85619

|

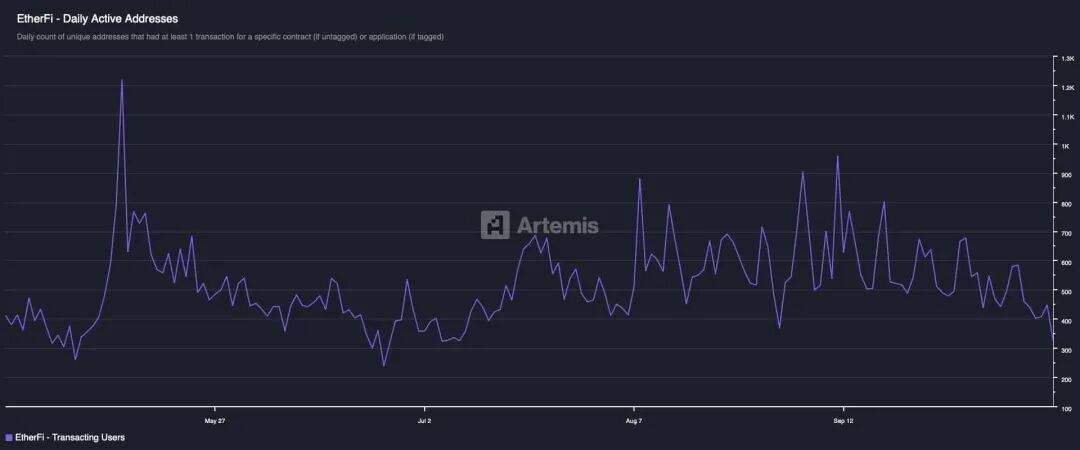

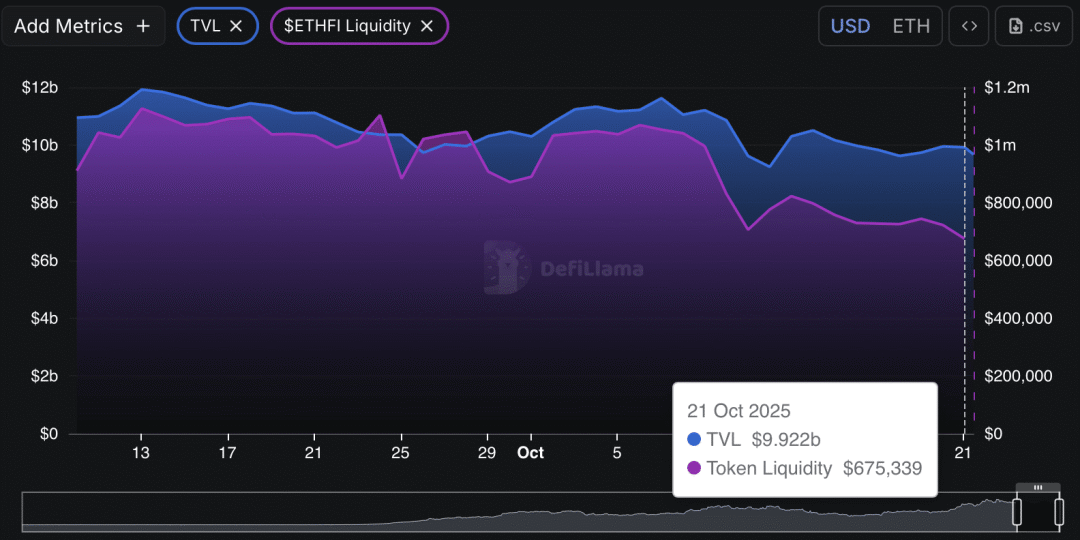

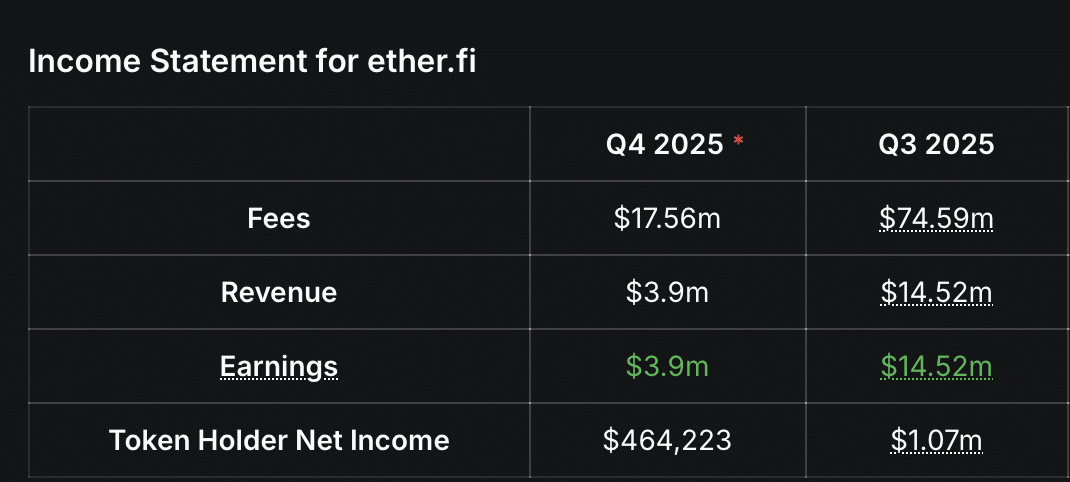

If you don’t know what to do in the bull market, you are welcome to scan the code to join the group for free. The spot code and layout strategy of the bull market can be shared for free. Welcome to private message me to join us Penguin number can be added: 3838974575 EtherFi [ETHFi] The worst outflows occurred in the past day, with a drop of 9%. AMBCrypto attributed the drop to weakening on-chain performance across the market. Its impact is gradually emerging and may fall further in the future.  These factors may influence ETHFi's price dynamics in the coming days. User churn is the main reasonETHFi's performance decline is largely due to users continuing to exit the platform. according to Artemis According to the latest data, the number of trading users has dropped to the lowest level since July 2025.  Currently, only 328 on-chain users interact with the protocol, a clear sign that investor sentiment has waned. This trend directly impacted the protocol’s revenue, with fees generated falling sharply.  Specifically, the fee dropped from $210,500 to $111,700 in one day, which equated to a loss of approximately $98,000 that could have been used in the proceeds of the agreement. However, declining protocol usage is not the only challenge facing ETHFi. AMBCrypto’s analysis uncovered additional factors contributing to rising selling pressure and declining liquidity. Liquidity squeeze fuels sell-offMarket data shows that there has been a significant sell-off as investors continue to reduce their holdings of ETHFi. The staking protocol’s liquidity has dropped to its lowest level this year. according to DeFiLlama According to the report, ETHFi’s available on-chain liquidity currently totals approximately $680,000. This shows that Uniswap [UNI] Waiting for the amount of ETHFi locked in the decentralized exchange (DEX) sharp decline.  The decline suggests that long-term confidence is waning as investors are dumping tokens to avoid further losses if market conditions worsen. Likewise, the total value locked (TVL) of the ETHFi protocol has also dropped significantly and currently stands at $9.92 billion. This pattern reflects a decline in liquidity, indicating that investors remain cautious and risk-averse. If you don’t know what to do in the bull market, you are welcome to scan the code to join the group for free. The spot code and layout strategy of the bull market can be shared for free. Welcome to private message me to join us Penguin number can be added: 3838974575 Protocol performance remains weakETHFi’s overall protocol performance continues to reflect the market’s bearish outlook. Net owner income (NHI) in the fourth quarter was only $464,000, a sharp drop from $3.9 million in the third quarter, the report showed. At the time, ETHFi was generating approximately $1.3 million in revenue per month, or $650,000 every two weeks. Data shows that the protocol failed to match its previous performance, suggesting that ETHFi holders may see less revenue in October.  This decline further intensifies the incentive to hold the asset, further damaging investor confidence in the short term. If you don’t know what to do in the bull market, you are welcome to scan the code to join the group for free. The spot code and layout strategy of the bull market can be shared for free. Welcome to private message me to join us Penguin number can be added: 3838974575  |