27338

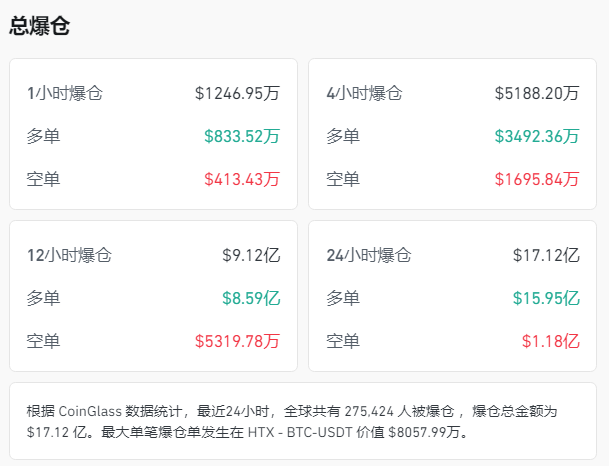

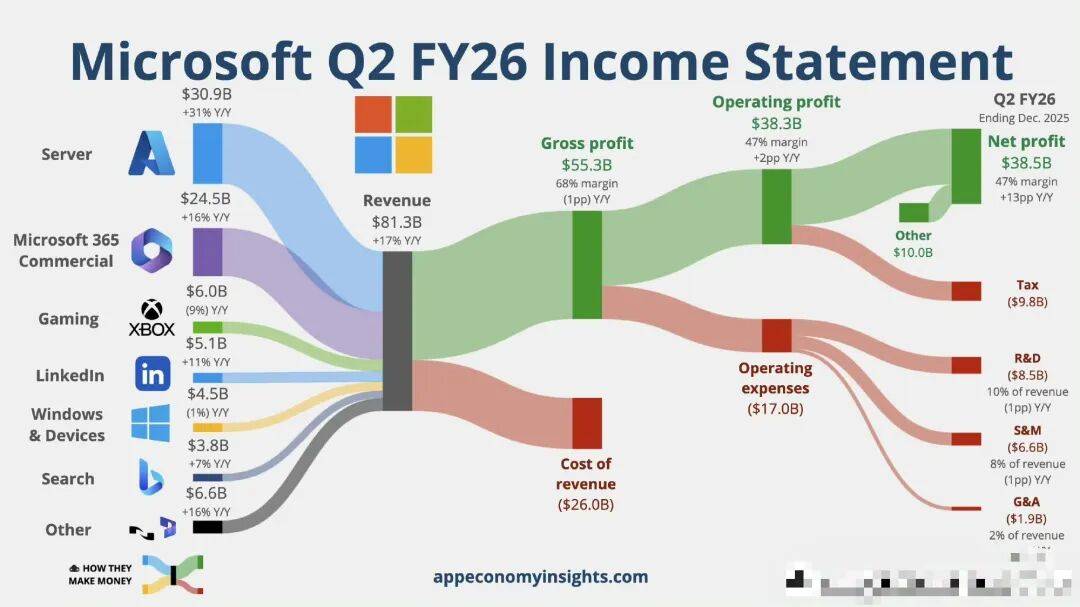

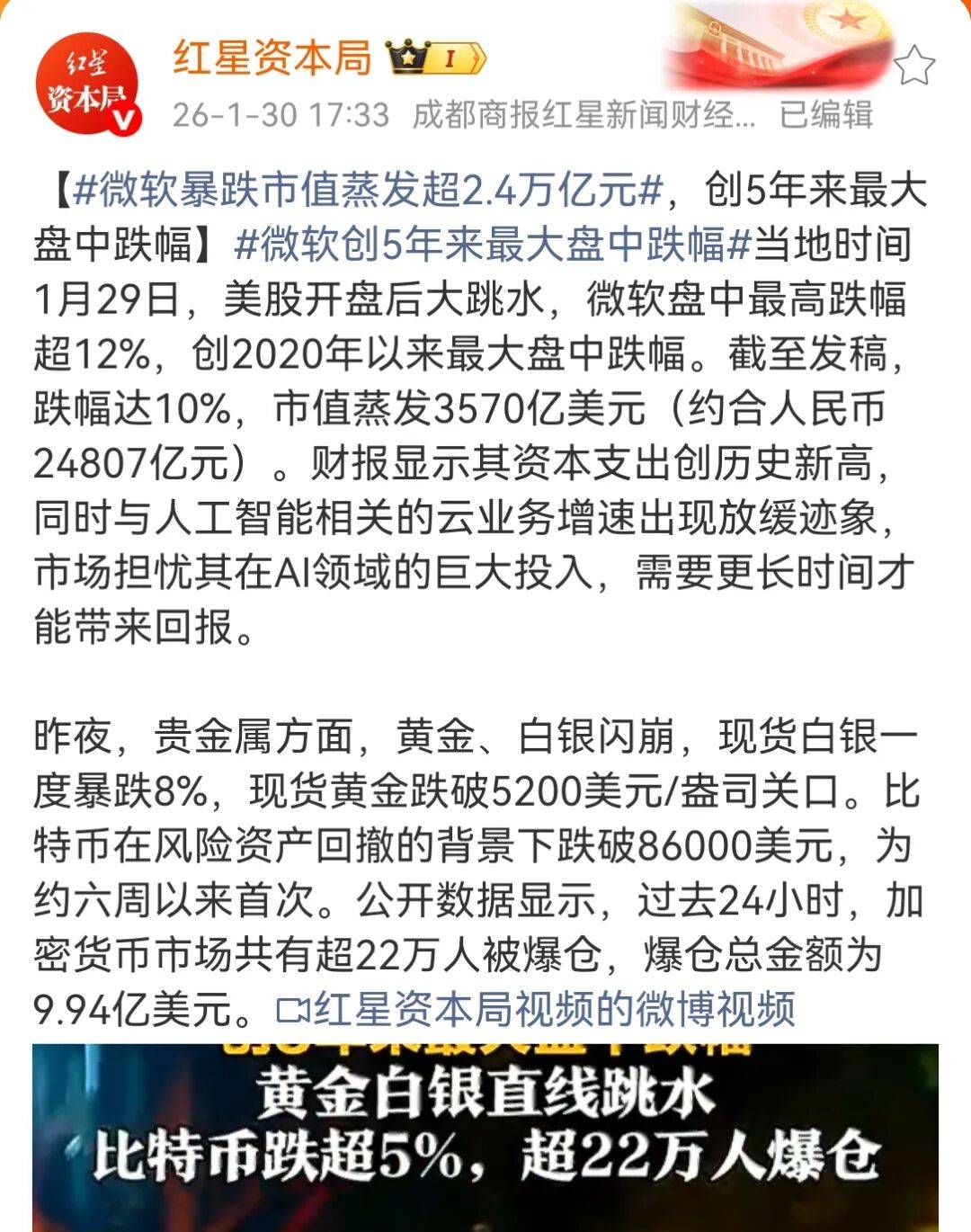

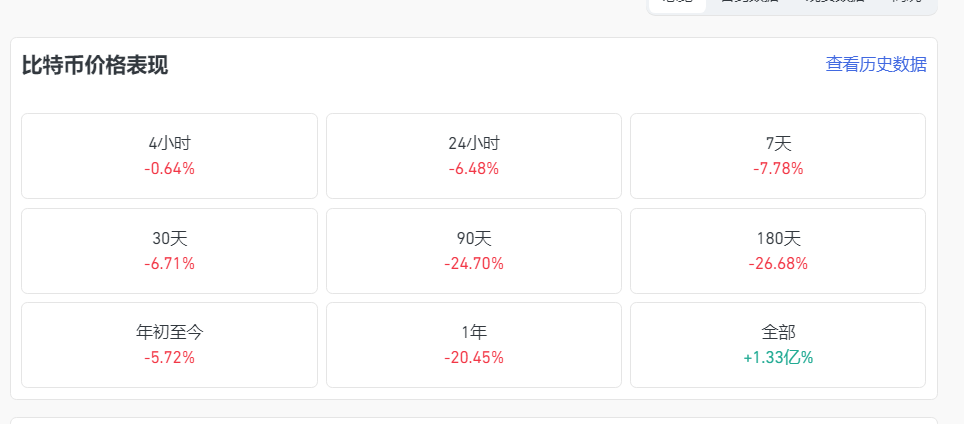

As crazy as it goes up, it goes down as hard as it goes.  Produced by | Chief Financial Observer Author | Song Tao “"One day in the cryptocurrency world is one year in the world." Ups and downs in the cryptocurrency world are normal. However, things are no longer simple when a plummeting storm sweeps across Bitcoin, gold, silver and even technology stocks, creating a chain reaction across the market. From the lightning collapse of gold to the dragging down of the Nasdaq index, this synchronized plunge revealed a more severe reality: this is not only a shock to cryptocurrencies, but also a deep resonance in the global financial market. So, who is the real executioner behind this storm? This issue deserves careful study.  Bitcoin plummets, who is to blame? In recent days, the cryptocurrency market has continued to fluctuate, and Bitcoin has plummeted, which has attracted widespread market attention. On January 29, Bitcoin fell below $85,000, a drop of more than 5%. Cryptocurrencies such as Ethereum also fell sharply. Within 24 hours, more than 220,000 people liquidated their positions and $1 billion evaporated. By January 30, Bitcoin continued to decline. As of now, Bitcoin's decline in 24 hours has expanded to 6.28%, with the price reaching a minimum of around US$81,465, continuously falling below important technical support levels such as US$85,000 and US$83,000. During the same period, the number and amount of liquidated positions further increased. More than 270,000 people were forced to liquidate their positions, and the total amount of liquidated positions reached approximately US$12 billion.   Image source: CoinGlass It is worth mentioning that what happened simultaneously with the tragedy in the cryptocurrency market was two huge fluctuations in the traditional financial sector: a lightning collapse in the international gold price, and the US technology sector, led by Microsoft, suffered a trillion-dollar market value evaporation. Market analysis points out that the almost simultaneous collapse of these three stocks is no coincidence, and there is a profound transmission logic between them. To understand this linkage, we need to return to the fundamental issue of Bitcoin’s financial attributes. In our previous analysis, we mentioned that, unlike "safe haven assets" such as gold and silver, the current mainstream financial attributes of Bitcoin are closer to "high-risk technology growth stocks" than to pure "digital gold." Generally speaking, Bitcoin and technology stocks are backed by the same investors, driven by the same macro sentiment, and follow the same trading logic when the market panics. Therefore, when the technology sector fluctuates, the Bitcoin market will inevitably be affected. On January 29, local time, the share price of technology giant Microsoft plummeted by more than 10%, and its market value evaporated by more than US$357 billion (approximately 2,481.2 billion yuan) in a single day, setting the largest single-day decline since March 2020.  Source: Sina Finance Relevant people said that this may be Microsoft's worst day since March 2020. The direct reason for Microsoft's market value plummeting by one trillion this time is the release of its latest quarterly financial report. It is understood that Microsoft’s latest quarterly financial report data is eye-catching, with overall revenue reaching US$81 billion, a year-on-year increase of 17%, 1% higher than market expectations.; Non-GAAP earnings per share (EPS) was $4.41, a year-over-year increase of 23%, exceeding market expectations by 5%. Its closely watched Azure cloud business grew 38% in constant currency, also slightly ahead of Wall Street expectations of 37%.  Source: Weibo But despite this, the report card handed over by Microsoft did not satisfy investors. Data show that Microsoft's capital expenditures in the quarter reached US$37.5 billion, 9% higher than the market consensus. This higher-than-expected capital investment did not result in the same higher-than-expected returns in Microsoft's business data. Investors worried that high investments might not translate into expected earnings growth in the short term, and their anxiety instantly triggered a sell-off.  Source: Weibo At the same time, Microsoft's plunge had a significant spillover effect, directly dragging down the overall performance of technology stocks and even the U.S. stock market that day. The Nasdaq index fell by about 1.5%, and the market values of Alphabet and Nvidia also evaporated by hundreds of billions. As a result, when anxiety spread, the selling wave quickly spread to the Bitcoin market, triggering a rapid decline in Bitcoin prices. Within a few hours, Bitcoin quickly fell from the original $88,000 to $85,200, hitting its lowest level in more than a month, and has continued this decline since then. Of course, in addition to the impact of technology stocks, the flash crash in the gold market is another key factor exacerbating this global asset sell-off. From January 29th to 30th, the international spot gold price plummeted from the historical high of US$5,598 per ounce, plummeting nearly US$500 to around US$5,100, with the largest intraday drop of 5.7%.  Source: Oriental Fortune According to market analysis, gold's plunge this time is a typical case of "profit-taking." Previously, gold had continued to surge driven by strong bullish expectations, attracting a large influx of funds, and market sentiment was extremely high. Many professionals even analyze that gold's short-term trading attributes have shifted from "safe haven assets" to "speculative assets." The continued rise has resulted in severe technical overbought, with technical indicators such as the RSI (relative strength index) and Bollinger Bands sending clear warning signs. The so-called RSI is like the market's "thermometer". When its value exceeds 70, it usually means overbought. Before gold plummeted, the indicator once exceeded 90, which is an extreme state. The Bollinger Bands are like a "runway" for prices. When the price continues to touch or even break through the upper track, it means that it has deviated significantly from the mean and the pressure for a correction is huge. These signals all indicate that the current gold trading market has accumulated an unusually large profit margin. When prices loosen, investors will undoubtedly choose to sell gold to lock in profits. As a result, the sudden outpouring of sell orders directly led to a "flash crash" in gold prices. At this moment, gold's attributes as a highly liquid asset that can be quickly liquidated in exchange for cash temporarily overwhelm its traditional safe-haven attributes. Its sudden collapse not only failed to provide a safe haven, but instead sent a strong risk warning to the entire market, exacerbating panic and triggering a behavioral pattern of "selling all high-risk assets." Therefore, Bitcoin's continued plunge is taking place against such a dual background: On the one hand, Microsoft's financial report triggered concerns about the growth logic and valuation of technology stocks, and the selling sentiment was transmitted from the stock market to Bitcoin, which has similar financial attributes.; On the other hand, the flash crash of gold further worsened the risk appetite of the global market, prompting investors to sell various risky assets, including Bitcoin, in search of liquidity safety. Among them, the sudden reversal of gold’s rebound trend became a clear trigger, and Bitcoin bore the brunt of this cross-market chain sell-off due to its “high-risk asset” attributes that were widely recognized by the market.  Cryptocurrency markets continue to fluctuate Looking back at the Bitcoin plunge triggered by Microsoft's earnings report and the gold flash crash, it is not an isolated incident, but a microcosm of the continued fluctuations in the cryptocurrency market over the past year. Bitcoin's plunge has further clearly verified its current mainstream financial attributes: it is closer to a high-risk technology asset that is sensitive to liquidity, rather than pure "digital gold." So when market risk aversion heats up, money pours into real gold, while Bitcoin tends to fall in tandem with tech stocks; And when gold plummets due to "profit taking", market anxiety spreads, which will also lead to a decline in the price of Bitcoin. Over the past year, the Bitcoin market has shown a complex "maturing pains." In October 2025, the price of Bitcoin hit a record high of $126,000. However, continued shocks and declines caused Bitcoin to plummet by more than $30,000 in just three months. So far, Bitcoin has fallen 20.45% in the past year.  Image source: CoinGlass Priced in gold, which has more purchasing power significance, Bitcoin’s value has actually fallen significantly from its peak in late 2024. This differentiation shows that while the market is accepting Bitcoin, it is also recalibrating its positioning. It is worth mentioning that today, the market structure of Bitcoin is also undergoing profound changes. The introduction of spot Bitcoin ETFs has brought new funds to it, but also made its price movements more susceptible to traditional macro sentiment. At the same time, long-term holders carried out large-scale position transfers, and ETF capital flows became a key supporting force. Recently, the intensification of international turmoil, the shift in market policies, and the differentiation of market sentiment have led to continued fluctuations in the cryptocurrency market. There are deep disagreements among different groups about the future development of Bitcoin. On the one hand, some analysts are worried that Bitcoin may face a deeper correction ; On the other hand, relevant professionals pointed out that Bitcoin’s long-term bullish logic still exists and deserves recognition. However, these are all things for later. We will continue to pay attention to the Bitcoin market. What is certain is that at present, Bitcoin has been deeply integrated into the global financial system, and its fluctuations are the result of the game of multiple forces of institutions, macroeconomics, and liquidity. For investors, understanding the properties and complex correlations of high-risk assets may be more important than predicting short-term rises and falls. Click to follow and make friends with the editor-in-chief    For copyright and business cooperation, please add phone number/WeChat: 18576718939 |