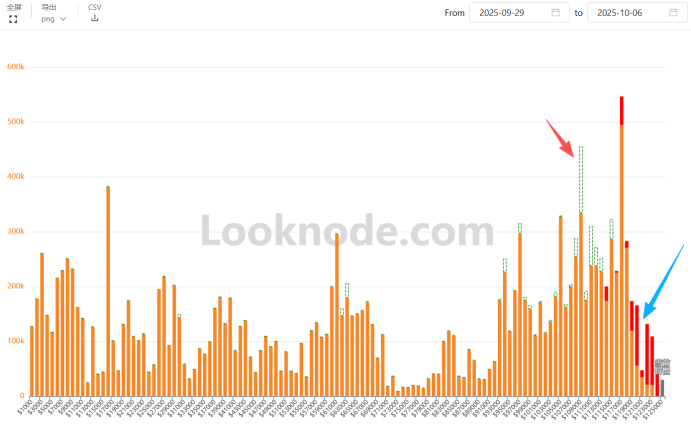

51847

|

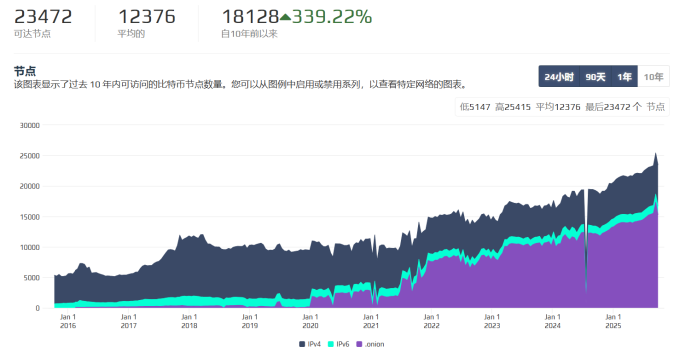

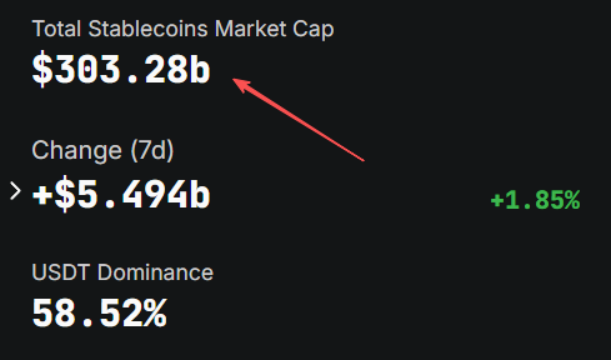

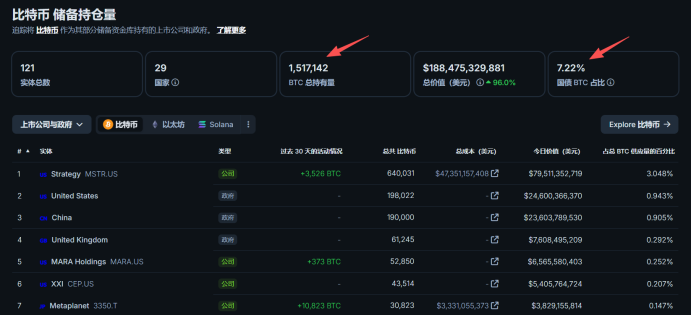

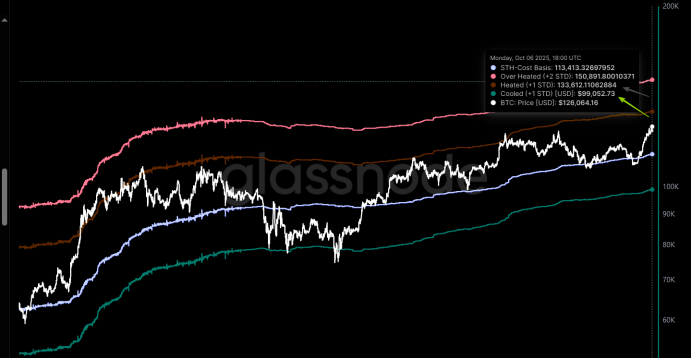

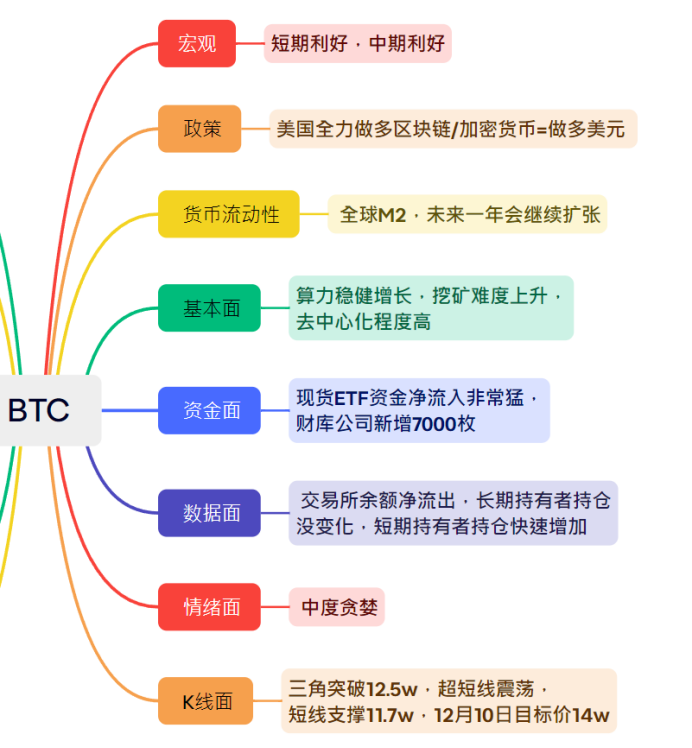

in conclusion: 12moon10day Head Price 14w, short-term support level 11.7w. Track the possibility of Japanese yen interest rate hike, (12moon19day,1moon23day,3moon19day) If the Japanese yen raises interest rates, BTC potential pullback25%。 PS : This is not any investment advice and is for reference only. Macroscopic aspect 1,Japanese Prime Minister Takaichi Sanae,10moon15day (Wednesday) Get on stage. Fiscal policy: the watchword is“expansion”, but with debt brake pads。clearly stated“Gradually reduce government net debt /GDP ratio”, and the Abe period“Grow first, consolidate later”The purely radical line is different. Funding sources mainly rely on strategic tax incentives (corporate tax cuts in exchange for capital expenditures)+ Supplementary Budget (11 It will be announced later this month and is expected to 10–15 trillion yen, less than 2020 year epidemic40 trillions). Focus: National defense 2% GDP(2027)、AI/ semiconductor/solid state battery/nuclear fusion/Biotechnology——with thick“industrial safety”Color, similar to the American chip+Japanese version of the Inflation Reduction Act. Monetary Policy: Put“interest rate hike”Take these two words out of the dictionary。 10moon4again after winning the election Letting go of doves pushes back expectations of Japanese yen interest rate hikes. The stance is almost identical to that of Central Bank Governor Kazuo Ueda. Both believe that current inflation is cost-push (food, energy) rather than overheating demand.; japanese core CPIAlready from1moon3.1%fall back to8moon2.7%, pressure to raise interest rates plummeted. USD/JPY breakthrough 150,2Depreciation in two days 2.4%, the Japanese yen carry trade is re-leveraged. Three spillover channels to global markets carry trade day Yuan interest rate hike expectations decline → Spreads widen → Resurrection of carry trade USD/JPY Upward155-158 U.S. and emerging market stock indexes gain liquidity。 interest rate anchor Japanese debt 10Y Suppressed by dovish expectations 1.6% Below, the formation of global long-term interest rates“second anchor”。 The upside of long-term bond yields in the United States and Europe is limited; gold, faucet technology stocks of Valuation compression risk decreases。 Industrial resonance Japan added“Safety+science and technology”Subsidies, combined with similar bills in the United States, will accelerate the global technology capital expenditure cycle.。 Semiconductors, high-end materials, orders are revised upward. market outlook 11 late month ,Japan2025The fiscal year supplementary budget is announced, If the amount> 20trillion yen, Japanese debt 10Y Possible breakthrough 1.8%, the global interest rate anchor moves upward; Short-term negative risk assets. If the amount< 15trillions Japanese yen, short term profit good Risk assets. 12moon19Japan, the probability of Japanese yen interest rate hike decreases, tracking next year Q1 Probability of interest rate hike. If interest rates are unexpectedly raised, it will be a repeat of last year8.5Liquidity crisis. Summarize: Takaichi Sanae3Big combo punch, Moderate fiscal expansion+Currency verbally suppresses interest rate hikes+Big subsidies for industrial safety. The widening of the yen's interest rate differential and the resurgence of carry trades are marginally positive for global risk assets。 track11Monthly supplementary budget size,12month day yuan interest rate resolution. 2,U.S. dollar interest rate cut cycle 10moon1On Japan, the U.S. government shut down, instantly igniting market sentiment.10Yuehe12Expectations for a rate cut in May pushed up BTC stand on 11.2w,11.8w , breaking through the previous high 12.5w。 https://www.cmegroup.com/cn-s/markets/interest-rates/cme-fedwatch-tool.html 10moon29day, interest rate cut 25bp Probability, tentative report94%。 12moon10day, interest rate cut 25bp Probability, tentative report83%。 3moon18day, interest rate cut 25bp Probability, tentative report43%。 6moon17day, interest rate cut 25bp Probability, tentative report32%。 9moon16day, interest rate cut 25bp Probability, tentative report23%。 5In September, when Powell stepped down and Trump arranged for his own people, expectations for an interest rate cut were instantly raised. 10moon1The U.S. government shut down on Japan, the market's expectations for interest rate cuts, and the price performance of Bitcoin have already set the tone for the market outlook. Believe it, just do it ; If you don’t believe it, just watch! U.S. debt bubble The current size of the U.S. debt37Trillion Dollars, (Big and Beautiful Act) Future10new yearly5Trillions of dollars in debt. Global central banks increase gold holdings 2022-2025Total net gold purchases by global central banks in 20184100 tons, annual average1025tons, for1971The highest consecutive level since the Nixon shock4year level. Gold prices approaching4000Pass, maybe next year4900。 Changes in reserve currency structure USD share:58.2 %。2020annual peak71 %,5Year decline12.8%, a record low. Africa-U.S. bilateral settlement accelerated China-Saudi Arabia:2025-06rise,Settled in RMB5510,000 barrels/Japanese crude oil accounts for Saudi Arabia’s exports to China40 %。 India-Russia:2025-01rise,Settlement in dirhams80 %Crude oil, dollar share drops to10 %。 ASEAN:2025-05,Announcing target for local currency settlement ratio of local trade,2027year reached50 %(at present18 %)。 U.S. debt takeover For U.S. debt, foreign central bank need of The ceiling has appeared,2026-2030Year USA need want rely Own Domestic pension+Stablecoin Reserve (Blockchain), do it Undertake。 Users around the world exchange their local currencies for U.S. dollars, exchange U.S. dollars for U.S. dollar stablecoins, and use them to participate in the blockchain/Cryptocurrency, or cross-border payment settlement; Stablecoin issuers use U.S. dollars to buy U.S. bonds (mainly short-term) to earn interest. Summarize: The market is jumping on expectations of a Fed rate cut (10moon/12moon). 11Later in the month, follow Japan2025Fiscal year supplementary budget announced。 12moon19day, tracking the probability of Japanese yen interest rate hike. 12moon10On the same day, the U.S. dollar interest rate cut was beneficial (positions can be reduced in advance). Q1 , tracking the probability of the Japanese yen interest rate hike. If the interest rate is raised, it will be a big washout gold pit before the final main rise of the bull market starts. BTC potential pullback25%(Historical highest price to callback lowest price). policy aspect USA 2024-01, Bitcoin spot ETF , opening up capital channels on Wall Street. 2024-08, Ethereum spot ETF , opening up capital channels on Wall Street. 2025-03, the Bitcoin Strategic Reserve Act. Incorporate Bitcoin into the U.S. national strategic reserve asset, alongside gold。 2026 – 2030,each year 20 Ten thousand pieces, cumulative100Thousands of pieces, lock up20Year,2031 – 2050 Any sale, mortgage, or swap is prohibited. 2025-07, "Stablecoin Act", institutions issue stablecoins in compliance with regulations,1:1 Short-term debt reserves. 2025-07, the Digital Asset Market Clarity Act, CLARITY bill: CFTC Manage goods, SEC manage securities,4Year-old mature public chains are exempted, exchanges have a single license, and customer assets must be isolated. 2025Year8moon , approved by Trump401(K ) to invest in cryptocurrencies. 401(k) It is the most mainstream among American folk“second pillar”Pension vehicle used to accumulate additional retirement income on top of Social Security (first pillar). currency liquidity 1,worldwide M2 The total amount of broad money managed by the world's major central banks, including cash in circulation, savings deposits, time deposits and other deposits, reflects broader purchasing power and is often used to assess the impact of monetary policy and forecast inflation and economic growth. worldwide M2(converted in U.S. dollars) vs. Bitcoin price12Monthly rolling correlation ≈ 0.83–0.94。 worldwideM2Most of the time the turning point leads BTC About two and a half months. https://www.tradingview.com/script/EYe8gSCy-Durdens-Global-M2-Liquidity-Tracker/  In the next year, the world M2 Scenario expectations  2,Offshore USD Liquidity Four core indicators Cross Currency Basis (EUR/USD 3M) Japanese yen basis (JPY/USD 3M) FRED Overnight reverse repo ( ON RRP) TED spread ( SOFR-T-Bill 3M) likeEUR basisWear it on top -10 bp and RRP fell below 400B→ The offshore U.S. dollar "released water", historically10within days Nasdag 100 average+2.8%(2018-2025sample)。 likebasisBreak down -25 bp or RRP>800 B→ Dollar shortage, U.S. stocks high beta Sectors pull back first, average-3.1%。  3,G4 central bank total assets “G4 central banks print money together” and “U.S. stocks rise” are like a pair of good friends: in the 12 years from 2013 to 2025, as long as the money printing speed becomes faster, U.S. stocks will rise in about 2-3 months.; If it slows down or even shrinks its balance sheet, U.S. stocks will easily fall. Correlation coefficient 0.64 ≈ medium to strong, which means they are often in the same direction, but not 100% synchronous , occasionally asynchronous time. https://sc.macromicro.me/charts/44829/si-da-yang-hang-zi-chan-fu-zhai-biao-gui-mo  4,Fiscal savings drain official definition The U.S. Government’s Treasury General Account at the Federal Reserve System (TGA,Treasury General Account ) balance increases → Commercial banks’ reserves at the Federal Reserve ( Reserve Balances ) reduced by the same amount → Base money (high-power money) is“smoke”out of the banking system and market liquidity decreased. Commonly known as: Fiscal deposit pumping = TGA ↑ = Liquidity↓。  Historical cases 2023-06,After the debt ceiling is lifted, the Treasury Department6-8Moon handle TGA from495100 million→6000100 million (+550B) , the same period Nasdaq100 fall4.7%,10Y U.S. Treasury yields rise 35bp。 2020-04-2020-07 ,TGAfrom 1.6T→1.0T( Release water 600B) , S&P+18%。  TGAsingle week↑ >100B→Trigger "pumping warning"」 TGA single week↓ >100B→Trigger "water release signal"」 「Fiscal savings drain」= The Ministry of Finance issued bonds to supplement the wallet → Bank reserves decrease→ Market dollars become more expensive。 Depend on pumping intensityTGA 4Weekly changes。   Fundamentals 1,Computing power of the entire network 1.03ZH/s  2,Mining difficulty rises  3,degree of decentralization Computing power ratio, rough calculation, USA42%,China19%,Kazakhstan13%。 https://data.hashrateindex.com/network-data/global-hashrate-heatmap  Number of nodes Every new1An independent full node is equivalent to "verification-reject-geography -IP- bifurcation-privacy」6 The redundancy of the safety door is at the same time +1, enabling the Bitcoin network to 51% Computing power attacks, single point review, and on-chain tracking are all more expensive and more likely to fail.——This is exactly what professional organizations include in the "node annual growth rate" BTC The core logic of the security scoring model.   Funding Spot goods ETF Net inflows, last week32.4billion dollars. Yesterday, net inflow11.9billion dollars.   30day capital inflow  Stablecoin market capitalization increased last week60billion US dollars  Changes in exchange stablecoin net positions  treasury company9Tianzheng7000pieces BTC , converted to8.4billion dollars.  Data plane Exchange balance283.8Thousands of pieces,9Heaven flows out4Thousands of pieces, net outflow last week7Thousands of pieces.  Long-term holders hold positions1450Ten thousand pieces, no change.  Long-term holders realize profits  Short-term on-chain cost price 11.35w  short-term holder cost model  MVRV Extreme deviation pricing range  The chips are loose this week  Bitcoin market capitalization share:58.4%  Emotional side Panic Greed Index:71(greedy)  short term holders NUPL  K line surface Probably9moon29A large number of options were delivered, and the dealer deliberately dropped to 10.9w , lure the air, pull it up with your backhand,10moon1The U.S. government shutdown in Japan instantly ignited market sentiment10Yuehe12Expectations for an interest rate cut in May are positive, and the market holds firm 11.8w ,breakthrough 12.5w,4h There is an ultra-short-term market crash.  hypothesis10moon18On Sunday, the U.S. government reopened its doors. BTC A possible fallback in the ultra-short term4%, then due to10moon30It is good news for the US dollar to cut interest rates, and it has risen slightly in the short term.11at the end of the month, because12moon10Expectations of Japanese dollar rate cut, BTC target price 14w。10No. 1 interest rate cut was implemented, ushering in the theory of the end of the four-year cycle, with short-term shocks and declines. Specifically track the possibility of Japanese yen interest rate hikes (12moon/1month/March), which may lead to BTC fall25%。 Final summary:  |