78272

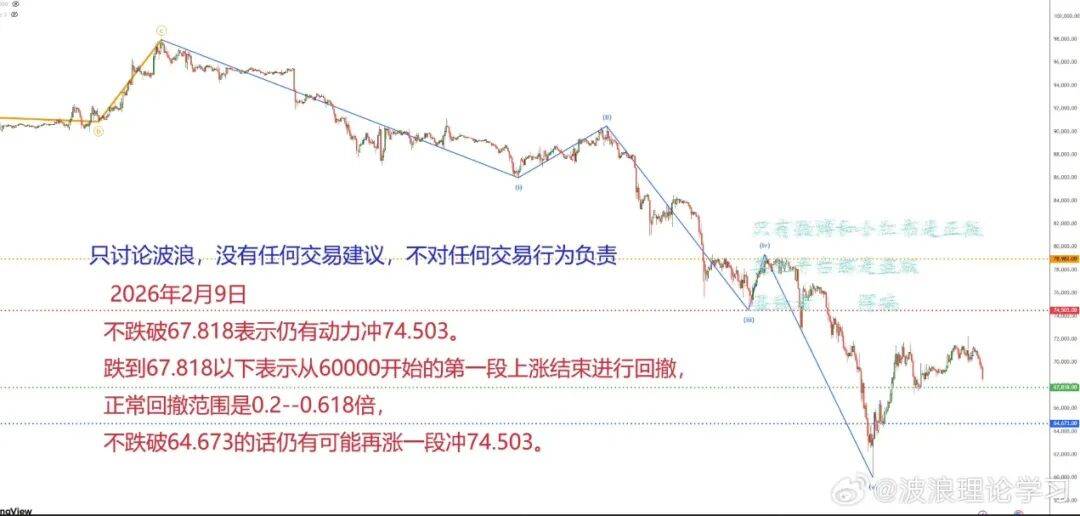

I. Quick Overview of Top Traders’ Perspectives1. Top trader: Eugene Ng Ah Sio Updated at 18:19 on February 8, Beijing time: Looking back at what happened last week, from the perspective of the market structure on a high-timeframe basis, it is undeniable that the situation has been disrupted. Although 60,000 remains a relatively reasonable support level, what I learned in the last cycle was…: Do not take excessive positions without any invalid bits present. In a bull market, the trends always tend to be even more extreme than you expect ; And in a bear market, things always turn out to be worse than you expect. I don’t know where the bottom of this bear market lies, nor whether we have already hit 60,000 levels, but survival is always the top priority. Each trading arrangement should be treated independently, and stop-loss orders should be set in place to prevent the market from deteriorating further than it already has. (Pigeons believe the market has entered a bear market and that it could worsen further; remember to set stop-loss orders.) ) 2. The trader: a genius of the bull market Updated at 10:03 on February 9, Beijing time: A big short squeeze – not a mistake, just came a bit early We were really excited about the prospect of a big short squeeze coming, but the bulls weren’t strong enough, and those dirty, nasty bears completely ruined that breakout attempt! Vomit! That’s not looking good at all! We noticed this around 71k and decided to panic sell, earning a profit of 60,000 dollars from that attempt. Not bad, but it’s not the big prize we were really hoping for. Let’s take a look at the cash flow and analyze what happened, as well as why the massive short-selling surge is still ongoing: ·Friday was a very strong day: the spot TWAP exceeded $1 billion. Almost no new long positions were taken on, and there were significant outstanding short positions ·The shorts are trapped, while the longs are outside the market! Everyone wants something that's cheaper ·The short seller refuses to close their position ·The liquidation map is completely unbalanced ·All these incentives are ultimately aimed at leading to a complete and massive short-selling spree Now it's time for the weekend: ·Clearly, the cash flow available over the weekend is even lower ·However, the price still rebounded back to the resistance level ·Why? Because the shorts realized the danger and chose to close their positions ·Try to break through at the opening of the green futures ·I’m so excited! The big short squeeze is coming! ·But the cash flow for spot transactions hasn’t kept up ·Oh no! It was a SFP (false breakout); they completely wiped us out! What a pity. But on the contrary, this is a perfect trap structure! Bring the price back down to 67.5k, and then create another fake breakout downwards—oops! ·Shorts are rebuilding their positions with full confidence → The lower level is being tested once again ·The bulls lost that last sliver of hope they didn’t even realize they still had… and then they gave up ·The shorts became exceptionally excited ·During the US trading session, Michael Saylor took a huge bite in the form of “Bitcoin B,” causing its price to plummet by 1 billion ·TWAP continuation ·A true breakthrough above 72k ·Big short squeeze Wish you all good luck  He believes that BTC will artificially fall below 67,500 to create selling pressure, only to then rise and push prices even higher. ) II. Quick Overview of Paid Influencer Views1.Vivian Updated at 21:03 on February 9, Beijing time:  Today's market conditions: It’s important to remember that 68.5k represents the 200-day EMA on a weekly chart. Every time BTC reaches this level, it is touching the demand zone on a longer-term horizon, and it tends to rebound as a result. We are still choosing to follow the bearish strategy from last night, simply because the price remains below the opening level of the daily chart throughout the day. We are shorting any attempt at a rebound from 68.5k downwards that fails. Suppose the same situation occurs tomorrow, but the price opens above the daily opening level For example, if the daily chart opens at 68.5k and then rises to 70k, we should no longer consider going short in such a market situation. If the opening level of the daily chart is held, we may need to choose to wait and not trade. According to my calculations, in the next few days, BTC is likely to fluctuate between 70,000 and 64,000. The discount range is 64,000 to 67,000. BTC managed to hold above the 68,500 level as well as all its moving averages at the close of the week, which represents a significant sign of local strength. Plus, we are approaching the Lunar New Year I think the real upward trend will start on Wednesday. Once the price drops below 68.5k again, we can start considering range trading, entering positions gradually using 3x leverage. Up until now, our principle has been…: As soon as a trade starts to generate a profit, it should be closed immediately or partially, and the stop-loss level should be monitored closely. Even when going short, it isn’t one of those “clean and straightforward” short-selling strategies. The ideal scenario today would be…: Cleanly short the rally after New York opens, with a target of 68.5k. But every time it approaches the 68.5k range, the open short positions have to be closed out; As long as the position is profitable, take a profit immediately or partially, and move the stop-loss level to the break-even point. (Vivian believes that in the coming days, BTC will fluctuate within the range of 64,000 to 70,000, with 68,500 serving as a support level.) ) 2. Wave Theory by Liu Yudong  February 9, 2026 Failing to drop below 67.818 indicates that there is still momentum towards reaching 74.503. Falling below 67.818 indicates that the first phase of the upward trend, which started from 60,000, has come to an end and a pullback is occurring. The normal range for such pullbacks is between 0.2 and 0.618 times the initial level If it doesn’t fall below 64.673, there is still a possibility of it rising further towards 74.503. (67,818 has not yet fallen below that level, but it is very close. Liu Yudong believes that if BTC does not fall below 64,673, it could still rebound to 74,503.) ) 3. Theophilus Updated at 2:40 PM on February 9, Beijing time:  The general idea of the video is…: BTC is likely to remain consolidating within the range of 65,000 to 71,000 for a long time. Even if there is a false breakout after the opening of U.S. markets, the price will likely fall back into this consolidation range. I don’t think the market has already hit bottom and started to turn around. 4. ELITE Team Brando Updated at 21:50 on February 9, Beijing time: Good morning everyone! Futures opened slightly lower SPX: Let’s see if we can hold above 6900 today and even break through 6945 QQQ: The decline is less than 1%; if it can hold above 610, it could test 614+ levels, but it needs to stay above 604 BTC / ETH: Opening slightly lower, BTC needs to hold above 69,000; ETH remains bullish above 2,000 META: 672 and 680 are still within the target range; let’s see if we can hold above 655 today IWM: Slight increase in green values AAPL: The goal for this month is 288; let’s see if I can reach 280 by tomorrow NVDA: It’s down by 1%; it would be best if it could hold at 184 SNDK: After breaking through 600, there is a possibility of another increase of 20–30 points this week TSLA: Standing at 414 can initiate a trend moving towards 424 MSFT: An increase of 4.4 MU: It dropped by 13; it needs to regain the level of 400 in order to regain its momentum MSTR: If BTC manages to hold above 69,000, there is a chance it could turn from red to green ; The APP stock price rose by 28%; AMD also turned slightly green today SPX Evaluation: ·Long position above 6945 (go long on calls) ·6900–6945 is a volatile range (be cautious) ·Bearish outlook below 6900 (put option strategy) SPX Options Premium 2x QQQ: February 11th, 612C: It’s feasible to land at 610 NVDA: February 13th: 187.5C; it would be ideal if it were above 184 TSLA: February 13th, 425C; preferably above 414 III. Conclusion Many bloggers are not posting updates today. Based on the current information, the market is expected to rebound in the short term, with a target of just over 74,000. I still remain bearish in the long term. The short-term support level for BTC is 67,500, while the resistance level is 72,000. A large amount of short-selling liquidity is concentrated in the 72,000 to 79,900 range; therefore, a rebound that forces sellers to cover their positions is likely to occur. Statement: The information provided above is for reference only and does not constitute any trading advice. The cryptocurrency sector carries high risks, and caution is advised when participating. Introduction to the Crypto Express Community: ·Discord: Aggregates internal groups of dozens of traders, real-time monitoring of top traders’ trades, live updates on market data, and free educational resources. ·WeChat official account: Alpha perspectives and analysis. Share daily market analyses, excellent articles, and more. ·Bilibili, YouTube: Crypto Express Lane. Analyze high-quality teaching courses; use AI-powered voice recognition to translate excellent teaching materials in English, American, and Korean; also analyze the videos themselves. ·Community: There are no barriers to participating in safety-related activities; you can learn, communicate, chat, and even share your thoughts 24 hours a day. |

2026-02-10

2026-02-07