96811

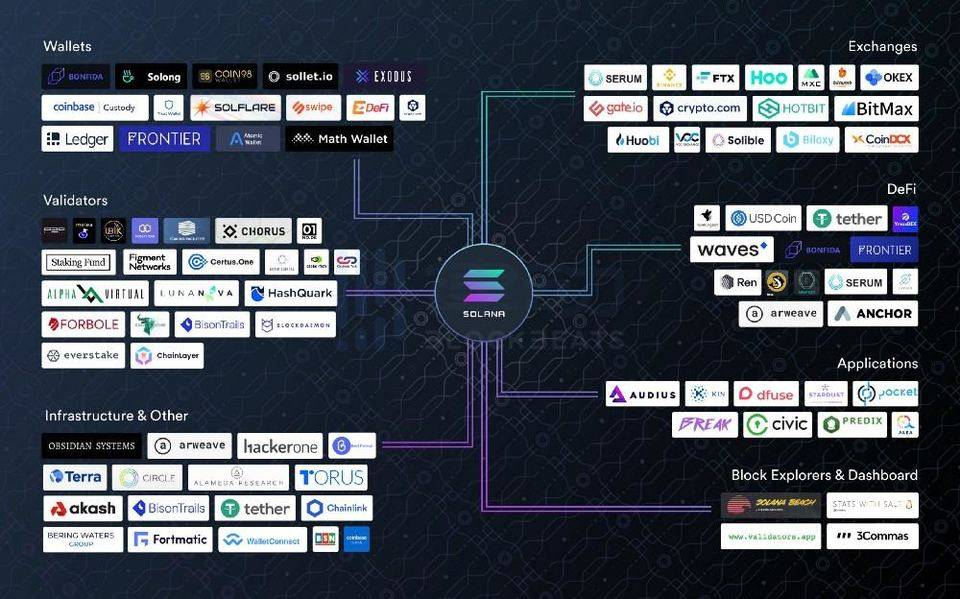

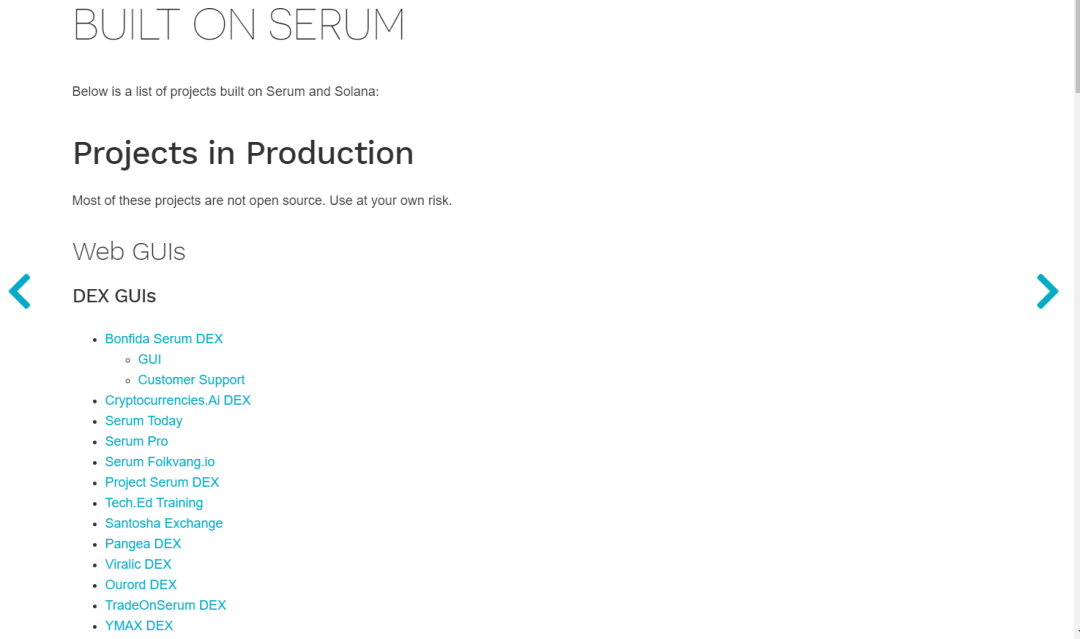

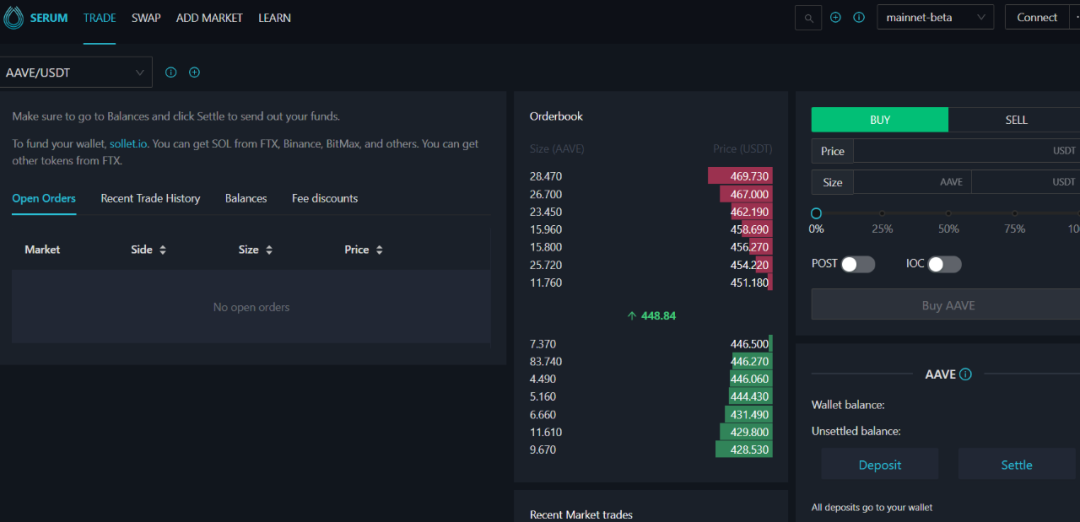

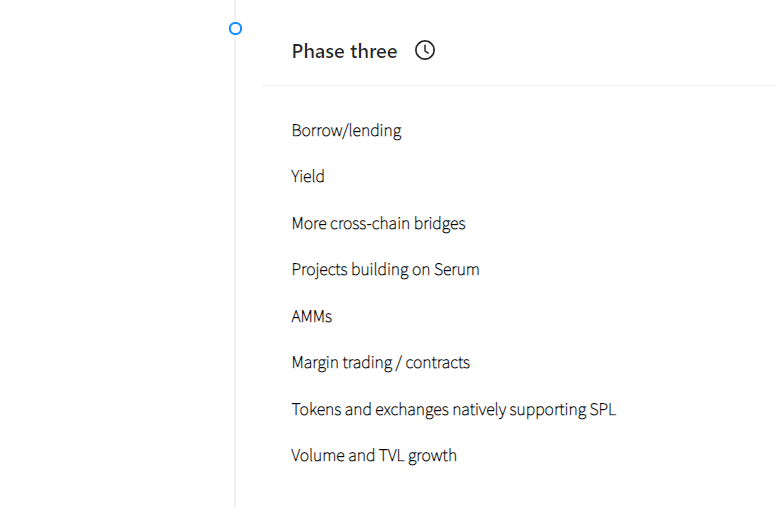

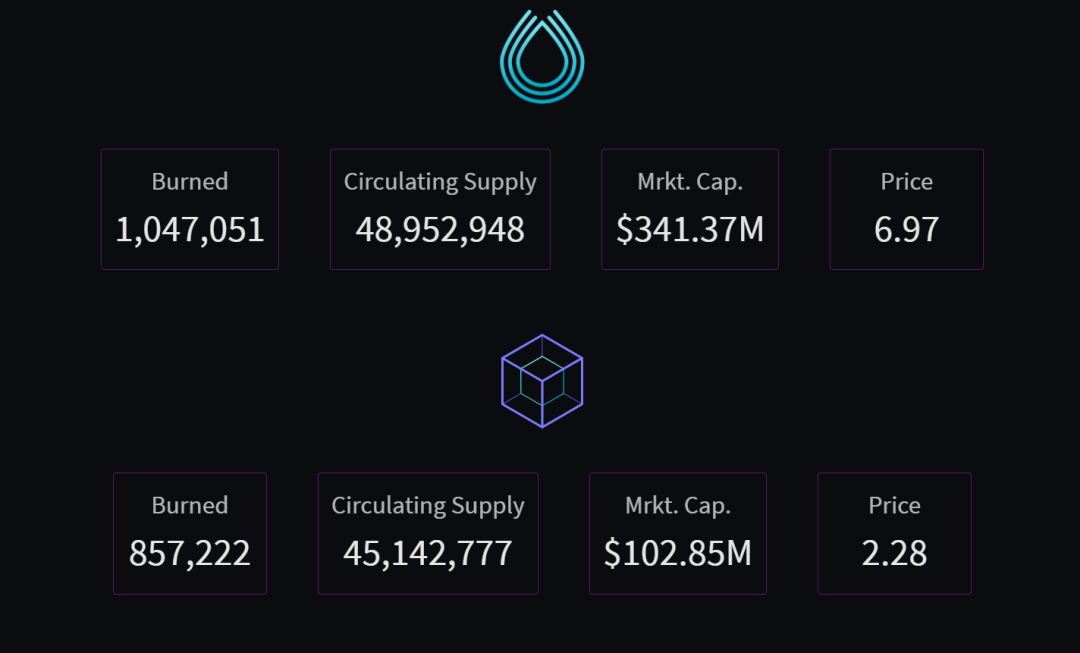

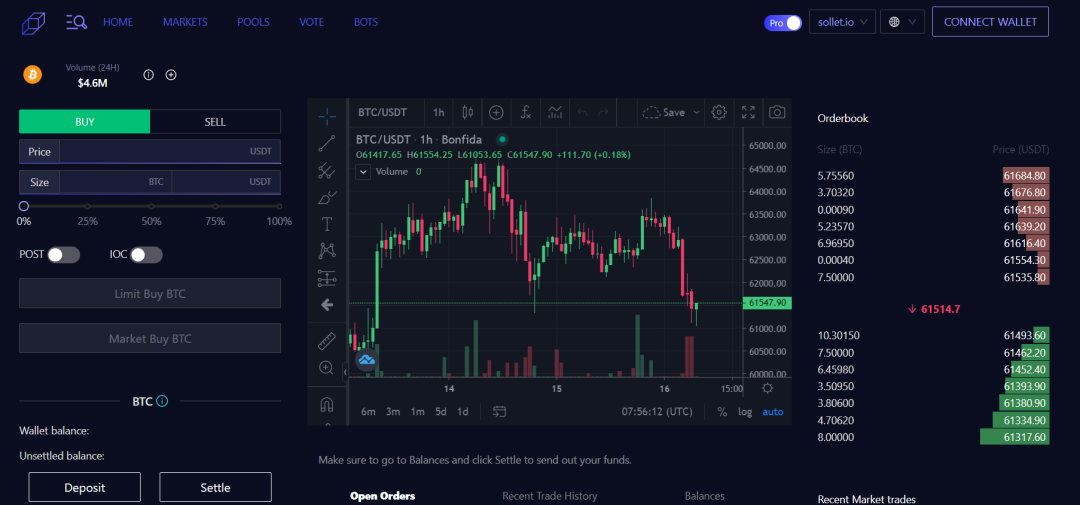

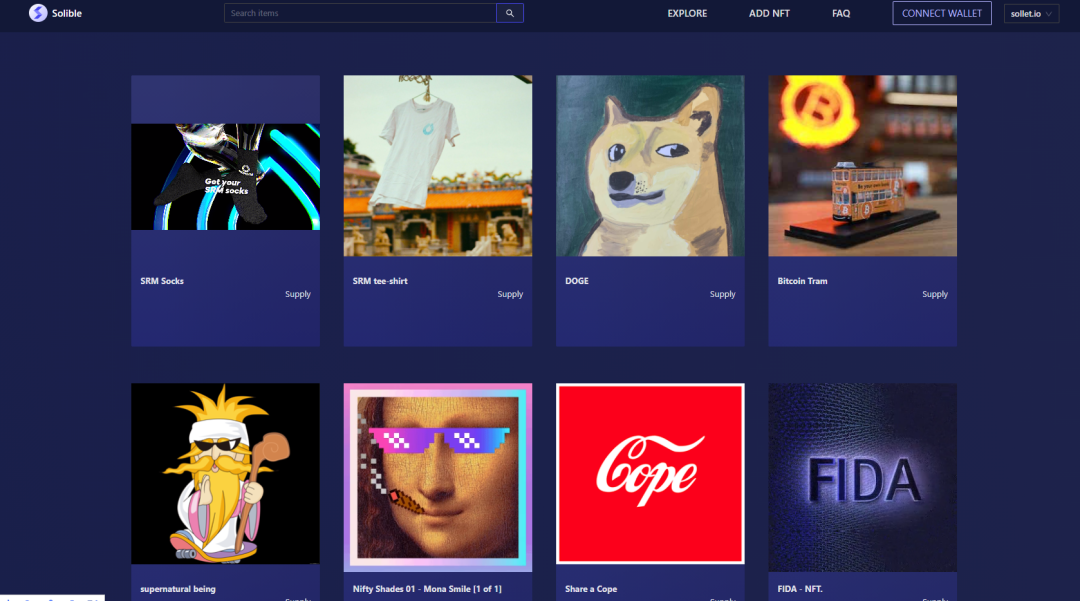

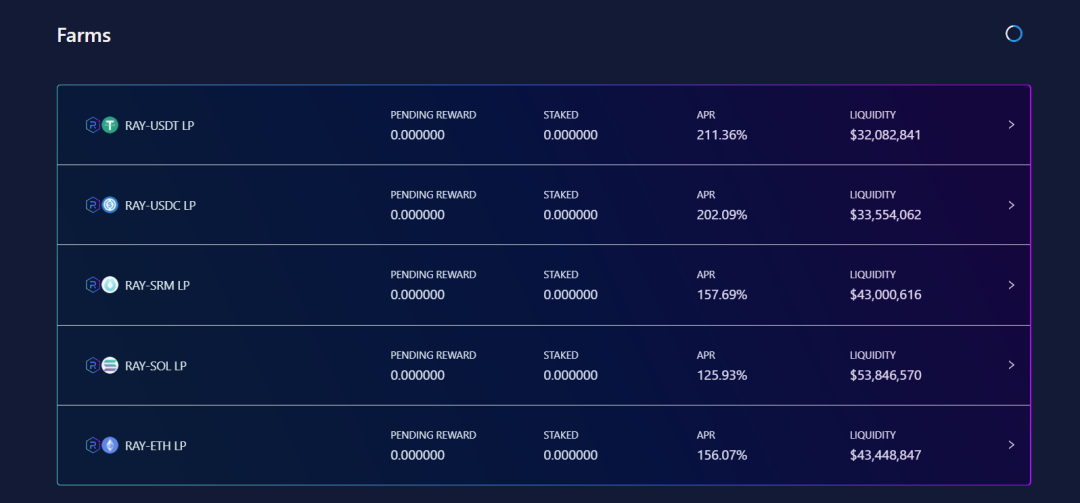

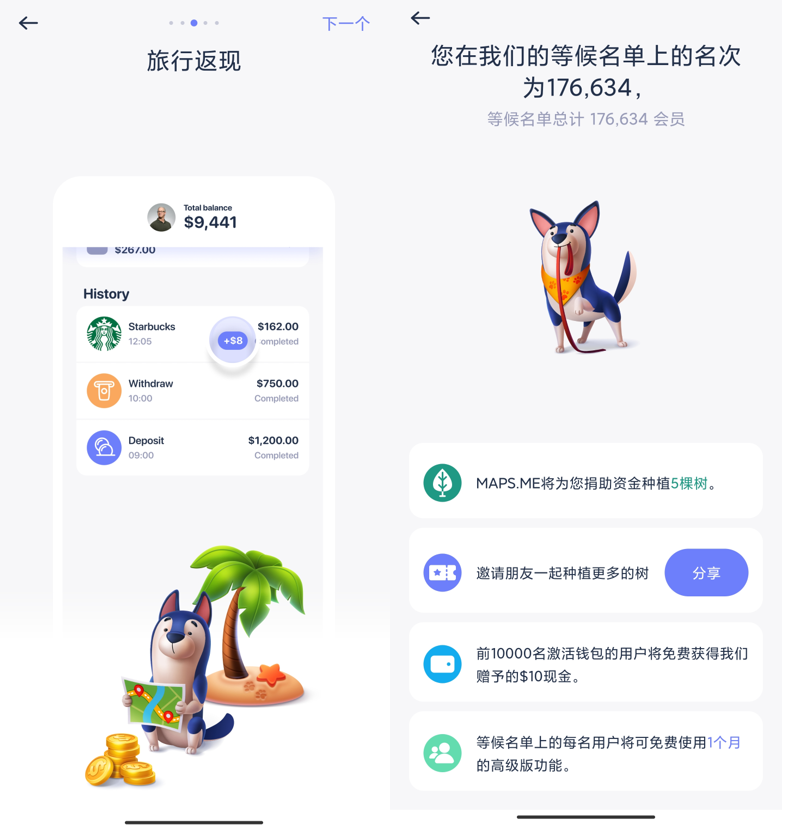

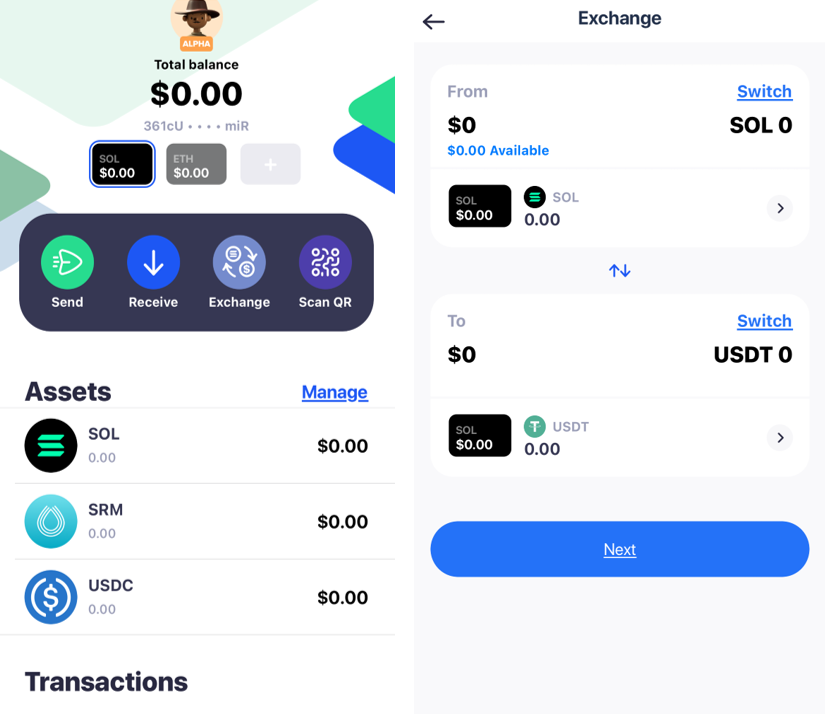

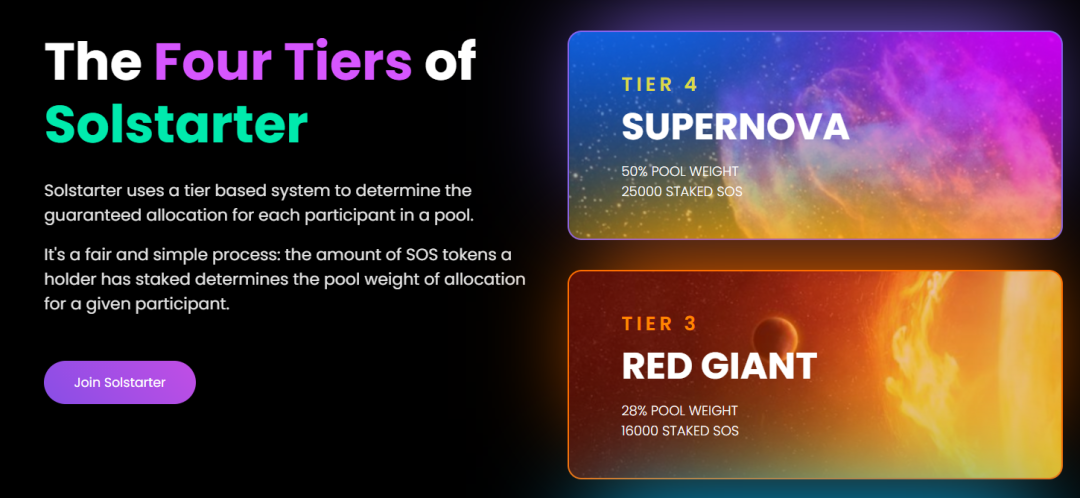

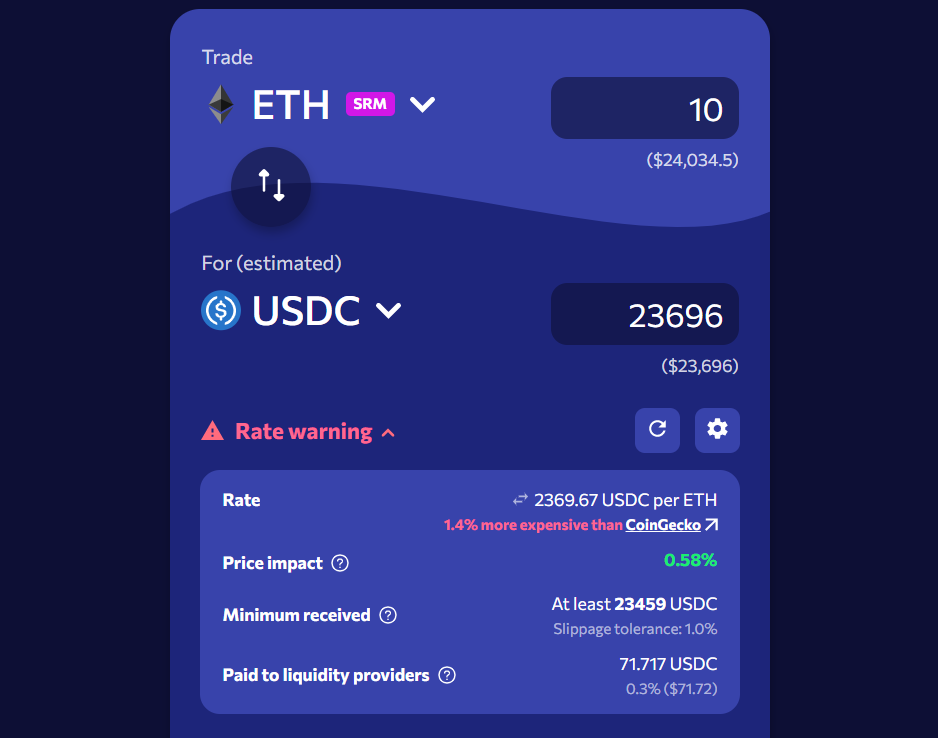

“Which products deserve more attention? Solana is a high-performance public chain founded at the end of 2017 by former engineers from Qualcomm, Intel and Dropbox. Solana is committed to building an Internet-level blockchain network. A major feature of Solana is its extremely high TPS, which can currently reach 50,000+. Solana's current ecological partners include Serum, Tether, USDc, Dfuse, Kin, Torus, Chainlink, Terra, Stardust, Arweave, Pocket, Audius and many other projects. In the current Solana ecosystem, there are both Tether, USDc, Chainlink, Terra, and other relatively mature products that have been developed in other ecosystems, as well as Solana native products such as Serum, Raydium, and Oxygen. The picture below is the ecological diagram recently announced by Solana officials. From the picture, we can see that there are quite a few projects in the current Solana ecosystem, but most of them are focused on infrastructure. In terms of applications, they are mainly external mature applications. There are still relatively few native applications based on Solana. Overall, the current infrastructure of the Solana ecosystem is not very complete, but it can already support the normal development of the Solana ecosystem.  Solana has been quite popular recently, with constant actions within the ecosystem and attracting a lot of attention. This article briefly introduces some of the native products of the Solana ecosystem. Compared with mature external applications, native products in a new ecosystem often contain more opportunities, but of course there are also risks. 1.Serum Serum is a decentralized exchange and a DeFi protocol launched by Sam Bankman-Fried (SBF), the founder of FTX Exchange. Sam Bankman-Fried has a high reputation and potential in the industry, which also gives Serum its own aura. Serum is the core product within the Solana ecosystem. Currently, many protocols have been built around the Serum protocol, most of which are closely related to SBF. We can see that many products have been built based on the Serum protocol, and we can see that the ecosystem is beginning to take shape.   Serum has two product forms: order book and AMM, and has the characteristics of both order book and AMM.  It can be known from the roadmap that Serum will also launch margin and contract businesses.  According to official data, the transaction volume during the period from April 2 to April 14 was US$200 million, and the single-day transaction volume was around US$16 million, ranking among the top fifteen DEXs on Ethereum. 2. Bonfida Bonfida is Serum’s “flagship front-end”, providing a better trading experience for DEX transactions. The services provided by Bonfida are as follows:  In addition to providing Serum-based trading functions, Bonfida also provides Serum API, strategy platform, Serum data analysis and other functions. Bonfida is also the first front-end to provide users with data analysis on the Serum chain. From the picture above, Serum's trading volume in the past seven days has reached 150 million US dollars, and the daily trading volume has exceeded 20 million US dollars. Bonfida also shows Serum and Bonfida token data.  Judging from the experience, Bonfida is indeed much easier to use than Serum's native product.  Bonfida's strategy platform currently provides four or five strategies. Users can choose a strategy to deposit funds, and the platform will automatically execute the corresponding strategy. Currently, the amount of funds deposited on the platform is small, and the number of users is relatively small. According to official information, the platform will introduce KOL to provide users with richer strategies, and users can also create their own strategies based on the platform.  Bonfida also released the first NFT trading platform Solible, which can trade digital collections on the Solana blockchain. It feels like it has no special features.  3. Raydium A special feature of Raydium is that it can provide on-chain liquidity to the order book, which means that Raydium users and liquidity pools can access the order flow and liquidity of the entire Serum ecosystem, and vice versa. In the future, Raydium anticipates using other liquidity provision models to take advantage of oracles and increase liquidity. Raydium's performance is still very good in terms of pool depth and transaction volume. Of course, the stimulation factor of mining is indispensable.   Raydium's next step is to implement the IDO function. In addition, Raydium plans to combine several new lending protocols launched by Serum to enable Raydium to add margin trading functions. The Raydium roadmap is as follows:  4. Maps.me Maps.me is an offline map application that has accumulated 140 million users. Google Play shows that Maps.me has been downloaded more than 50 million times. As a map product, various peripheral services are provided within the program, such as reservations for hotels, restaurants, etc. Payment through a third-party payment platform requires higher handling fees, and large exchange losses will also occur during international travel. Maps.me recently completed $50 million in financing and issued a platform token. Maps.me is currently developing its own multi-chain wallet and will launch a DeFi ecosystem on this offline mobile map platform. One of the tokens supported by the multi-chain wallet is USDC, which is created based on Solana and enables instant payments, especially for travelers to remote areas that lack payment infrastructure. Maps.me will integrate DeFi income into the wallet to provide users with passive income, while attracting existing users by providing related services, and will provide users with more DeFi services in the future.   The product that provides DeFi services for Maps.me in the early stages is Oxygen, which will be introduced next. 5. Oxygen Oxygen Protocol is a non-custodial decentralized brokerage protocol. Oxygen can help users generate liquidity, earn income, borrow short assets, and obtain trading leverage for the user's asset portfolio. Oxygen focused on lending business in the early stages, and then gradually added various common investment banking businesses. Oxygen allows users to trade directly in the fund pool, simplifying the transaction process. After the lending agreement, the next stage will be the creation of an OTC swing trading platform and structured products that developers can tailor for themselves and their users. The ultimate goal is to allow the prime brokerage business that only exists in investment banks to reappear in DeFi and make this service available to everyone. Oxygen relies on Serum's price data for order execution, market data, pricing, and risk management. Benefiting from the composability of DeFi, various participants on Serum can integrate and expand Oxygen's functions. In the early stages, the Oxygen protocol will be imported into Maps.me to gain users of Maps.me, who will generate income from the wallet embedded in Maps.me. Maps.me users will not realize that the wallet they are using is a DeFi wallet, so the user experience will be very smooth, and the wallet can be used just like using a traditional App wallet. Oxygen is currently in its early stages and has only launched an iPhone APP. Currently, it only provides basic functions such as deposits, transfers, and transactions.  6. Solstarter Solstarter is the first IDO platform on Solana, and the product is not yet online. From social media, Solstarter is very popular, and each tweet has a lot of comments.  Solstarter has not been officially launched yet, and no specific details have been announced, but one of the main rules is that the more platform coins you hold, the higher the IDO quota you can obtain, which is basically the same as most IDO platforms.  7. Orca Orca, one of the first 12 projects funded by the Solana Foundation, is an automated market maker (AMM) and aggregator platform. Orca has a small team and the product has been officially launched, but the token has not been issued yet. Orca defines itself as: a people-oriented, non-programmed DEX. Orca wants to provide a simpler and more user-friendly experience for the Solana ecosystem. Specifically, Orca optimizes some usage details. For example, when entering a transaction on Orca, the system will check whether the following two conditions are true:

If the above conditions are met, you can trade with confidence. But as long as one condition is not met, the system will pop up an "interest rate warning" or "slippage warning" prompt, as follows:  Another example is the reason why Orca added the "Tokens" panel to the interface. Through it, it is possible to see the balance of all tokens listed on Orca, and its value is updated in real time based on transactions made or liquidity provided. 8. Summary At present, there are not many native applications on Solana, but as the ecosystem develops, we will see more and more native applications appear. Recently, we often see projects in the Solana ecosystem completing financing, and projects outside the ecosystem announcing deployments based on Solana, which also shows that the Solana ecosystem is growing. We look forward to the emergence of a more colorful Solana ecosystem. After all, the vigorous development of any ecosystem is only good for the industry. The article mentions project financing overview: DeFi exchange Serum completed a $20 million private placement round in three days DEX platform Bonfida completes US$4.5 million in seed round financing, led by CMS Holdings Offline travel application Maps.me received US$50 million in seed round financing, led by Alameda Research DeFi prime brokerage service provider Oxygen completes US$40 million in financing, led by Alameda Research Solana IDO platform Solstarter receives investment from DeFiance Capital Reference links: https://serum-academy.com/en/built-on-serum/ https://dex.projectserum.com/#/market/6bxuB5N3bt3qW8UnPNLgMMzDq5sEH8pFmYJYGgzvE11V https://bonfida.com/?ref=block123#/ https://projectserum.medium.com/serum-newsletter-26-547816951347 https://solible.com/#/ https://raydium.io/info/ https://raydium.medium.com/introducing-acceleraytor-536574aae1c0 https://mp.weixin.qq.com/s/9RM-hIzYQfwPPXr7dkcM0A https://www.chainnews.com/articles/896314410177.htm https://www.orca.so/ https://www.chainnews.com/news/401153080463.htm Statement: This article is the independent opinion of the author, does not represent the position of the Blockchain Research Society, and does not constitute any investment opinions or suggestions. -END- Blockchain Research Club The Blockchain Learning Club is a one-stop platform for blockchain knowledge learning and investment services. We try to export in-depth knowledge in various fields of blockchain to users in the form of popular science courses and articles, and explore deterministic and stable investment opportunities for investors, ultimately opening up the path to knowledge and wealth. Founded in January 2017, we have 100,000 community users and 30 branches around the world. We have delivered more than 100 popular science courses on blockchain and written more than 1 million words of popular science articles. The Study Society has been deeply involved in the Polkadot ecology for a long time. When the current Polkadot parachain slot auction is approaching, the Study Society has launched the "Polka Quick Start Course" specially created for the Polkadot ecology, which will give you a comprehensive understanding of the Polkadot ecology and better grasp ecological opportunities. Limited time only 9 yuan 9, massive benefits are given away, first come first served. Scan the QR code to add a secretary and seize the huge opportunities of the Polkadot ecosystem with many friends.      Revealing the secrets of Dfinity | Comparison of mainstream Rollup solutions | Polkadot slot auction Latest progress of ETH2.0 | Polkadot’s 9 most popular DeFi IDO model explanation | Polkadot ecological financing overview | SNX Layer2 migration Polkadot DeFi Ecological Progress | NFT Quick Start | DeFi+Layer2 Understand the Terra ecology | Massive assets are introduced into Polkadot | DeFi+NFT Overview of Polkadot’s unissued currency project | BSC Getting Started Guide | Rollup splits the ecology NFT and Storage | DeFi Index Overview | King of Unsecured Lending DAO | Polkadot Quick Start | DeFi Insurance Layer2 Affects Composability | Stablecoin Model PK Fixed Rate Lending | Bitcoin Anchor Coin | Comprehensive Understanding of SNX  It is said that everyone who clicked "Looking" bought a hundred times the coins! 👇 |