76321

|

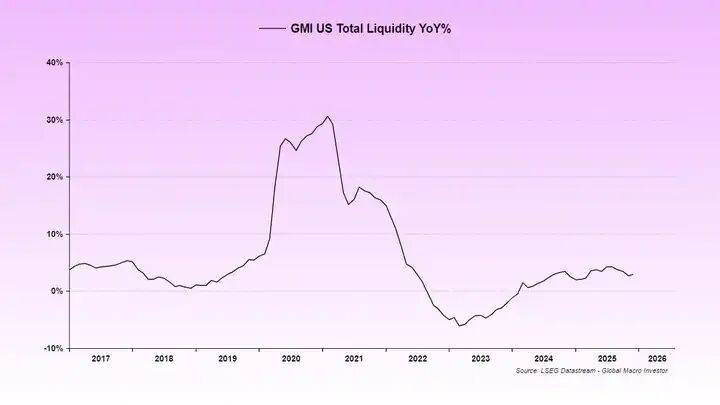

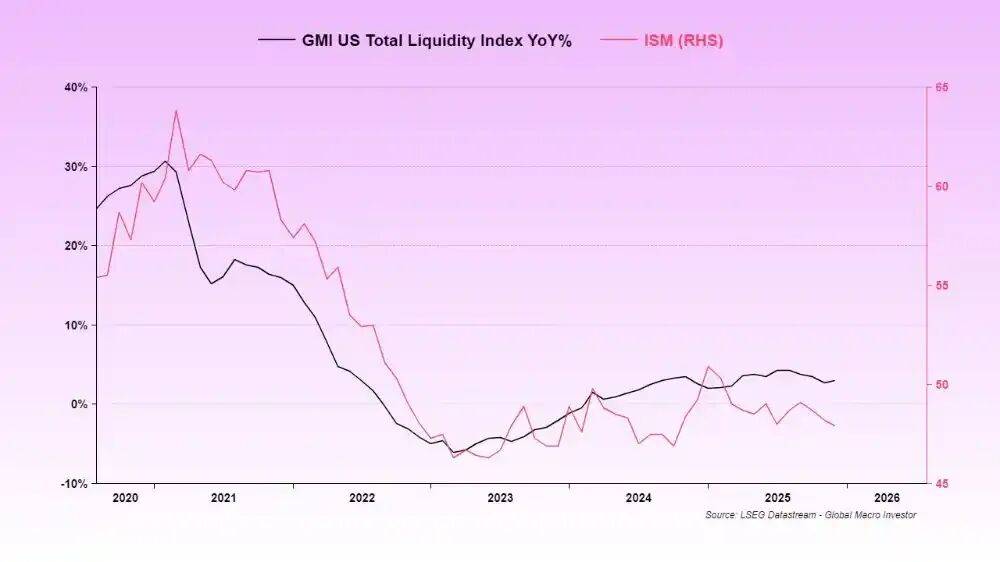

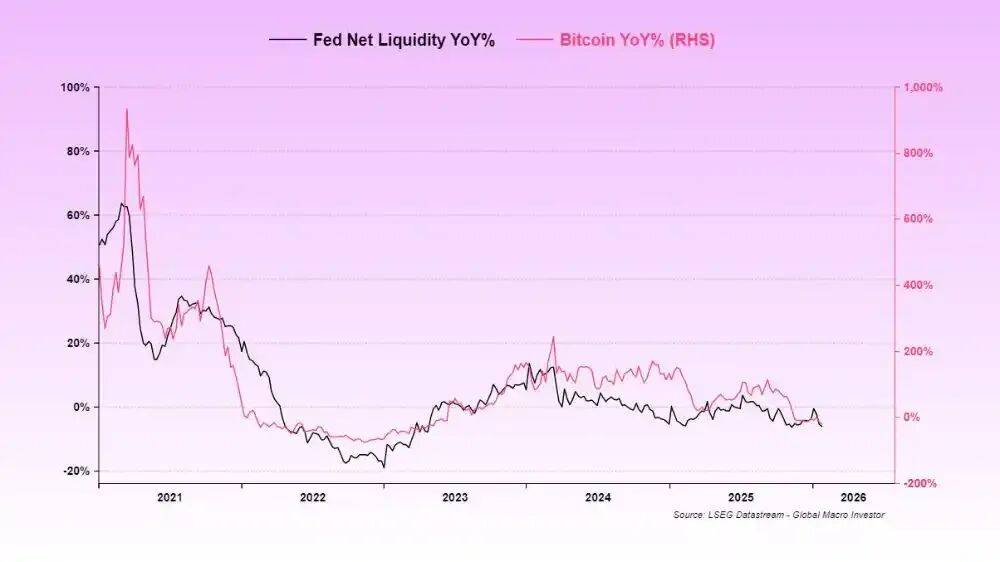

As market sentiment continues to weaken, cryptoassets have been repeatedly labeled as "end of cycle." However, this article believes that the price decline is not due to the failure of fundamentals, but the result of a phased liquidity contraction. The reconstruction of the U.S. fiscal account, the exhaustion of reverse repurchase facilities, the government shutdown, and the strength of gold have jointly drained funds that should have flowed to high-duration assets, putting assets such as Bitcoin and SaaS under simultaneous pressure. At the same time, the "wrong narrative" surrounding monetary policy is also worthy of vigilance. The market generally views Kevin Warsh as a hawk, but Druckenmiller's statement shows that his policy thinking is closer to the Greenspan era: allowing the economy to run hotter and betting on productivity improvements to ease inflation. Under this framework, what is more likely to happen in the future is that interest rate cuts and the fiscal side will coordinate to release liquidity. In a full cycle perspective, time is often more important than price. Risk assets are likely to remain under pressure in the short term ; But as liquidity constraints are gradually lifted, the current pessimistic narrative may be repriced. The following is the original text: False narrative... and some scattered thoughts I would like to share some of my experiences while writing GMI this weekend, hoping to help you stabilize your mood and regain some confidence. Sit back and pour yourself a glass of wine or a cup of coffee...I would have left this to GMI and Pro Macro, but I know you guys really need to be reassured right now. 「grand narrative」The prevailing grand narrative right now is that Bitcoin and the entire crypto market are broken. The cycle is over, everything is lost, we can never have nice things again. It has been completely decoupled from other assets - either blame CZ, blame BlackRock, or blame someone else. To be honest, this is indeed a very tempting narrative trap...especially when you wake up every day and see prices plummeting and smashing the market again and again. But yesterday, a GMI hedge fund client sent me a quick message asking: Is now the time to buy SaaS stocks? They have fallen very cheap ; Or has Claude Code "killed" SaaS, as the current narrative suggests? So I decided to do some serious research. As a result, what I found directly destroyed the narrative of "BTC is dead" and the narrative of "SaaS is dead". Because the trend charts of SaaS and BTC are exactly the same.  UBS SaaS Index vs Bitcoin This means that there is another factor at play that we all overlook…… This factor is: Due to two shutdowns and problems at the "pipeline" level of the U.S. financial system, U.S. liquidity has been suppressed. (The "water release" process of the reverse repo tool Reverse Repo has actually been basically completed in 2024) Therefore, the TGA (U.S. Treasury General Account) reconstruction in July and August did not have a corresponding currency hedging mechanism. The result is that market liquidity is directly drained.  Liquidity, which has been weak so far, is the reason why the ISM index continues to remain low.  We typically use Global Total Liquidity (GTL) because it has the highest correlation with BTC and the Nasdaq Index (NDX) over the long term. But at this stage, US Total Liquidity is obviously more dominant - because the United States is still the core supplier of global liquidity. In this cycle, global total liquidity (GTL) has changed ahead of US total liquidity (USTL), and the next liquidity recovery is approaching - and the ISM will also pick up.  And this is the key reason affecting SaaS and BTC. These two types of assets are essentially the assets with the longest duration.; When there is a phased retracement of liquidity, they will naturally be discounted and revalued as a whole. At the same time, the rise of gold has sucked away almost all the marginal liquidity in the system - funds that might have flowed to BTC and SaaS were "cut off" by gold. When liquidity is insufficient to support all assets at the same time, the part with the highest risk is the first to be hit. This is the reality of the market.  Now, the U.S. government is shut down again. The Ministry of Finance actually hedged against this: after the last shutdown, it did not use funds from the TGA (Treasury General Account), but continued to add money to it - which was tantamount to further draining market liquidity. This is exactly the "liquidity vacuum" we are facing right now, and why the price action is so brutal. There is currently no liquidity flowing into our beloved crypto markets. However, signs are that the shutdown is likely to be resolved this week, which will be the last liquidity hurdle to overcome. I have mentioned the risks of this shutdown many times before. Soon, it will be in the rearview mirror and we can truly enter the next phase - a period of liquidity flooding driven by a combination of eSLR adjustments, partial release of TGA, fiscal stimulus, interest rate cuts, etc. Ultimately, it all revolves around the midterm elections. In complete cycle trading, "time" is often more important than "price". Yes, the price could take a hit ; But as time passes and the cycle continues, everything will repair itself, and the "crocodile's mouth" will eventually close. This is why I repeatedly emphasize "PATIENCE". Things take time to unfold, and staring at your P&L every day will only harm your mental health, not improve your portfolio performance. The "False Narrative" About the Fed」Speaking of interest rate cuts, there is another widely circulated false narrative in the market: that Kevin Warsh is a hawk. This is complete bullshit. These claims are largely based on remarks made 18 years ago. Warsh’s duty and mission is to replicate the operational playbook of the Greenspan era. Trump said it, Bessent said it. It would be too long to go into details, but there is only one core meaning: cut interest rates to make the economy run hotter, and it is assumed that the productivity improvements brought by AI will suppress core CPI. Just like the 1995–2000 phase. It's true that Warsh doesn't like table expansion, but now that the system has hit reserve constraints, it's almost impossible for him to change its current path. If he makes forced changes, the credit market will be directly blown up. So the conclusion is simple: Warsh will cut rates, but won't do anything else. He would make way for Trump and Bessent to push liquidity through the banking system. And Miran is likely to force a comprehensive downgrade of eSLR and put another foot on the accelerator for the entire process. If you don't believe me, then believe Druck.  Warsh has a very open and approving attitude towards the monetary policy ideas of former Federal Reserve Chairman Alan Grenspan. He firmly believes that economic growth can be achieved without triggering inflation. I know that listening to any narrative when everything seems so dark can feel incredibly jarring. Our Sui position now looks like shit, and we are beginning to wonder what and who to believe. But first things first: We’ve been through this situation many times. When BTC drops 30%, it’s not uncommon for small coins to drop 70%; And if they are high-quality assets, they tend to rebound faster. Admit your mistake (Mea Culpa)Our mistake at GMI is that we did not realize in time that "US liquidity" is the real dominant variable at the current stage. In previous full cycles, total global liquidity has usually dominated, but this is not the case this time. Now it's clear - "The Everything Code" is still in effect. There is no such thing as "decoupling". It’s just that we didn’t predict, or underestimated, the superimposed effect of such a series of events: Reverse Repo was drained → TGA was rebuilt → government shutdown → gold surged → another shutdown. This combination of punches is difficult to fully predict in advance, and we did underestimate its impact. But it's all coming to an end. finally. Soon, we will be back to "business as usual". We can't get every variable right, but now we have a clearer understanding of the situation, And we remain extremely bullish in 2026 - because we know the Trump/Bessent/Warsh playbook very well. They've told us this repeatedly. All we have to do is listen and be patient. In a full-cycle investment, what really matters is time, not price. If you're not a full cycle investor, or you can't handle the intensity of the volatility, that's totally fine. Everyone has their own style. But Julien and I have never been day traders, and to be honest, we suck at it (we don't care about the ups and downs within cycles). However, when it comes to full-cycle investment, our verifiable and traceable long-term performance over the past 21 years is among the best in history. A disclaimer of course: we make mistakes too. 2009 was an extremely tragic example. So now is not the time to give up. Good luck and let’s have a fucking epic 2026. The mobile cavalry is coming. |

2026-02-07