42331

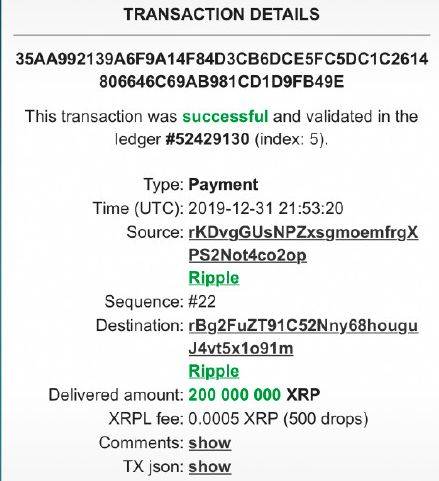

As 2020 approaches, Ripple is becoming active again. Throughout 2019, as one of the few cryptocurrency projects that regularly reaches transactions with financial institutions, Ripple is highly topical and has received widespread attention and discussion in the industry, whether it is the "qualitative nature of XRP," "financing situation," or "XRP price fluctuations." On December 20, 2019, Ripple announced that it had received US$200 million in Series C financing. This round of financing was led by Tetragon, with participation from SBI Holdings and Route 66 Ventures. Looking at the ten years of the blockchain industry from Ripple, we may be able to see the unique attraction of blockchain technology to the traditional financial industry.  Ripple’s “Big Brother” Customers Banks have always been the first to implement the intersection between the cryptocurrency field and traditional finance. Ripple’s large user base also proves this. Earlier, Ripple Senior Vice President Marcus Treacher said in an interview that half of Ripple’s customer base are banks and the other half are financial technology payment providers. Another 25% of the banks are really big banks, such as Bank of Tokyo, Bank of Mitsubishi, Santander and Standard Chartered. The easiest thing for banks and payment companies to accept is remittance. Currently, the traditional cross-border payment field is dominated by the SWIFT (Society for World Interbank Telecommunications) system. SWIFT was established in the 1970s and is currently the main service provider for international inter-bank cross-border settlement. Due to the lack of standardized payment operation methods between different banks, most transfers can still only be made through the SWIFT protocol. However, today, as the speed of information transmission increases rapidly, the cross-border payment system is often accused of being inefficient, high-cost, and unreliable. There are many stakeholders and responsibility attribution issues, making it difficult for this oligopoly system to gather the power of innovation. Since the main problem that makes it difficult to improve transfer efficiency is trust and security, blockchain technology can provide a good solution to a large extent. As early as 2004, the Ripple payment protocol RipplePay was born. In 2013, the company officially changed its name to Ripple and began to focus on cross-border remittances and cooperate with banking financial institutions. Ripple builds a distributed digital payment network without a central node and uses distributed identity authentication technology. Currently, Ripple provides three products: xCurrent, ODL cross-border payment platform and xVia. These functions have been integrated into RippleNet at the end of 2019. Among them, xCurrent has the highest acceptance and can provide customers with interoperability between any or all currencies, and each bank can issue its own credit certificate. Banks can synchronize data in real time and make end-to-end cross-border transfers relatively quickly and at low cost. Since most financial institutions that cooperate with Ripple have a conservative attitude towards cryptocurrencies and their main purpose is to transfer funds quickly, the choice of most traditional institutional customers is xCurrent. On Ripple's XRP-based cross-border payment platform ODL (the platform was formerly known as xRapid), Ripple has incorporated XRP into cross-border transactions. Since XRP is a native asset based on the blockchain, when using XRP for xCurrent payments, the counterparty can directly verify the initiator's XRP reserves and respond quickly. According to reports, some large remittance service providers such as Western Union and Moneygram are temporarily trialing this product in their operations. xVia uses a standardized API interface for Ripple network services. Users can directly use the above two functions through this interface. It is called "the last stage of the Ripple product ecosystem." Some remittance providers, such as Brazil's Beetech and Canada's Zip Remit, have previously stated that they are planning to use this product. Currently, according to Ripple officials, it already allows banks to pay each other at microsecond speeds in up to 45 countries currently and globally in the future.  Industries and Trends: Financial Institutions May Have No Choice Through blockchain technology and the products provided by Ripple, it is not difficult to find why large traditional financial institutions like Ripple. According to foreign media reports, through XRP, banks and other institutions can exclude middle parties in the cross-border payment process and reduce costs. For example, PayPal charges approximately 3% for electronic payments. If using Ripple, the average transaction fee is currently 0.0009 XRP. Another reason why institutions like Ripple is its scalability. XRP can handle 1,500 transactions per second and has the potential to match Visa’s throughput of 50,000 TPS. Previously, in order to verify the efficiency of XRP, TechCrunch founder Michael Arrington had sent $50 million. The network took only three seconds to complete the settlement payment, and the transaction cost was only 30 cents. For many in the cryptocurrency community, though, XRP’s partnership with financial institutions took it away from Satoshi Nakamoto’s vision of a peer-to-peer currency that would allow people to take back control from their banks. However, from the perspective of industrial development, this is the intersection between the encryption community and the traditional financial industry that cannot be ignored. Graham Bright, head of compliance and operations at the European Export-Import Bank (Euro Exim Bank), affirmed Ripple’s role, saying that it fully exploits the weaknesses of the existing SWIFT system. XRP eliminates the need to establish existing bilateral relationships with foreign banks to retain foreign exchange reserves and handle local legal currencies. On Twitter, Marjan Delatinne, who has worked at SWIFT for 20 years, observed that the future of blockchain technology will be focused on liquidity and will be developed in smaller countries where funds are more difficult to flow. It can be seen that in the more than ten years since its establishment, Ripple has confirmed to the media that the company has established cooperative relationships with 200 banks and financial customers, such as Mitsubishi Bank of Tokyo UFJ (MUFG), Banco Bradesco, Standard Chartered Bank, etc. Canadian Imperial Bank of Commerce, Swiss UBS, Spanish Bank Santander, Italian UniCredit, and American Express are the first batch of banks to participate in the Ripple network test.  (Some partners on Ripple’s official website) Mark Davis, a cryptocurrency enthusiast and industry analyst contacted by Blocklike, analyzed: “Over the years, because crypto transactions that meet KYC standards have indeed significantly reduced transaction costs, more and more large banks may be forced to adopt new technologies. You know, if your competitors cooperate with Ripple, then the other party will gain great convenience and reduce costs and manpower. Traditional financial institutions without cooperation will be under great pressure. When the institutions themselves do not have the advantage to develop research and development from scratch, they will not sit back and wait, but will become more involved in cooperation. This will also be the trend of the blockchain + financial industry in the future. 」 Interestingly, on January 1, 2020, the Ripple custody account had just released 200 million XRP, worth approximately US$38 million. (Note: The screenshot time is UTC time).  Let us guess here, which bank or payment institution is involved? More column recommendations: "Industry·Digital Securities" | Analysis of dual-token model under blockchain + cross-border payment | Looking ahead | DoraHacks: Geeks’ road to “equity freedom” | Looking ahead | UPRETS CMO Wei Ran: Sharing practical experience in digital securities | Ultra-forward looking | Interview with JK, Director of Securitize Asia Pacific | Looking ahead | The founder of Resolute.Fund talks about real estate and STO | Looking ahead "Witness" |IDAX platform lost assets and ran away|Witness |The New Year’s Eve is approaching. Check out the exchanges in Shanghai|Eyewitnesses |Huobi OK and others were accused of not being among the first batch of licensing targets in Hong Kong|Witness |Platform user data has been turned into a private weapon, and no one can trust it in the face of interests|Witness | SGCC was removed from the shelves, INVE was reset to zero, Yincoin.com was torn apart, and Han Zhiqi was accused of being a "pest" in the industry | Witness "Super Character" | Huang Butian, founder of Yunxiang Blockchain, talks about the "Tao" of distribution | Super People | Blockchain + forestry, securitization tokens and traditional assets | Super People | Duan Yu, founder of Leilu Group, talks about blockchain | Super People | Interview with Luo Xiao, co-founder & CEO of everiToken | Super People | Koyin China CEO Xu Yinglong talks about investment | Super People   |