23427

|

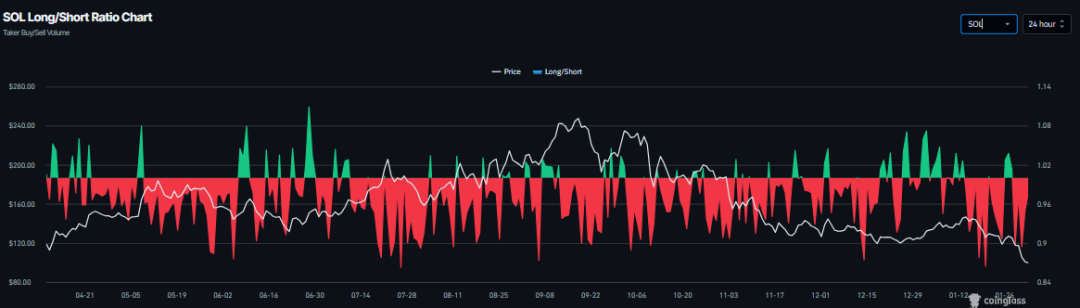

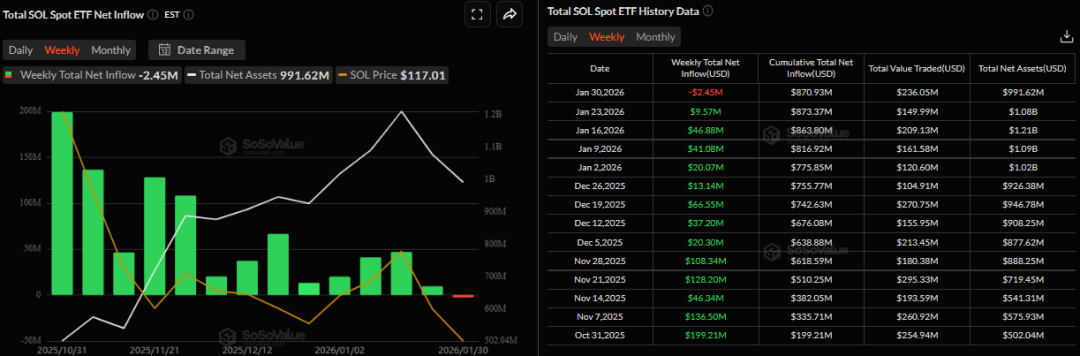

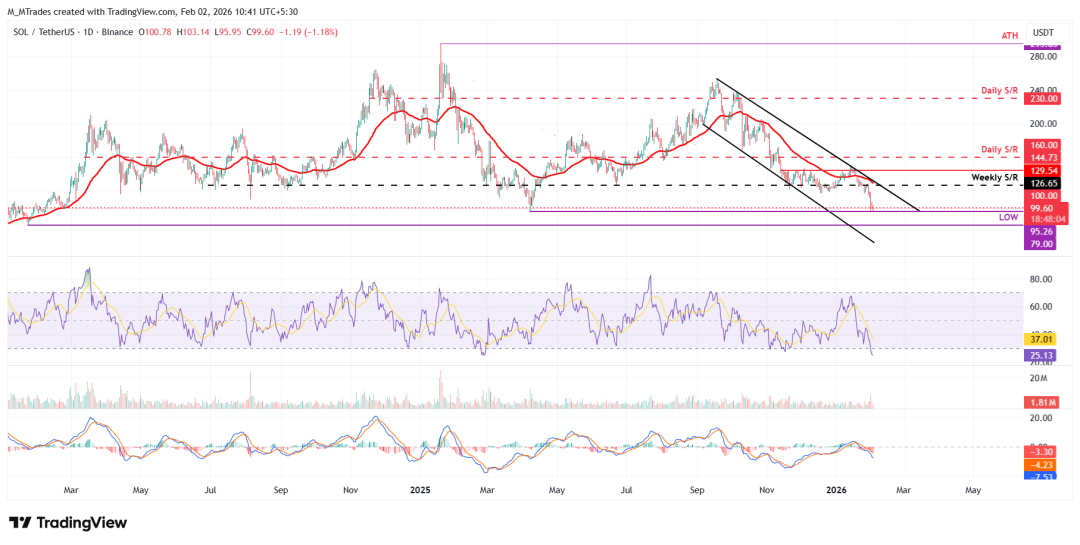

The weather conditions change rapidly, so the specific entry and exit points should be determined based on the current weather situation. Just follow the trend once it is established! No matter how confident you are, please strictly follow the stop-loss and take-profit strategies! That’s all for today! Follow me as I help you navigate through the fog of the cryptocurrency market and identify the best assets for a bull run! The price of Solana (SOL) continued its downward trend, falling below $100 on Monday, after having dropped by more than 15% in the previous week. Derivative data indicates an increase in short positions and negative financing rates, which further support the downward trend in stock prices. Technically speaking, if the daily closing price of SOL falls below $100, it could trigger a even more significant correction. Derivative data supports more in-depth adjustmentsDerivative data on Solana indicate that its prospects are bearish. Coinglass’ data on the weighted financing rate of open positions shows that the number of traders betting that the price of SOL will continue to fall is higher than the number of traders expecting a price increase. This indicator turned negative on Saturday and stood at -0.0080% on Monday, indicating that bears are paying dividends to bulls and suggesting a pessimistic outlook for SOL in the market.  Additionally, Coinglass announced on Monday that the SOL long-to-short ratio was 0.97. A ratio lower than 1 indicates bearish market sentiment, as more traders are betting on a decline in the price of SOL.  The demand for such systems has diminishedLast week, there was also a decline in demand for Solana from institutional investors. Data from SoSoValue shows that spot exchange-traded funds (ETFs) experienced outflows of $2.45 million last week, marking the first time such outflows have occurred on a weekly basis since their inception. If the outflow of funds continues and intensifies, the price of SOL could experience further declines.  Solana price prediction: SOL fell below $100On Wednesday, Solana’s stock price encountered resistance at the weekly resistance level of $126.65, and on Sunday it fell by more than 15%, breaking below the crucial psychological threshold of $100. As of Monday, the trading price of SOL was $99.60. If Solana’s stock price closes below $100 per day, it could continue to decline and reach the low of $95.26 set on April 7. If the closing price falls below that level further, it could potentially drop to the low of $79 recorded on January 23, 2024. On the daily chart, the Relative Strength Index (RSI) is at 25, indicating an extremely oversold condition and suggesting that there is considerable downward momentum. The Moving Average Convergence/Divergence indicator (MACD) also showed a death cross on January 19th, and the red bars continued to extend below the neutral level, further reinforcing the negative outlook.  On the other hand, if SOL manages to recover, it could continue to rise and approach the weekly resistance level of $126.65. The weather conditions change rapidly, so the specific entry and exit points should be determined based on the current weather situation. Just follow the trend once it is established! No matter how confident you are, please strictly follow the stop-loss and take-profit strategies! That’s all for today! Follow me as I help you navigate through the fog of the cryptocurrency market and identify the best assets for a bull run! |