88108

1. What is Solana? Getting Started in One SentenceSolana (SOL for short, sometimes also referred to as its token SOL) is a blockchain platform targeting high performance and high throughput. You can think of it as: the chain in the blockchain world that provides "highway and infrastructure" for decentralized finance (DeFi), NFT, and Web3 applications, rather than being mainly used for "value storage" like Bitcoin or "truck jams" under high load like Ethereum. Solana's goal: to achieve fast transaction speed, low cost, and good user experience as much as possible while ensuring security and decentralization. 2. Solana’s historical trajectory: from conception to directionOrigin and founding

The ups and downs of development

To sum up: Solana is not a "myth of smooth sailing", but it does have many bright spots in terms of technical roadmap, community support, and ecological expansion. 3. Solana’s core technology and algorithm: Look at this “magic””To understand "why Solana is fast" and "why it can scale", we must have a look at the technical structure behind it. I try to talk in chunks and use diagrams/process ideas as much as possible. Core concept: “Write time” into the blockchain—Proof of History (PoH)Traditional blockchains (such as Bitcoin and early Ethereum) require all nodes to "know the order". The common approach is for each node to communicate, compare and reach consensus with each other. But this itself becomes a bottleneck: communication, waiting, and confirmation all take time. Solana's breakthrough lies in: PoH (Proof of History, historical proof/verifiable delay function), which actually adds an "encrypted timestamp chain" to all events, allowing nodes to know "this transaction before/after that transaction and how long the interval is" without always relying on communication. (Solana) A simple metaphor: If you want to prove which of two things A and B happened first, the tradition is "I tell you, you ask others", while PoH is "I leave a chain record that cannot be forged (like a verifiable clock). Through this chain, you can tell who came first and who came last." This reduces the overhead of communication confirmation between nodes. Technically, it uses a method called Verifiable Delay Function(Verifiable Delay Function, VDF), combined with hashes such as SHA-256, forces the node to perform a series of calculations, strung together in chronological order.

Structural modules and parallel processingSolana is able to squeeze out high throughput not only by time stamps, but also by its unique "engine design." The following are several important modules:

This may not be intuitive enough. Here is a flowchart idea. It will be helpful if you draw it in your mind or on paper: 用户发起交易 → 交易发送到网络 → 根据 PoH 时间戳排序 → 流水线处理(验证 / 执行 / 写状态)→ 被打包进区块 → 共识确认 → 成为最终链上记录In this process, every step is designed to be as parallel as possible to reduce waiting and repeated communication. Consensus mechanism: PoS + PoH hybridAlthough PoH is Solana's characteristic star, it is Proof of Stake (PoS) that really determines which node will "produce the block", who will verify it, and who will write the status. Nodes participate in the competition based on the number of SOLs they have locked, reputation, performance, etc. PoH here is not about "choosing who will block", but "giving a verifiable time sequence to each event on the chain." PoS determines who has the right to produce blocks and who participates in the consensus. The combination of the two can achieve a better compromise between efficiency, decentralization, and security. Transaction fees, inflation mechanism, etc.

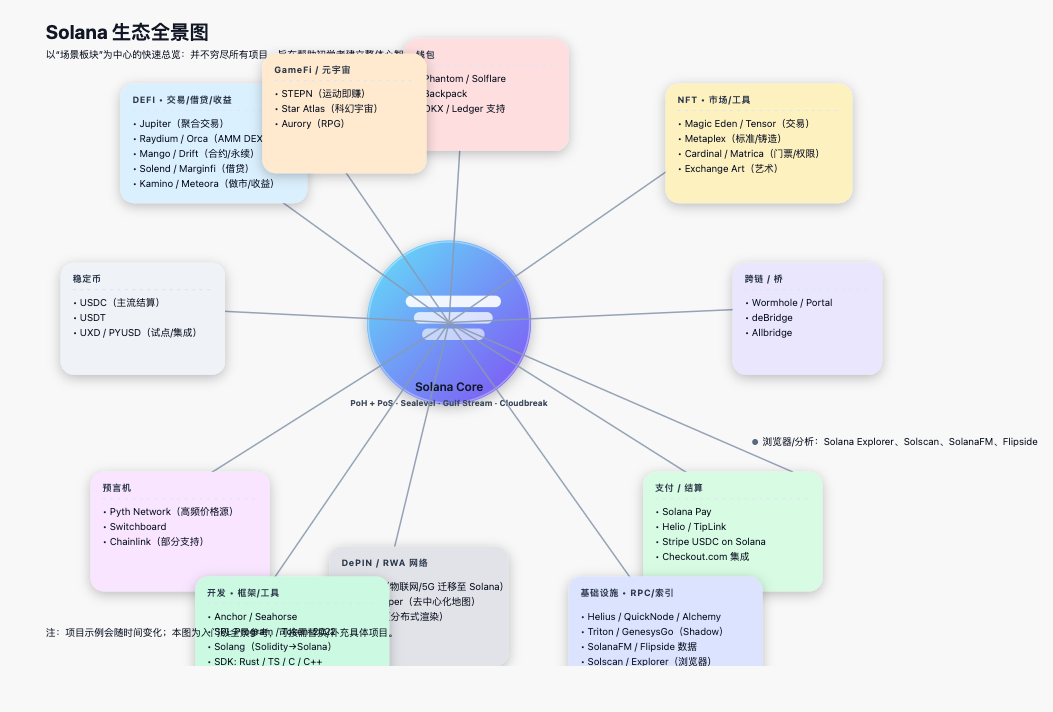

These designs are not perfect, but they can support Solana to maintain low cost and good experience under high-frequency use. 4. Solana’s application scenarios: what it can doAfter talking about technology on one side, ecology is on the other side. The following are several typical and representative application directions. Novices can also perceive these "on-chain use cases": Decentralized Finance (DeFi)This is one of the core uses in the crypto world: such as decentralized exchanges (DEX), lending platforms, asset management, derivatives, stable coins, cross-chain bridges, etc. Because of its fast speed and low fees, Solana is very suitable for high-frequency trading/high liquidity DeFi applications. For example, Serum, Raydium, Mango Markets, etc. are well-known DeFi projects in the Solana ecosystem (providing decentralized trading/leverage/lending and other functions). NFT and Digital Art/Collectibles/GamesThere are many NFT projects on Solana, including works of art, tradable props in games, digital collectibles, and more. What users like: low mint/transaction costs, fast speed, and smooth wallet experience. Game + metaverse is one of the directions Solana is often mentioned - imagine you are running and jumping in the game, and the transaction items are confirmed immediately without any lag. Web3 Applications & Decentralized Social/IdentityIn the future, many on-chain applications will not only be "money/asset transfers", but may also be social networking, identity verification, decentralized publishing, identity authentication, decentralized storage, etc. This scenario has higher requirements for chain performance, scalability, and user experience. For example: If you use a decentralized social app, and every post/like is on the chain, then you want the experience to be as fast as posting an ordinary social media post, otherwise no one will use it. Payments/Micropayments/Cheap TransactionsBecause Solana’s transaction fees are very low, it can theoretically support scenarios such as “very small payments” and “instant transfers”. For example, in the game, you pay a little money to buy a prop, and it will be credited to your account instantly. ; Or give others a tip of a few cents or a few millidollars. Infrastructure/Tools/On-Chain ServicesIn addition to direct user-facing applications, there are also many "underlying tool/infrastructure" projects on Solana: on-chain data indexing, or off-chain data acquisition, or cross-chain bridges, security audits, wallet services, RPC node services, etc. Without these infrastructures, the ecology cannot be implemented. 5. Advantages, Challenges and Risks: Don’t just look at the glamorBefore we talk about the future, let’s be honest: Solana is good, but it’s not without its problems. Advantages (its strengths)

Challenges and Risks

6. Solana’s future: Where to go?When it comes to the future, there are always dreams and uncertainties. However, based on current trends, several possible directions/evolution paths can be listed. Expansion, stability, and availability continue to be polishedThis is almost the first lesson Solana needs to make up for in order to make the network more stable and more resistant to stress (without problems under extreme trading peaks and extreme market emotions). It is also necessary to lower the node threshold, allow more people to participate, and improve decentralization. Cross-chain/multi-chain collaborationThe future is likely to be an era of "interoperability between different blockchains" - assets and data can flow across chains. If Solana wants to occupy a place in the multi-chain ecosystem, it must build bridges with other chains, develop compatibility protocols, and provide cross-chain services. Infrastructure improvements such as on-chain identity/decentralized identity (DID)For example, proof of "who you are" on the chain, privacy/zero-knowledge proof, permission control, on-chain authentication, mortgage identity reputation system, etc., will become increasingly important. Solana has the potential to work in these infrastructure areas. Richer Web3+ application scenariosThe future chain is not just "transaction + money flow", but may also be a scenario of "decentralized social networking, games, content platforms, computing markets, AI and chain integration". For Solana to be part of these futures, it must attract these types of applications. Evolution of economic/governance mechanismsToken economics, fee design, reward mechanisms, governance mechanisms, community governance upgrades, etc., may all evolve. In the future, Solana may add more governance mechanisms to give users/communities more say. 7. Trump/Trump family actions in Solana or crypto circlesThis part is more interesting.

To sum up: Trump/his family is indeed involved in encryption and has intersection with Solana (especially through memecoin, token projects, investments/asset portfolios). But many of the details are controversial/have yet to be fully transparently evidenced. 8. Some understanding suggestions and warnings for beginners

|