47940

The "tenth largest liquidation incident in history" occurred last Saturday. Did you find any unusual "clues"?If it was just a normal market correction, the data would not be what it is now. But this time the liquidation structure, drop distribution and drop time points are all pointing in the same direction: ——Someone is focusing on "sniping" Ethereum. Let's look at it one by one. 1. Liquidation data is extremely abnormal: ETH liquidation is 50% higher than BTCIn this liquidation:

In other words, the liquidation scale of ETH is nearly 50% higher than that of BTC.  This has almost never happened in history. Why is this an "abnormal signal"?

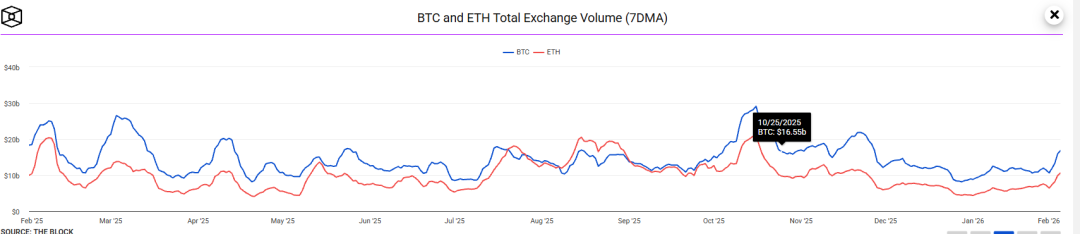

Even from the perspective of trading activity:

👉 Under normal logic, ETH cannot bear greater liquidation pressure. But this time, it happened.  The picture above shows a comparison of the transaction volumes of Ethereum and Bitcoin. You can see that the transaction volume of Ethereum has been significantly lower than that of Bitcoin in recent months! 2. Abnormal decline structure: ETH fell harder than “altcoins””Let’s look at the decline. Within the same time window:

This is even stranger. According to past experience:

But this time it became:

👉 This is no longer the result of "market panic", but the trace of a targeted attack. 3. The timing is extremely tricky: Why was it chosen on Saturday?What’s even weirder is the timing of the drop. In this past round of market conditions, the crypto market has closely followed the U.S. stock market. And as we all know:

The result this time:

what does that mean? 👉 As long as it is not an emotional panic, it can only be: Someone deliberately chose a time when it was "easiest to break through the defense line." 4. Three doubts, pointing to the same conclusionLet’s look at the above three points together:

👉 The only reasonable explanation is: Some people are systematically shorting Ethereum, and their intensity is far greater than that of other currencies. 5. Why has “Ethereum” become the best prey?There is only one reason:

It is public on the chain:

Clear as day. This gives the Hunter the perfect combat map. 6. Several big fish that may be “targeted”1️⃣ "Insider Brother" - a typical example of high leverage bullsThe "insider brother" who opened the market on 10.11, many people speculate that he is Trump's youngest son (whether true or false). But the result is:

Although it has not been directly liquidated, it is close to "psychological zero". 👉 This type of character is more like an object to be "displayed" rather than the ultimate goal.  2️⃣ Yi Lihua/Trend Research——ETH whale with leverageAccording to public information:

The original liquidation price was around 2250. Subsequently, by selling part of the ETH, the liquidation line was lowered to around 1,800. 👉 He survived for the time being, but this is the "forced lightening" state that short sellers want to see most. 3️⃣ BitMine + Tom Lee - the largest ETH treasury company in this roundThis is the most critical one.

But here's the thing: it's a public company. After enquiry, there were two previous financing events to raise funds to buy ETH: 1. June 2025: Private financing of US$250 million 2. September 2025: Registered direct issuance of US$365 million For the third time, it announced the launch of an ATM additional issuance plan, which can refinance billions of dollars in the future to purchase ETH. The current situation is:

👉 If ETH continues to fall:

7. Just a quick mention: MicroStrategy vs BitMine

Everyone can experience this data for themselves! 8. What’s next?Today is Monday:

My judgment is:

The reason is simple:

The last sentence (say important things three times)Financial markets are always:

Don't use leverage. Don't use leverage. Don't use leverage. Living is always more important than "getting it right once". Behind the 2.58 billion liquidation, why is the currency circle so fragile? How cheap is Bitcoin? Mining cost, micro-strategy, AHR999 gave the same answer. Is gold crazy? Soaring by 2.5 trillion, where will global funds stop next? You want it a hundred times, I just want to live until the next cycle Today’s market market analysis of the community: https://kebaq.xetlk.com/s/1wLuqG Xiaoetong community: https://applkmx4o5d3183.h5.xet.citv.cn |