83705

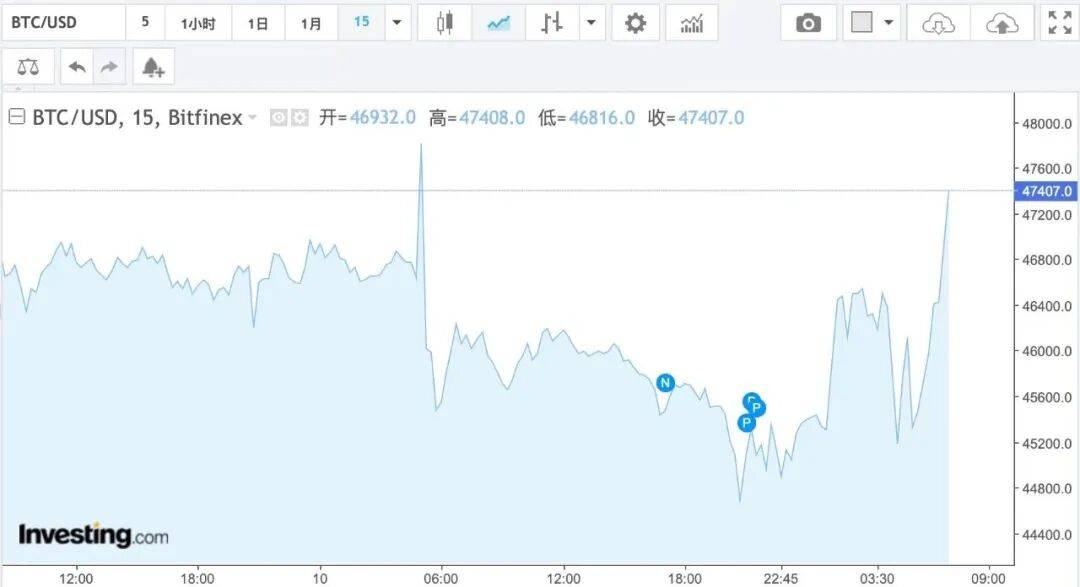

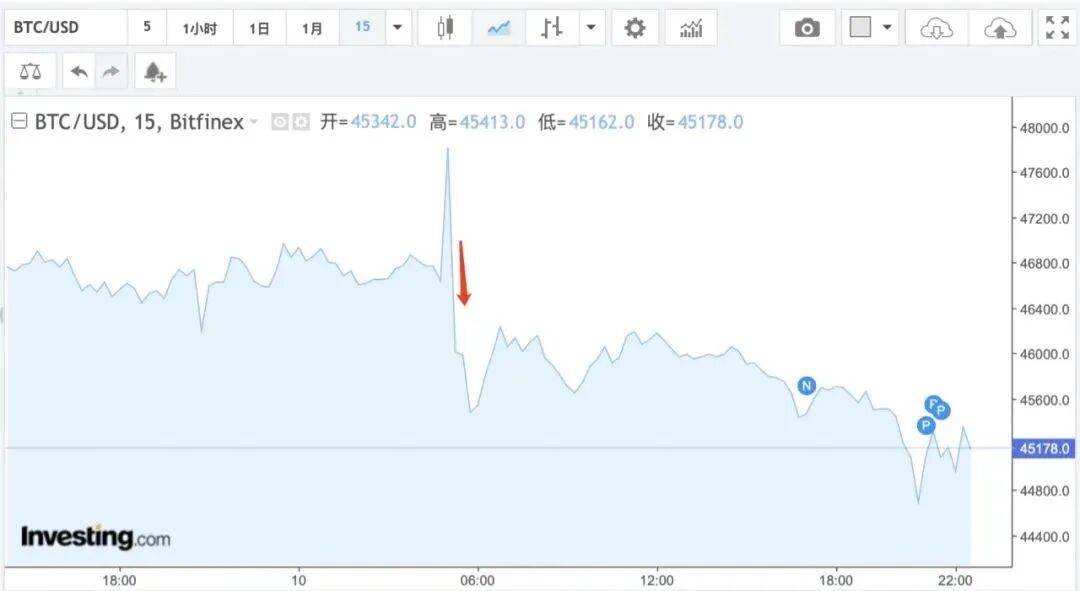

In the early morning of January 11, Beijing time, the U.S. Securities and Exchange Commission (SEC) announced that it had approved the listing and trading of spot Bitcoin ETFs through expedited mode and authorized 11 ETFs to begin trading on Thursday, local time. The SEC’s approval is actually a rare compromise. After the news was announced, the price of Bitcoin soared by more than $2,000, once again standing above the $47,000 mark.  Prior to this, the price of Bitcoin once suffered a big plunge. On January 10, Beijing time, the largest intraday drop in Bitcoin price once exceeded 7%. According to CoinGlass data, as of the evening of that day, more than 75,000 investors had liquidated their positions in the cryptocurrency market across the entire network in 24 hours, with the total liquidation amount reaching US$280 million (approximately RMB 2 billion). The "trigger" for the sharp plunge in Bitcoin prices was the SEC's own mistake. On January 9, local time, the SEC announced on its official social media account X that it had approved the listing of spot Bitcoin ETFs. Subsequently, the Chairman of the SEC issued an urgent document clarifying that the SEC's account had been compromised and unauthorized content had been published. The Securities and Futures Commission has not yet approved the listing and trading of any spot Bitcoin ETFs.  Official announcement in the early morning In the early morning of January 11, Beijing time, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs for the first time in history, authorizing 11 ETFs to begin trading on Thursday. The SEC said it has approved the listing and trading of the spot Bitcoin ETF through expedited mode. Approved spot Bitcoin ETF issuers include: Grayscale, Bitwise, Hashdex, iShares, Valkyrie, Ark 21Shares, Invesco Galaxy, Vaneck, WisdomTre, Fidelity and Franklin. In addition, according to the latest notice posted on the Chicago Board Options Exchange (CBOE) website, spot Bitcoin ETFs from multiple issuers are scheduled to begin trading on Thursday local time. After the news was announced, the price of Bitcoin once soared by more than 2,000 US dollars, regaining its position above the 47,000 US dollars mark, with an intraday increase of 2.44%, recovering most of the previous day's decline.  The approval of a Bitcoin spot ETF will allow investors to trade the digital currency in their traditional stock brokerage accounts rather than on those startup platforms. The cryptocurrency industry has endured a series of scandals and bankruptcies, with startups coming under increasing scrutiny. Cryptocurrency investors have been eagerly awaiting regulatory approval for a Bitcoin spot ETF, as it would make mainstream investors more comfortable with the digital currency. According to a report released by Standard Chartered Bank, if the relevant ETF is approved, it will greatly change the rules of the game for Bitcoin, allowing institutional and retail investors to invest in Bitcoin without directly holding Bitcoin. This year alone, it could attract $50 billion to $100 billion in funding and push the price of Bitcoin to $100,000. Other analysts believe inflows will be closer to $55 billion over the next five years. This approval by the US SEC is actually a rare compromise. The Bitcoin spot ETF was proposed as early as 2013. For 10 years since then, the current SEC Chairman Gary Gensler and his predecessor Jay Clayton have refused to allow the launch of such products, citing the violent fluctuations in Bitcoin prices, concerns about investor protection, and the possibility of market manipulation. On January 10, local time, Gensler issued a statement stating that although it approved the listing and trading of some Bitcoin spot ETFs, it did not recognize Bitcoin. Bitcoin is a speculative, volatile asset. The approval of Bitcoin spot ETF will bring more supervision. Since 2023, many financial institutions such as BlackRock and Fidelity have submitted applications for Bitcoin spot ETFs, attracting market attention. According to incomplete statistics, a total of 14 applicant institutions have held multiple meetings with the SEC to discuss the relevant details of the issuance of Bitcoin spot ETFs. It is worth mentioning that many Bitcoin ETF issuers are currently further reducing fees to attract investors, highlighting the fierce competition in this field. On January 9, local time, many investment institutions such as BlackRock, VanEck, and Invesco submitted new documents to the SEC, lowering the fee standards set for ETF products, and detailing the arrangements made by institutions and market makers to ensure the liquidity and efficiency of transactions.  The U.S. Securities and Exchange Commission made a "big mistake"” In fact, on the eve of announcing the approval of the listing and trading of spot Bitcoin ETFs, the SEC made a "super big mistake", which once caused a huge shock in the virtual market. In the early morning of January 10th, Beijing time, the price of Bitcoin rose instantly, once approaching US$47,900. However, just ten minutes later, the market situation suddenly changed, and the price of Bitcoin quickly plummeted by more than 2,000 US dollars, and then continued to fall. As of the evening of January 10, the price of Bitcoin fell below US$44,500, falling as low as US$44,352, with the largest intraday drop exceeding 7%.  According to CoinGlass data, as of the evening of January 10th, Beijing time, more than 75,000 investors had liquidated their positions in the entire cryptocurrency market in 24 hours, and the total liquidation amount reached US$280 million (approximately RMB 2 billion). The "trigger" for the sharp plunge in Bitcoin prices was the big mistake made by the U.S. Securities and Exchange Commission. On January 9, local time, the SEC announced on its official social media After the news was released, the price of Bitcoin soared, once approaching $47,900, setting a new high in the past year. Subsequently, SEC Chairman Gary Gensler issued an urgent statement clarifying: “The SEC’s account was compromised and unauthorized content was posted. The Securities and Futures Commission has not yet approved the listing and trading of any spot Bitcoin ETFs. ” After the SEC refuted the rumor, the price of Bitcoin crashed and plummeted. The huge fluctuations caused by this "own error" caused dissatisfaction among many "big guys" in the currency circle, calling for an investigation into this market manipulation. Gemini co-founder Cameron Winklevoss even said bluntly: “It would be great if @SECGov stopped manipulating the Bitcoin market. ”  SEC Chairman warns of risks After this "big oolong" occurred, SES urgently stated that it would cooperate with law enforcement agencies to investigate hacker attacks. At present, the unauthorized access to SEC accounts by "unknown parties" has been terminated. In addition, X platform also stated that it is investigating the reasons why the US Securities Regulatory Commission account was stolen. It is worth noting that Gensler has since issued a risk warning about virtual currency investments: “If you are considering an investment involving virtual currency assets, please be cautious. Cryptocurrency assets may be viewed as new opportunities, but they also present significant risks. ” Recently, Gensler has repeatedly reminded of the investment risks of virtual currencies. On the 8th local time, Gensler said that individuals who provide virtual currency asset investments or services may violate applicable laws, including federal securities laws. Investors participating in virtual currency investments should understand that they may lose critical information and other important protections related to their investments. In addition, investing in virtual currency assets can also be associated with a high level of risk and is often subject to severe fluctuations. Source: Brokerage China SFC Editor of this issue Jiang Peipei’s intern Song Jiayao 21 Recommended Reading Flash crash! More than 70,000 people liquidated their positions, and nearly 200 billion in market value evaporated instantly The data is surprising! Is there any uncertainty about the U.S. interest rate cut? Are there hidden risks behind the new high of gold prices?  |