9103

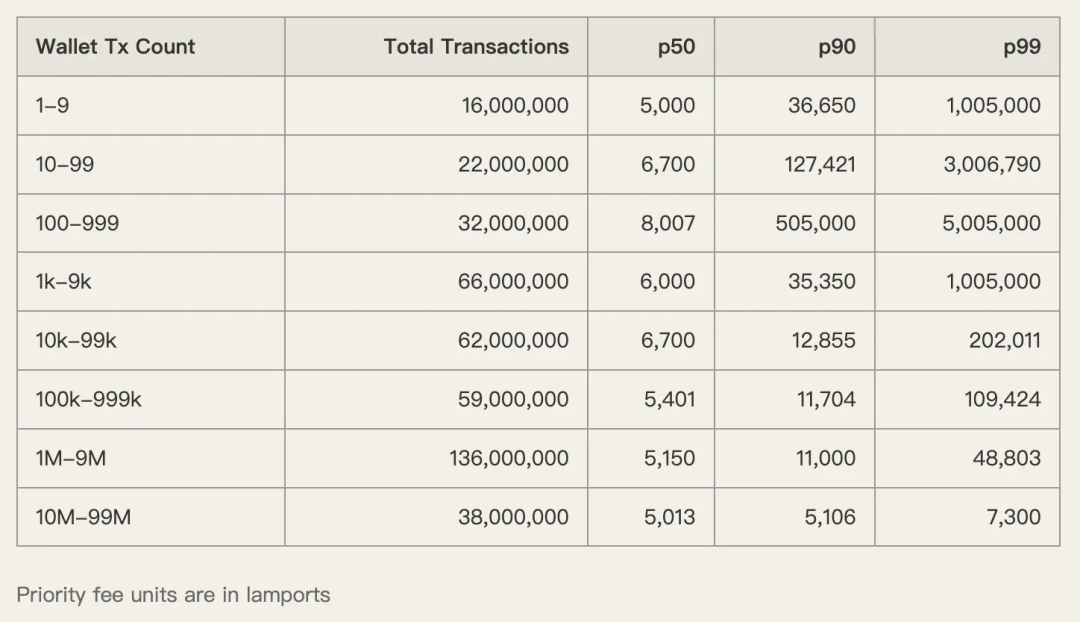

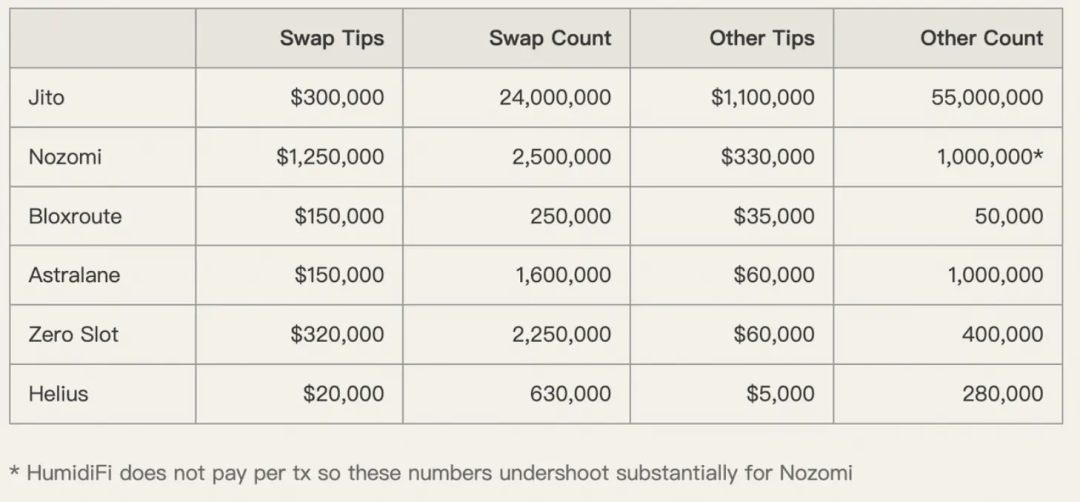

introduction In the traditional financial world, retail investors have long been accustomed to being "protectively harvested"”; In the on-chain world, this fig leaf doesn’t even bother to exist. Solana is known for its high speed and low fees, but it is quietly developing a highly mature but extremely opaque fee allocation system. Users think they are paying for "faster on-chain", but in fact they are paying for an entire benefit chain composed of applications, market makers and infrastructure. This is not a loophole, but a carefully designed business model.  1. From Robinhood to Solana, PFOF has not disappeared PFOF (Payments for Order Flow) is not new. In traditional financial markets, this model has been operating for decades. Robinhood relied on selling retail order flow to market makers, launched its "zero commission trading" brand, and quickly subverted the U.S. retail brokerage landscape. The data is intuitive enough. In 2021 alone, Robinhood's PFOF revenue approached $1 billion, accounting for half of total revenue for the year ; Even by 2025, its single-quarter PFOF revenue will still reach hundreds of millions of dollars. This is not a subsidy, but a huge profit. The reason why market makers prefer retail orders is also very practical. Compared with institutional orders, retail trading is considered "non-toxic", lacking information advantages and more like the product of emotions or immediate needs. By swallowing these orders, you can earn the price difference without worrying about being harvested in the opposite direction. In traditional markets, regulation puts up guardrails, at least formally. The SEC requires that even if an order is sold, it must receive execution that is no worse than the best market price. However, when this logic was moved to the on-chain world, the lack of supervision caused PFOF to evolve into a more covert and radical form. 2. The front end is power, and traffic is chips. On Solana, it is not the protocol that truly controls pricing, but the front-end. Wallets and applications determine how transactions are structured, where they are routed, and at what speed they are uploaded to the blockchain. Every link in the transaction life cycle can be used to "realize user value." The most direct way is to sell "access rights" to market makers. The RFQ model is an on-chain version of this logic. Aggregators like Jupiter have integrated inquiry systems like JupiterZ. The application can charge connection fees to market makers, and even directly package and sell batches of retail order flows. As the price difference on the chain continues to narrow, this "selling head" business becomes more attractive. A tacit alliance of interests has gradually formed between DEX, self-operated market makers and aggregators. Liquidity providers pay fees to aggregators in order to compete for trading opportunities. ; The aggregator then returns a portion of this to the front-end wallet in the form of a “rebate.” All this may not be written in the contract, but driven by incentives, it is almost an inevitable result. 3. Market orders, trailing arbitrage and “legal clips”” When the user clicks Confirm in the wallet, they are essentially submitting a market order with a slippage limit. For the application side, this order can be "processed" into different revenue models. On the surface, there are so-called benign paths and malignant paths. The benign path is to sell the backrun opportunities generated by the transaction to professional trading companies. Users' buying orders drive price changes, and arbitrageurs complete cross-pool arbitrage within the same block, which does not affect the user's transaction price. The application end and the arbitrage party share profits. But even this “virtuous path” is not clean. In order to increase the arbitrage value, applications have incentives to deliberately slow down the speed of transactions on the chain, or route users to pools with poor liquidity, artificially creating greater price fluctuations. The vicious path is more direct: cooperate with sandwich attacks to directly increase user transaction costs. According to relevant reports, some headends on Solana are systematically performing the above operations. The only difference is that they are better at packaging. 4. Where did the tip go? Axiom has the answer   If transaction routing is still complicated, then the operations at the fee level are almost open to the public. On Solana, the fees paid by users are divided into two categories: priority fees and transaction tips. The former is an in-protocol fee paid to the verifier. ; The latter is transferred to the SOL at the designated address, usually to a landing service provider such as Jito. The landing service provider provides the so-called "VIP channel" to improve the transaction success rate by optimizing the network path. Under the narrative of network congestion, users are constantly hinted that if they don’t tip, they may fail. The reality is that many times the blocks are not filled up. Data shows that the priority fees paid by low-activity wallets are significantly higher than necessary, and there are serious overcharges. Axiom is the most typical case. In the week from December 1 to 8, 2025, Solana generated 450 million transactions across the network, of which Jito processed approximately 80 million, accounting for 93.5% of the builder market. The median priority fee paid by Axiom users is a whopping 1,005,000 lamports, while high-frequency trading wallets only require about 5,000 to 6,000 lamports, a gap of nearly 200 times. In terms of tips, Axiom users’ payments on multiple landing services are also much higher than the market average. The author bluntly stated that most of these expenses are likely to eventually flow back to the Axiom team itself. Conclusion Meme brought prosperity to Solana, and also planted the gene of pursuing profit first. When the power of fee pricing is in the hands of front-end applications and middlemen, user welfare is destined to be ranked last. Multiple concurrent proposers, prioritization mechanisms, and dynamic base fees. The significance of these technical upgrades is not to be "faster" but to regain pricing power. Only by eradicating the rent-seeking soil can Solana truly move towards a market structure that is fair, transparent, and able to compete with traditional finance. Otherwise, the so-called ICM will be just another beautifully packaged illusion. 👉 Follow us and we will bring you the latest information and in-depth interpretation of the Web3 market as soon as possible! End Friends who are interested in Web3 are welcome to scan the QR code to add an assistant on WeChat, join our communication group, chat with senior players in the industry about the latest developments in Web3, and explore the infinite possibilities of the future together! Disclaimer  Some of the pictures in this article are from the Internet. If there is any infringement, please contact us to delete them. The content of this article is for reference only and does not constitute any form of investment advice. The cryptocurrency market is highly volatile and investment risks are extremely high. Investors are advised to make prudent decisions and assume corresponding responsibilities based on their own risk tolerance and investment goals. Shuozu Community is committed to the dissemination of knowledge and cannot be held responsible for any investment decisions or economic losses caused by referencing the content of this article. This article does not constitute financial, legal or other professional advice. Please consult professionals before investing and abide by the relevant laws and regulations of the country or region where you are located. |