69656

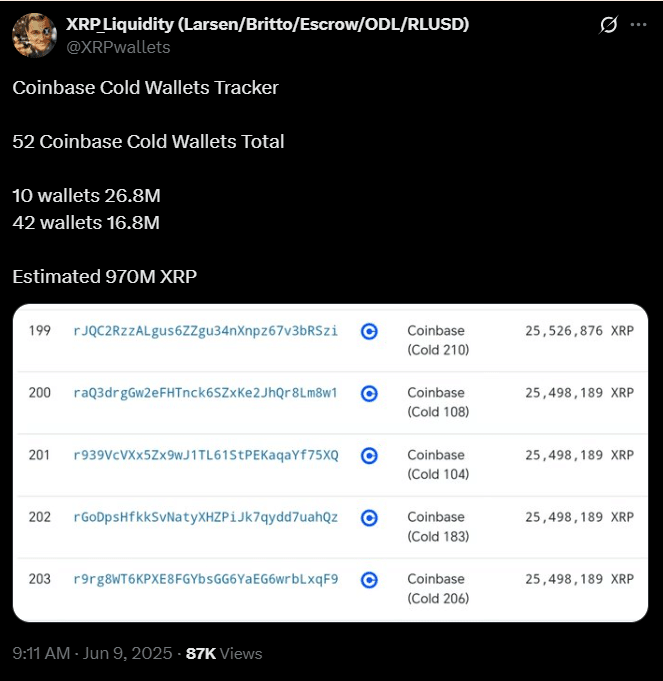

Among the mainstream cryptocurrencies, Ripple (XRP) had the weakest quarterly return performance, recording only 33.64%, far lower than Solana (SOL)'s gain of more than 50%. If you look at the monthly differences, the gap is even more obvious. In fact, XRP’s gains in the third quarter were almost entirely focused on a 33% surge in July that peaked at $3.60, while the rest of the time was in a choppy consolidation phase. In contrast, SOL's performance is more balanced with solid monthly growth of around 11%.  Nonetheless, market research firm AMBCrypto believes that this trend may be the foreshadowing of a new round of gains. VX:BTC800WU (You can get the position allocation guide to teach you how to make money in the bull market and earn coins in the bear market) Investment is risky, so you need to be cautious when entering the industry. Derivatives Market and Position Changes Currently, SOL traders are actively deploying in the derivatives market, pushing its open interest (OI) to close to historical highs. The overall market value of XRP has fallen below US$10 billion, showing that the distribution of market positions is more concentrated and controlled. This highly concentrated pattern often makes investors wait longer, but once a breakthrough occurs, the trend is usually extremely rapid. The single-month surge in July is a typical example.  Coinbase whale reduction and supply tightening Entering September, the concept of ETF has once again become the focus of hot discussion in the market. Dogecoin (DOGE) has risen 25% this month, far outperforming Ripple. But unlike DOGE, which tends to be sentimental, XRP’s moves are more structural. According to XRPwallets data, Coinbase’s cold wallet reserves plummeted by 90% in three months. As of now, Coinbase only holds 6 cold wallets totaling 99 million XRP ; In June, it controlled as many as 52 wallets, with a total amount of approximately 970 million XRP. This whale-level selling has significantly reduced the risk of concentrated positions in the market.  Technical aspects and potential catalysts From a technical perspective, the current XRP structure is quite similar to the pattern before the surge in July - the price previously fluctuated repeatedly in the range of $2.70-3.15 before experiencing a rapid rise. Nowadays, "smart money" in the market seems to be taking advantage of the consolidation period to gradually increase their positions. Combined with the potential promotion of the ETF concept, the low valuation of the derivatives market and the reduction of circulating chips, XRP may be preparing for a large-scale market in the fourth quarter. For long-term holders, this delayed cash-out trend tests patience, but once the market starts, it may once again bring parabolic returns. VX:BTC800WU (You can get the position allocation guide to teach you how to make money in the bull market and earn coins in the bear market) Investment is risky, so you need to be cautious when entering the industry.  |