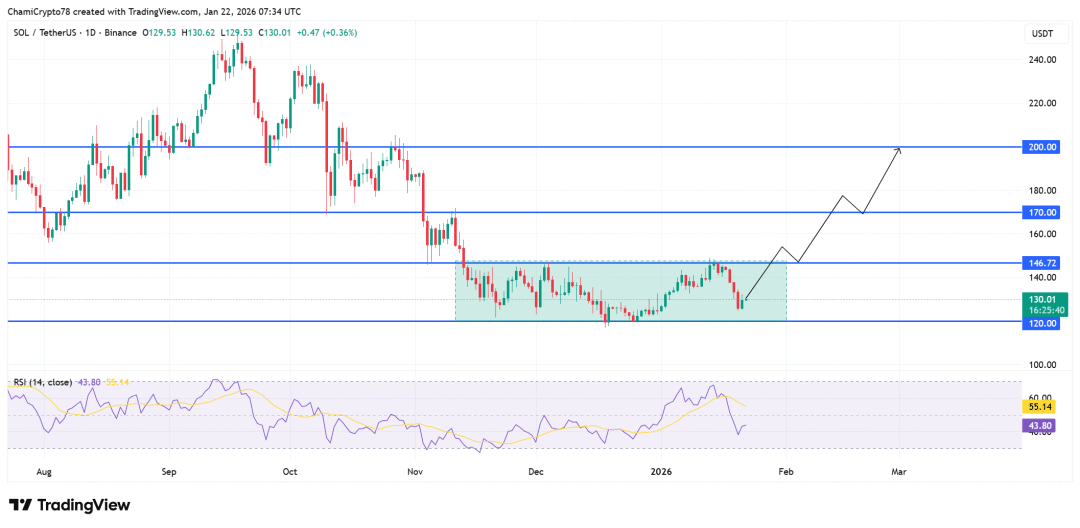

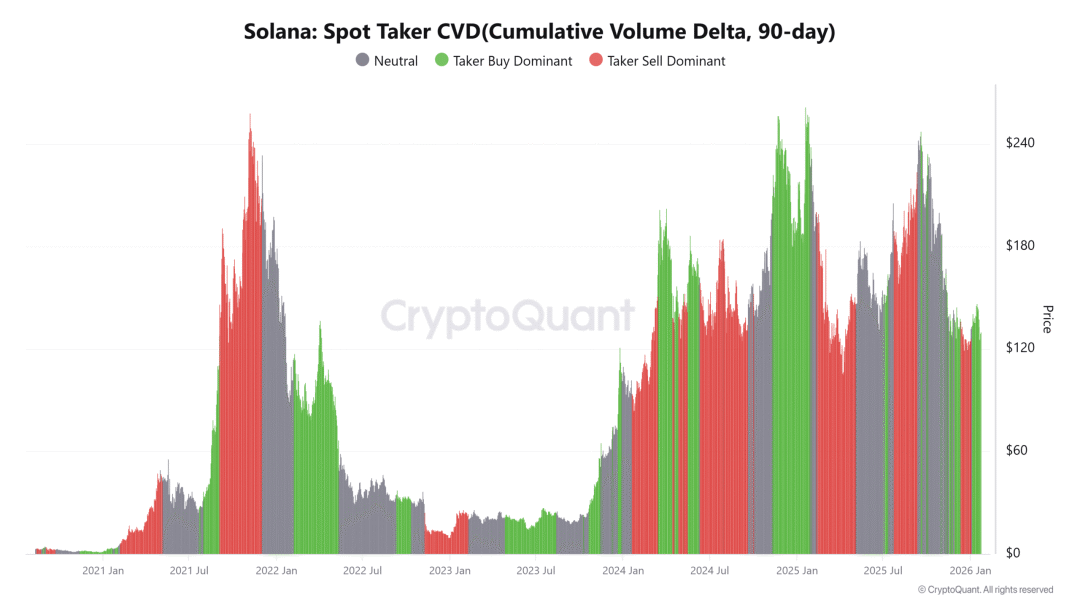

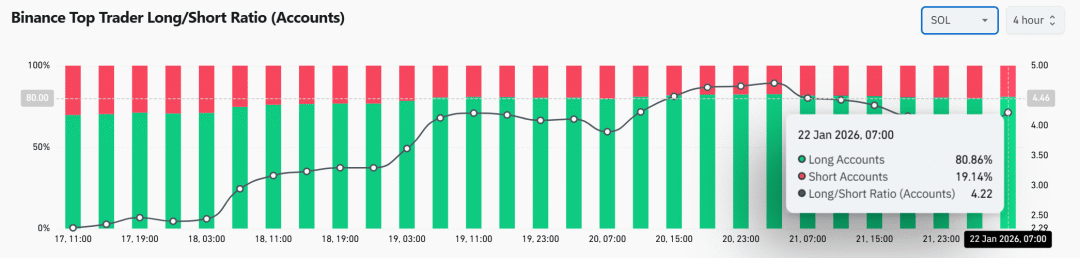

👆Follow me to share Web3 cutting-edge news every day👆Jinqun +Q: 3846328374 1. Core news: Long-term holders have decided to leave the market and have realized a loss of over US$6.6 million. A long-term user who has held SOL for nearly two years has started the exit process, and has previously released more than 98,000 SOL from the pledge. This wallet once pledged coins when the price of Binance was close to the cycle high. The current exit price has fallen sharply, and it has realized a loss of more than 6.6 million US dollars. Holders adopted a fixed investment (DCA) strategy to gradually sell, avoiding the market panic caused by liquidation, but it also created continued upward pressure. At the same time, buyers continue to take orders at the support level, and the game of supply and demand is obvious. 2. Price trend: Trapped in the range of US$120-150, fluctuations continue to be limited As of press time, the price of SOL is still fluctuating in a clear range. Buyers continue to hold the demand zone of $120-125, and will rebound quickly every time it falls below.; However, when it rose to $146-150 (the upper edge of the consolidation), breakout attempts repeatedly failed, and then fell back to the midpoint of the range. $135 has recently become a short-term pivot, switching between support and resistance. Market volatility continues to be suppressed and supply and demand are in balance.  (Data source: TradingView) From a technical perspective, the daily RSI has dropped from a high of nearly 70 to around 43.8. The upward pressure has weakened but is not oversold. It is well above the 30 threshold, indicating that sellers are not dominant.; At the same time, it is difficult to return to the 50 midline, limiting the upward momentum. Flat indicators reflect price compression, momentum is weak rather than collapsing, and buyers continue to enter the market to prevent momentum from deteriorating. Enter skirt +Q: 3846328374 3. Funding and positions: Buyers absorb selling pressure, top traders prefer long positions Despite the selling by long-term holders, the 90-day SOL spot trader CVD remains dominated by buyers.  (Data source: CryptoQuant) Buyers continued to raise prices to take orders, but the price did not rise simultaneously. It was in the supply absorption stage rather than chasing the increase. It only stabilized the price without forcing a breakthrough, which reduced the probability of a sharp decline. Binance’s top traders are still heavily long, with 80.86% holding long positions, short positions accounting for only 19.14%, and the long-short ratio reaching 4.22.  (Data source: CoinGlass) The ratio has fallen slightly from the recent high of over 4.4. Market sentiment has eased and traders are more confident, but the price structure has not yet been confirmed. Summary: Waiting for a breakthrough under the balance of supply and demand, there is still a gap between confidence and confirmation The SOL market is currently absorbing long-term selling pressure without losing structural support: buyers are holding key support, RSI is not oversold, spot buying is active, and top traders are bullish. However, the price lacks room for expansion and is always trapped in the shock range. Before SOL clearly breaks through the $120-150 range, the market is still in a balanced state of sufficient confidence and trend confirmation, with no clear direction in the short term. That’s it for today’s article. I don’t know what to do in the bull market. Welcome to join the skirt+V: sun568298 for free.  |