43411

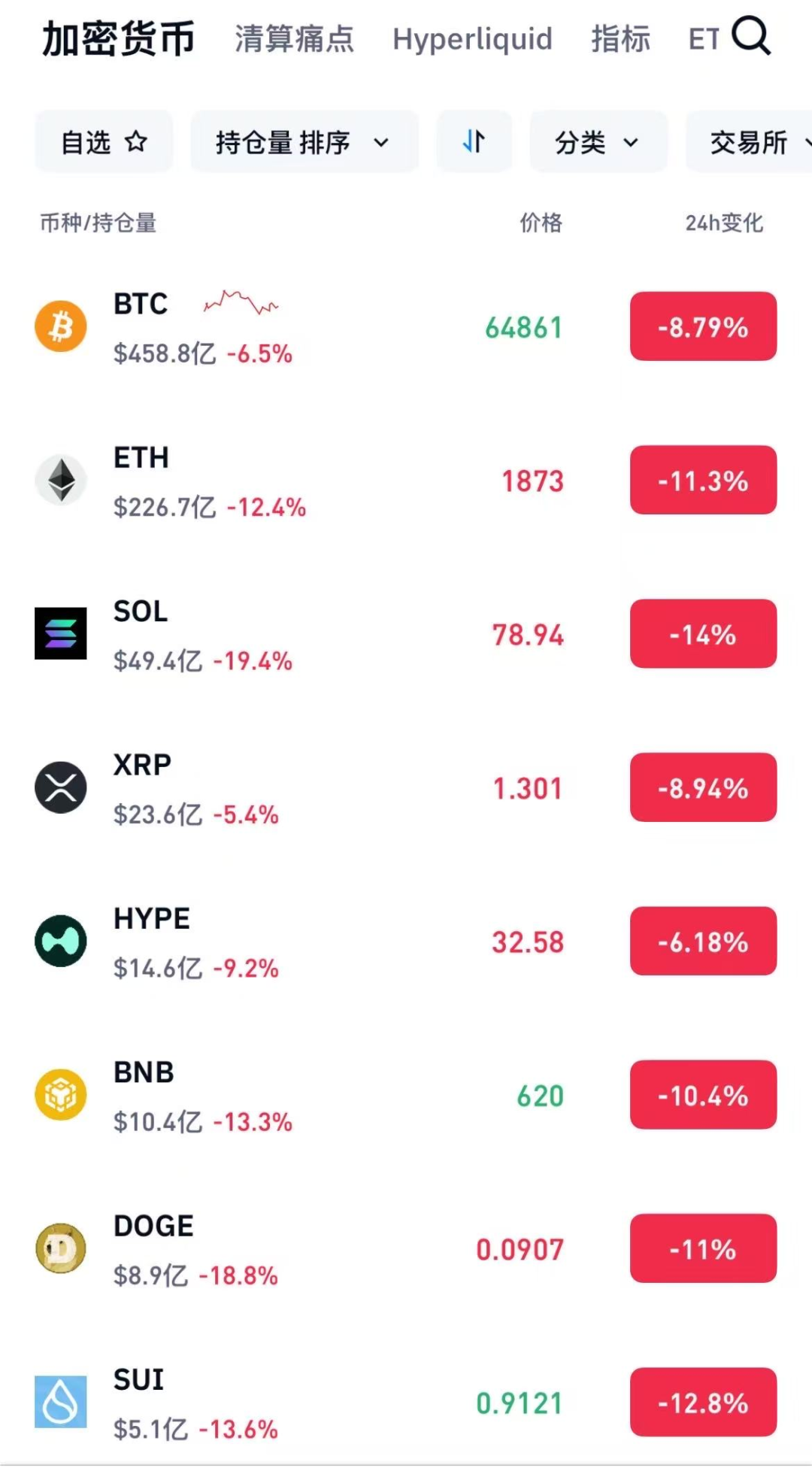

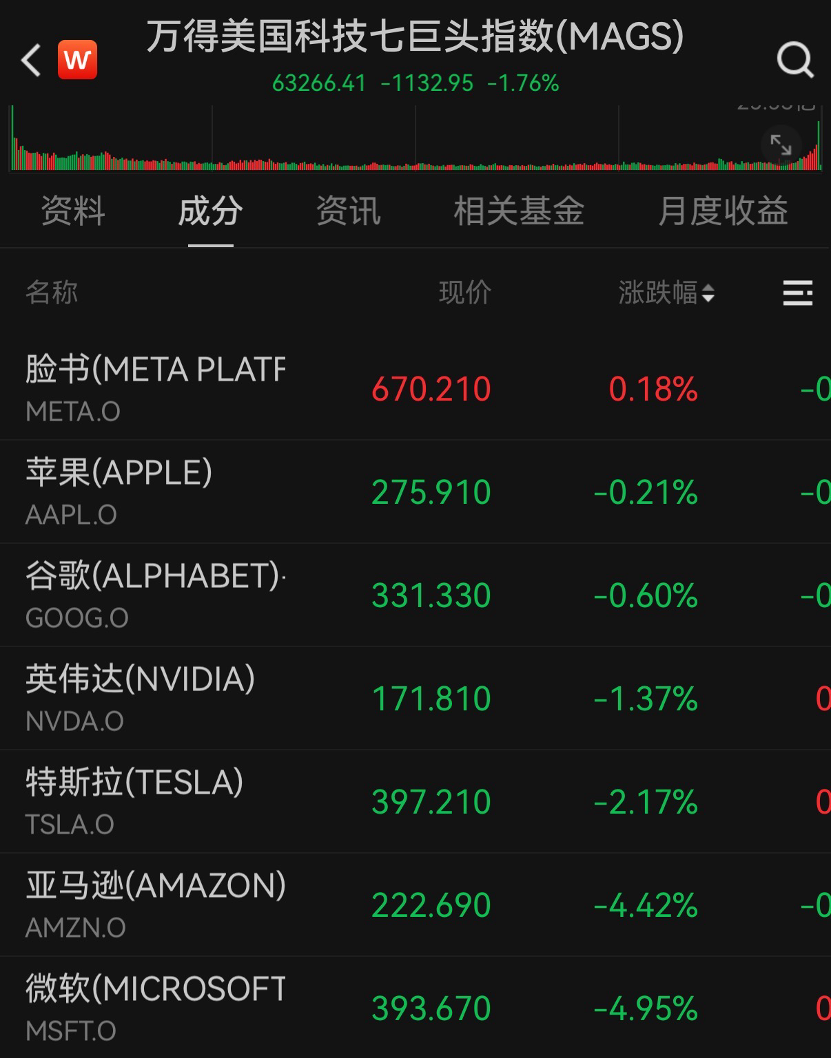

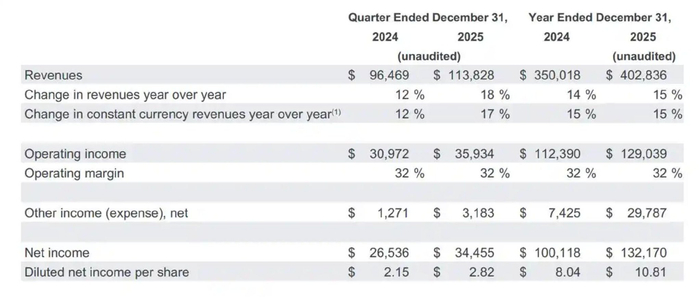

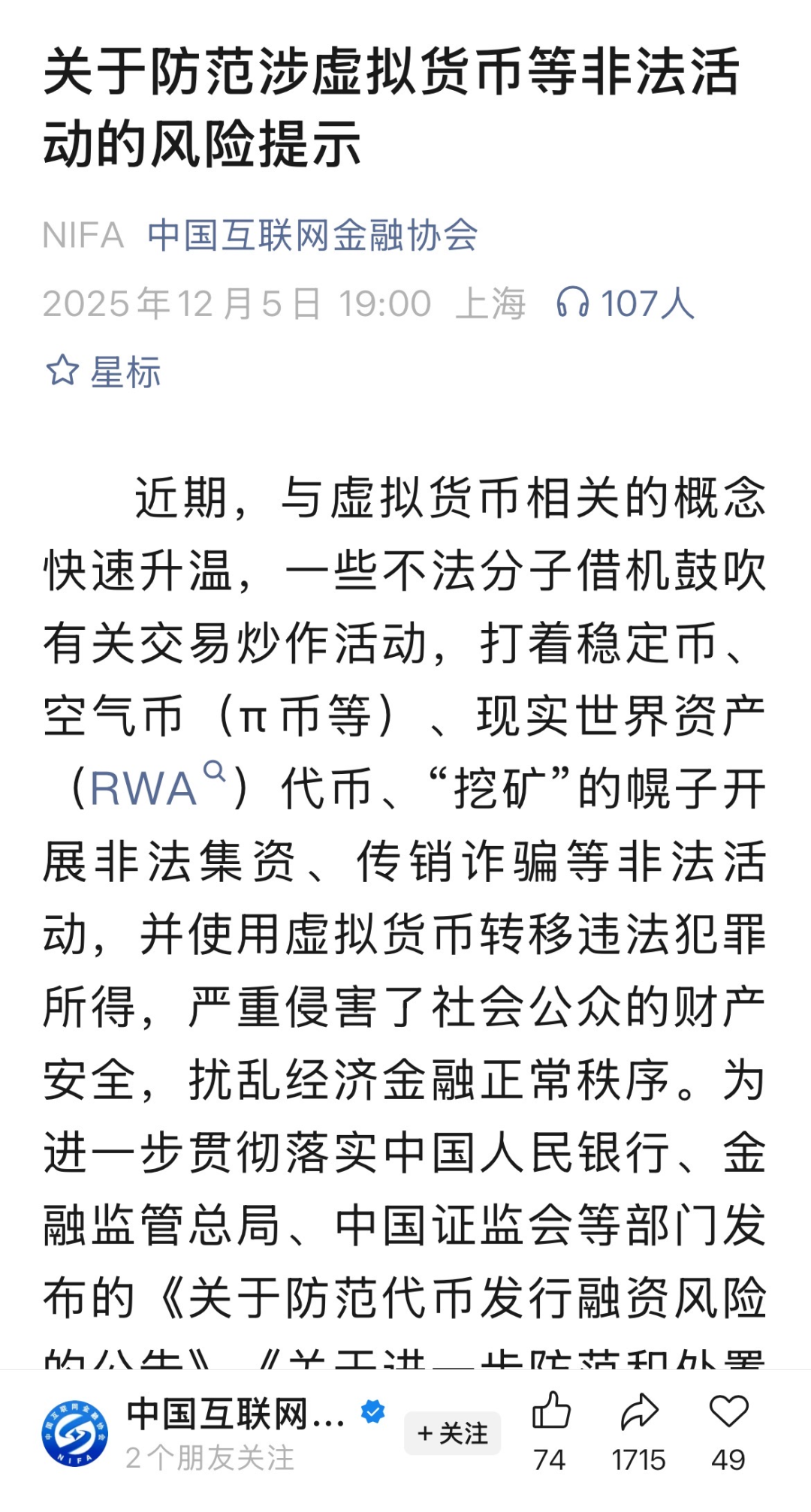

570,000 people liquidated their positions, and 17.3 billion was wiped out.  Produced | New Quotes Author | Song Hui Once upon a time, Bitcoin was called “"Machine to create wealth", but now, it has made many people miserable. February 6 , Bitcoin welcomes crash, intraday drop overtake8%,fell below The $65,000 mark has reached the lowest level59800Dollar. since last year Since reaching its peak in October, Bitcoin’s market value has fallen by nearly half. CoinGlass data shows that within 24 hours, more than 570,000 people liquidated their positions in the cryptocurrency market, and the total liquidation amount exceeded US$2.5 billion (approximately RMB 17.3 billion). “The Fear & Greed Index has reached 10, indicating that the market is in a state of "extreme fear". This storm was more violent than expected.  Bitcoin has plummeted across the board, and its market value has been cut in half On Friday, the cryptocurrency market ushered in a storm. As of 17:00, Bitcoin fell more than 100% during the day. 8%, falling below the $65,000 mark.  Image source: CoinGlass sinceSince hitting a record high of $126,223 in October 2025,Bitcoin this A round of decline has wiped out half of the market value。 at the same time, downtrend also spread arrive Other tokens, related exchange-traded funds, and public companies holding large amounts of Bitcoin , the cryptocurrency market fell across the board。as of pm At 17:00, Ethereum fell by more than 11% in 24 hours, XRP fell by more than 8%, SOL and Dogecoin fell by more than 11%, and BNB fell by more than 10%.  Image source: CoinGlass Small, illiquid speculative tokens decline Even Because of the tragedy. The data shows, The MarketVector Digital Assets 100 Small Cap Index is down about 70% in the past year. Precious metals markets were also hit hard. Previously, spot silver once plummeted by more than 20%, and spot gold once fell by more than 4%. But today, gold and silver are back again. As of the afternoon, spot gold rose to Above US$4,885 per ounce, silver rose to above US$74 per ounce. Bitcoin’s sharp decline this time, yes The result of the resonance of multiple factors such as the macro environment, capital flows, trading mechanisms and market sentiment. On the one hand, large-scale redemptions from exchange-traded funds are one of the important drivers. China Business News revealed that this year In January, U.S. spot Bitcoin ETF outflows exceeded US$3 billion in a single month, after outflows of approximately US$7 billion and US$2 billion in November and December respectively. The wholesale withdrawal of institutional funds has resulted in a serious lack of market capacity. Although there was a brief reversal during the period, it was difficult to change the overall outflow trend, which further strengthened market sentiment and formed a vicious cycle. Deutsche Bank analysts believe that traditional investors’ interest in crypto assets is waning, and the market’s overall pessimism about cryptocurrencies is increasing。 On the other hand, the amplification effect of leveraged trading triggered a market stampede. CoinGlass data shows that in the past 24 hours, more than 570,000 people liquidated their positions in the cryptocurrency market. The Fear & Greed Index has reached 10, indicating that the market is in a state of "extreme fear".  Image source: CoinGlass  Image source: CoinGlass It is worth mentioning that what happened simultaneously with the state of the cryptocurrency market was that the U.S. technology sector, led by Microsoft, suffered heavy losses.  Image source: wind So here comes the question. One is digital currency, and the other is the equity of a technology company. They cannot compete with each other. Why do they become birds in the same forest and fly together when disaster strikes? In fact, in the current market perception, Bitcoin is closer to a risk asset than a safe-haven asset such as gold. Similar to technology stocks, they are highly sensitive to changes in macro liquidity and interest rates. At the same time, the two also almost share similar investor groups. ——Institutional investors and risk-appetite investors. Data shows that the 30-day correlation coefficient between Bitcoin and the Nasdaq 100 Index has risen to 0.72, with significant synchronous fluctuations. Under this logic, when anxiety spreads, panic can easily spread to each other. On February 4, Alphabet, Google’s parent company, released its financial report. Annual revenue exceeded US$400 billion for the first time, reaching US$402.84 billion. Alphabet also disclosed that capital expenditures in 2026 may be as high as $185 billion, which is almost double the full-year expenditure in 2025.  Image source: Alphabet Although the performance is improving, some investors are worried that future investment that exceeds expectations will be difficult to obtain matching returns in terms of business data. Since then, Alphabet’s stock price has fluctuated violently, with a flash crash after the market closed. 7%, and finally narrowed to a decline of about 2%. Not only Alphabet and the AI war are getting more intense. Many large technology companies have revealed in their financial reports that they are expected to expand investment in the field of artificial intelligence. These include Microsoft, local time On January 28, Microsoft announced its second quarter financial report for fiscal year 2026. In a follow-up conference call, it stated that capital expenditures for the quarter reached US$37.5 billion, a year-on-year surge of 66%. Microsoft also stated that it would continue to increase strategic investment in the AI field. Investors' concerns were directly reflected in the stock price. The next day, Microsoft's stock price plummeted by more than 10%, the market value evaporated by more than 357 billion U.S. dollars (approximately 2,481.2 billion yuan) in a single day, the largest single-day decline since March 2020. Goldman Sachs pointed out that if The huge investment in AI spending cannot be converted into the expected profit acceleration, and the high valuations of technology stocks will face a severe correction. The market’s anxiety over the huge capital expenditures related to artificial intelligence continues to ferment. But in the long term, the relationship between Bitcoin and technology stocks is more complicated. For now, uncertainty in all aspects is still the Sword of Damocles hanging over the Bitcoin market.  Is the Bitcoin narrative unraveling? Some analysts believe that one of the profound changes in Bitcoin’s current plunge is the collapse of its market narrative. Bitcoin has long been promoted as a hedge against inflation and has been billed as “Digital gold”. But this time During market adjustments, they behave more like high-risk assets. “The safe-haven narrative of “digital gold” is facing severe tests in the current environment.  Source: Sina Finance Risks of Cryptocurrency Investing, No It only affects ordinary investors, and even celebrities seem not to be immune. last year In October, Jay Chou posted on social platforms A public "person search" was launched, naming long-time friend and magician Cai Weize. China Business News revealed that behind this "person missing" incident, there may be a Bitcoin investment dispute involving hundreds of millions of New Taiwan dollars: Jay Chou entrusted Cai Weize with NT$100 million (approximately 23 million yuan) to trade Bitcoin on his behalf a few years ago. But now, the trader has lost contact, and the whereabouts of this huge asset have become a mystery. After searching for it many times to no avail, Jay Chou chose to speak out publicly.  Image source: Weibo Later, Cai Weize appeared, but did not respond directly. He said: “Sorry, I will be deactivated from social media for a while and will not reply to messages for the time being. ”Since then, Cai Weize has not made any public appearances or responses, and no actual progress has been reported yet. The fragility of the cryptocurrency market has been exposed by a series of recent events.  Cryptocurrency fluctuates violently, a risk warning Suppose investors useWith a principal of US$1,000 and choosing 10 times leverage to buy Bitcoin contracts, it is equivalent to controlling a position of US$10,000.,when price falls10%, the principal has been lost. In reality, many users use 20x, 50x or even 100x leverage, which means that they may be "swept out" if the price fluctuates by 2%-5%.The losses were even more severe. In fact, domestic regulatory agency Already Risk signals have been sent out. On December 5, 2025, seven associations including the China Internet Finance Association jointly issued a risk warning on preventing illegal activities involving virtual currencies, reminding the public to identify risks and stay away from illegal activities.  Image source: China Internet Finance Association Which means: The price of virtual currencies fluctuates sharply, and is often used for speculation, pyramid schemes, fraud and other illegal activities. The public is requested to enhance risk awareness and identification capabilities, and protect their own “money bag”。 In addition, regulation of cryptocurrencies continues to tighten globally. Song Hui's analysis is only based on public market information and does not involve any investment advice. For ordinary investors, understanding the attributes and complex correlations of high-risk assets may be more important than predicting short-term rises and falls. In the future, Bitcoin is a repeat previously The cycle will still go to Michael ·The "value destruction" Bury warned about is yet to be determined. But what is certain is that, This time cryptocurrency The bloody storm in the market, to global investors All Lesson learned. Click to follow and make friends with the editor-in-chief    |

2026-02-07