Hello everyone, I am Crypto Mubai

"Dabai" in the mouth of fans is known as "Buffett on the rise and Soros on the decline." As a leader in the crypto field, Dabai focuses on spot trading, supplemented by contract operations. With his precise market judgment and steady operating style, he has become an all-round trading master.

Dabai is also a senior analyst of Dongfeng Community’s spot, contract and on-chain Golden Dog layout in the blockchain market, with a winning rate of over 96%!

Preface

Crypto market sentiment did not improve this past weekend. After experiencing slight fluctuations for several consecutive days, Bitcoin weakened significantly from Sunday night to Monday in the U.S. stock market, with the price falling below the $90,000 round mark, and the lowest was close to $86,000. ETH fell 3.4% to $2,980 ; BNB fell 2.1% ; XRP drops 4% ; SOL fell 1.5%, back to around $126. Among the top ten cryptocurrencies by market capitalization, only TRX rose slightly by less than 1%, while the others were in decline.

This wave of adjustments is no accident. Since hitting a record high in mid-October, Bitcoin has fallen by more than 30%, and each rebound has appeared weak and short-lived. Although Bitcoin ETF funds have not flowed out on a large scale, the inflow rate has slowed down significantly, making it difficult to support the market as before. Overall, the crypto market is moving from a unilateral rise to a more complex and patience-testing stage.

Against this background, Mike McGlone, senior commodities strategist at Bloomberg Intelligence, released a latest report. He analyzed the current trend of Bitcoin within a more macroeconomic and cyclical framework, and put forward a point that made the market quite uneasy: Bitcoin may fall to $10,000 in 2026. He pointed out that this is not alarmist, but one of the trends that may occur under a special "deflation" cycle.

The reason why this view has caused widespread controversy is not only because the target price seems "too low", but also because McGlone does not regard Bitcoin simply as a cryptocurrency, but re-examines it in the long-term framework of "global risk assets-liquidity-wealth distribution".

1: Today’s market analysis of BTC and ETH

BTC:

Yesterday, BTC continued to fall, falling below the support near 88k in one fell swoop, and temporarily stopped around 85k. Now it depends on the strength of the rebound. Is it possible to form a short-term bottom here? From the perspective of short-term trends, it is a good sign that the rebound started at 85k, but it remains to be seen whether the rebound can be sustained. The first pressure level upward is near 88k. Only by regaining above 88k can it become stronger again and reach a decent bottom.

This wave of BTC is an accelerated decline after the rising wedge broke, and it has now fallen below support. Yesterday's small rebound was very weak, falling back as soon as it reached 90,000, which can easily mislead people. The downward trend is still continuing and it is not recommended to buy the bottom. If you really want to pick up more, you can wait for the 83,000-80,000 area. The short-term short-term strength has weakened, and there may be a small rebound to 87,000-88,000, but the range is limited. After the rebound, short selling is still the main idea, and the target is 83,000-88,000. The daily line has not stopped falling and may accelerate its decline at any time. If 83,000-80,000 is lost, the next target will be 75,000. Overall remains bearish.

In short: the overall direction of Dabai is bearish! ! !

ETH:

The ETH bearish flag pattern has basically ended. The first wave of decline was the flagpole, and then consolidated to form the flag, and now it has chosen to break down. Yesterday's shock may have misled many people into thinking it was a rectangular consolidation, and the market quickly turned downwards after being lured into the bull market.

After the flag shape is established, the decline in this period is usually similar to the first wave of flagpoles, and there is no stop signal yet.

From the 4-hour level, the downward trend will continue. There may be two possible follow-up moves: one is to continue the decline directly, and the other is to rebound and then fall again. Considering that a direct decline is easy to rebound and close quickly, the second trend is more conducive to stable short selling.

Combined with the evening non-agricultural data, if the results are positive, it may lead to a small rebound in prices, with the high point expected to be in the 3030-3050 range. It is recommended to go short near 3050-3070. This position is the pressure level for the flag-shaped lower rail transition. The target for another decline is towards the 2760-2730 range.

2: McGlone warns: BTC may face “deflationary impact””

To understand McGlone's point of view, the focus is not on how he views the encryption industry, but on his judgment of the next global macro trend.

In his latest analysis, he repeatedly refers to a key concept: the tipping point from inflation to deflation. He believes that the global market is at such a turning point. As inflation peaks and growth slows in major economies, the logic of asset pricing is shifting from "anti-inflation" to "coping with deflation." He wrote: “Bitcoin’s downward trend may be similar to the stock market’s reaction to Fed policy in 2007. ”

This is not the first time he has been bearish on Bitcoin. As early as November last year, he predicted that Bitcoin would fall to around $50,000.

McGlone further pointed out that by around 2026, the price center of commodities such as natural gas, corn, and copper may fluctuate around $5. Among these commodities, only assets backed by real industrial demand, such as copper, are likely to remain above $5 by the end of 2025.

In his view, Bitcoin is not “digital gold”, but an asset that is highly correlated with market risk appetite and speculative sentiment. When the inflation narrative recedes and global liquidity tightens, Bitcoin tends to react earlier and more violently.

McGlone’s core logic is based on the overlap of three long-term trends:

Mean reversion after extreme rises

Bitcoin is one of the most prominent wealth amplifiers in the monetary easing environment of the past decade or so. When asset price increases continue to exceed the growth rate of the real economy, the correction is often not mild, but violent. At similar stages in history, the market often looks for a "new narrative" at high levels, and the final adjustment often far exceeds the most pessimistic expectations.

Relative Valuation of Bitcoin vs. Gold

He pays particular attention to the Bitcoin/gold price ratio. The ratio rose from about 10 times at the end of 2022 to more than 30 times in 2025, and has now fallen back to about 21 times. If deflationary pressures persist and gold remains resilient, a return of this ratio to its historical range is not a radical assumption.

The overall valuation pressure of the crypto ecosystem

Although the total amount of Bitcoin is limited, the market trades a risk premium for the entire crypto industry. When thousands of tokens and projects compete for the same funding, the entire sector can be systematically discounted in a deflationary cycle, and Bitcoin cannot remain completely immune.

McGlone is not the long-short “voice” of the crypto market. As a commodity strategist at Bloomberg, he has long studied the cyclical relationship between commodities, interest rates and risk assets. His predictions may not be accurate every time, but their value lies in that he often puts forward structural reverse thinking when market sentiment is consistent.

In his latest analysis, he also took the initiative to reflect on some of his previous misjudgments, such as underestimating the time for gold to break through $2,000, and misjudgment of U.S. bond yields and the rhythm of U.S. stocks. But he believes that these errors just show that the market is most likely to produce trend illusions before a cycle turns.

There are clear differences in market opinions

McGlone’s views are far from the consensus. At present, the opinions of institutions are clearly divided:

Institutions such as Standard Chartered have lowered the mid- to long-term target price of Bitcoin, with the forecast in 2025 falling from US$200,000 to around US$100,000, and the forecast in 2026 from US$300,000 to approximately US$150,000, believing that the buying support brought by ETFs and corporate allocations is weakening.

Glassnode research shows that Bitcoin has formed a pressure structure similar to January 2022 in the range of US$80,000 to US$90,000, and the market's unrealized losses are close to 10% of the market value, reflecting that the market is in a state of "liquidity constraints and macro sensitivity", but has not yet entered a comprehensive sell-off stage.

10x Research directly judged that Bitcoin has entered the early stage of a bear market, and on-chain data, capital flows and market structure all show that the downward cycle has not yet ended.

From a more macro perspective, the current trend of Bitcoin is not only related to the encryption market itself, but also a reflection of the global macro cycle. The next week is regarded as a key macro observation window:

The European Central Bank, Bank of England and Bank of Japan will announce interest rate decisions, and the United States will also release a variety of employment and inflation data. The data will provide an important "reality check."

The Federal Reserve released an unusual signal at its December 10 meeting: not only did it cut interest rates by 25 basis points, but there were also three dissenting votes. Powell even pointed out that the previous employment data may have been overestimated. The next week's data will affect the market's core expectations for 2026 - whether the Federal Reserve can continue to cut interest rates or whether it will have to pause for a longer period.

For risk assets, the answer to this question may be more important than the long-short debate on any single asset.

Three: Why the consensus failed: BTC predictions in 2025 collectively "overturned"”

At the beginning of 2025, the Bitcoin market was optimistic. Institutions and analysts generally predicted that the price would exceed US$150,000 by the end of the year, and some were even bullish on it reaching more than US$200,000. However, the reality is exactly the opposite: Bitcoin has fallen by more than 33% from its October high of about $126,000, and it plummeted 28% in November. The current price is fluctuating around $92,000.

This widespread forecast error is worth pondering: Why were market expectations so consistent at the beginning of the year? And why did almost everyone get it wrong?

1. Forecast comparison: There is a clear contrast between the beginning of the year and the current situation.

1. Three reasons to support optimistic forecasts at the beginning of the year

At the beginning of this year, institutions were collectively optimistic about Bitcoin, mainly based on the following three "certainty" logics:

Halving effect: Historical data shows that the price peak often occurs 12-18 months after Bitcoin halving, and 2025 happens to be in this window period, so the market is generally looking forward to a new round of bull market.

ETF capital inflows: After spot ETFs are approved, the market expects a large influx of traditional institutional funds, with net inflows likely to exceed US$100 billion in the first year.

Improved policy environment: The Trump administration has a friendly attitude towards cryptocurrency, and the market believes that policy uncertainty has been reduced, which is conducive to long-term development.

Under these expectations, the average target price given by institutions at the beginning of the year reached US$170,000, which is equivalent to an expected increase of more than 200% within the year.

2. Comparison between major institutions’ forecasts and actual situations

| Institution/Analyst | Year-end 2025 Forecast (USD) | deviation from status quo |

|---|

| VanEck | 180,000–250,000 | +95% ~ +170% | | Tom Lee | 150,000–250,000+ | +65% ~ +175% | | InvestingHaven | 80,000–151,000 | -13% ~ +64% | | Standard Chartered | 200,000 | +115% | | JPMorgan | 94,000–170,000 | +2% ~ +85% | | Most institutions | Over US$150,000 | Deviation exceeds 80% | | the only one close | MMCrypto (Bearish to 70,000-80,000) | Minimal deviation |

It can be seen from the predicted distribution:

Radicals are in the majority: 8 institutions forecast more than $150,000, with significant deviations;

There are fewer moderates: For example, JPMorgan gives a range, leaving a certain amount of room.;

The contrarians are the only ones who are accurate: only MMCrypto analysts clearly warned of the downside risk, and their judgments are closest to the actual trend.

A noteworthy phenomenon is that the most aggressive predictions are often made by well-known large institutions, while relatively small technical analysts make more accurate judgments.

Four: Consensus failure: Why did collective predictions overturn?

1. Benefits of homogeneous expectations and failure

At the beginning of the year, almost all institutions relied on the same logic: ETF funds would continue to flow in and become the key to promoting the bull market. But when the "good news" has been fully digested by the market, what the market needs is no longer "in line with expectations" but "exceeds expectations." In fact, ETFs have become a channel for capital outflows when the market goes down. When everyone believes the same story, it's an outdated story.

2. Disconnection between cyclical laws and macro reality

Many institutions rely on the historical rise cycle after the Bitcoin halving as a basis for prediction, but ignore that the macro environment in 2025 is already different. What we are facing now is the reality of the Federal Reserve maintaining high interest rates, not the historical background of loose liquidity. When interest rates continue to rise and the market environment changes, the "deterministic" cycle model that relied on halving in the past will naturally fail.

3. Interest-related and structural deviations

The most inaccurate predictions are mostly from large institutions, which are often providers of Bitcoin-related products or services. Bullish forecasts are not only good for business, but also cater to the psychological needs of customers with high-cost positions. The forecasts of these institutions are often optimistic due to the pursuit of brand exposure, customer trust and business traffic, and it is difficult to overturn their past positions. In contrast, the judgments of small independent analysts are closer to reality.

4. Misplaced understanding of asset attributes

The market often views Bitcoin as "digital gold" or an anti-inflation asset, but in fact, it is more like a highly volatile technology stock that is extremely sensitive to liquidity. In a high interest rate environment, Bitcoin's appeal as a "zero-interest asset" decreases significantly. At the beginning of this year, most institutions incorrectly assumed that the Federal Reserve would start a rate cut cycle. This key misjudgment ultimately led to the overall collapse of optimistic forecasts based on easing expectations.

Conclusion: How should we think about forecasting?

This round of collective misjudgments in 2025 reminds us that the prediction itself may be a false proposition. Bitcoin is affected by multiple complex variables, and it is difficult for a single model to accurately capture its future direction.

The value of institutional reports lies in helping to understand current market consensus and sentiment, rather than being used directly as an investment guide. When the mainstream views are highly consistent, it is even more necessary to be alert to the collective blind spots and structural biases that may be hidden.

History does not simply repeat itself. The driving factors and macro background of each cycle are different. Thinking independently, remaining open to opposing voices, and always putting risk management first - these are the key capabilities to respond to market changes.

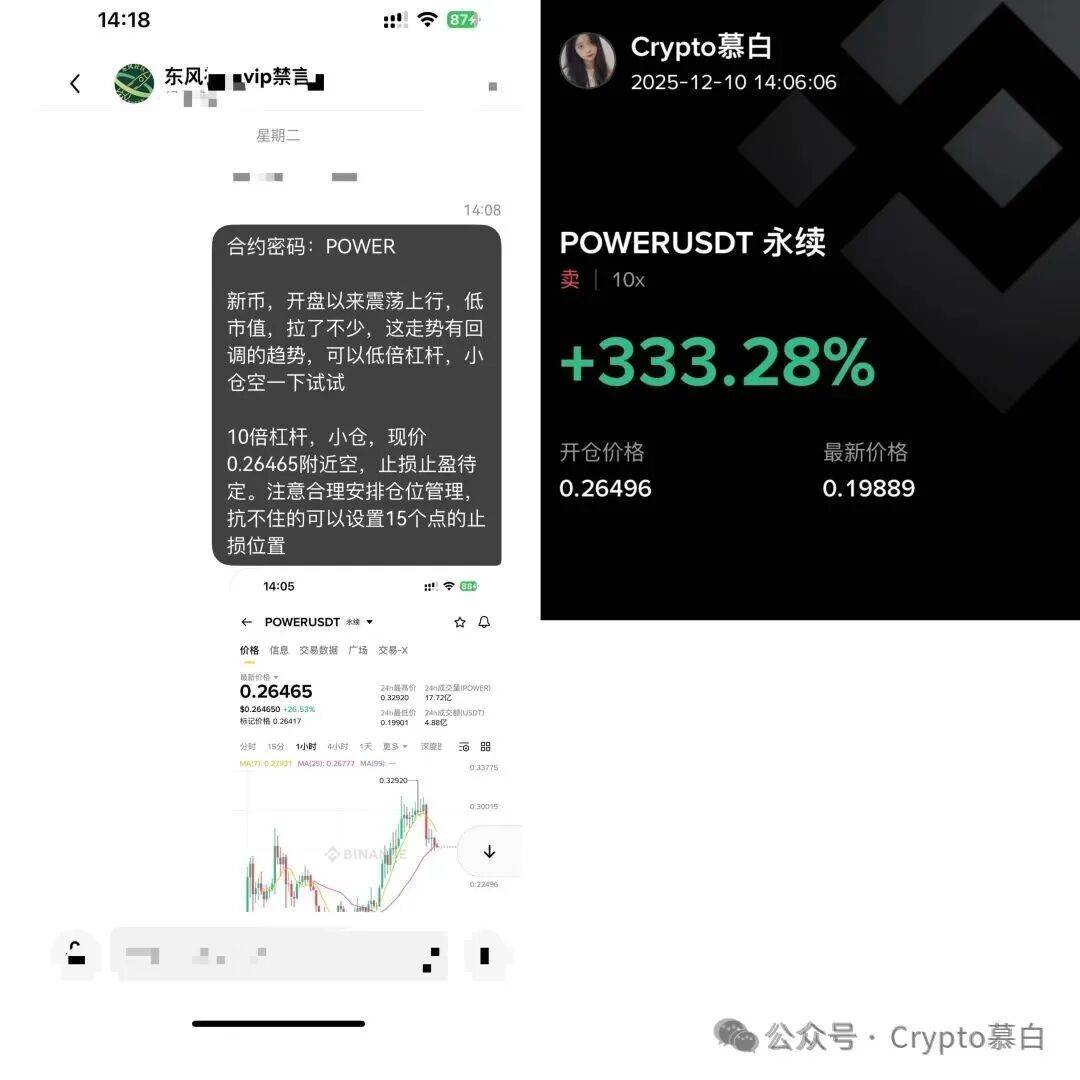

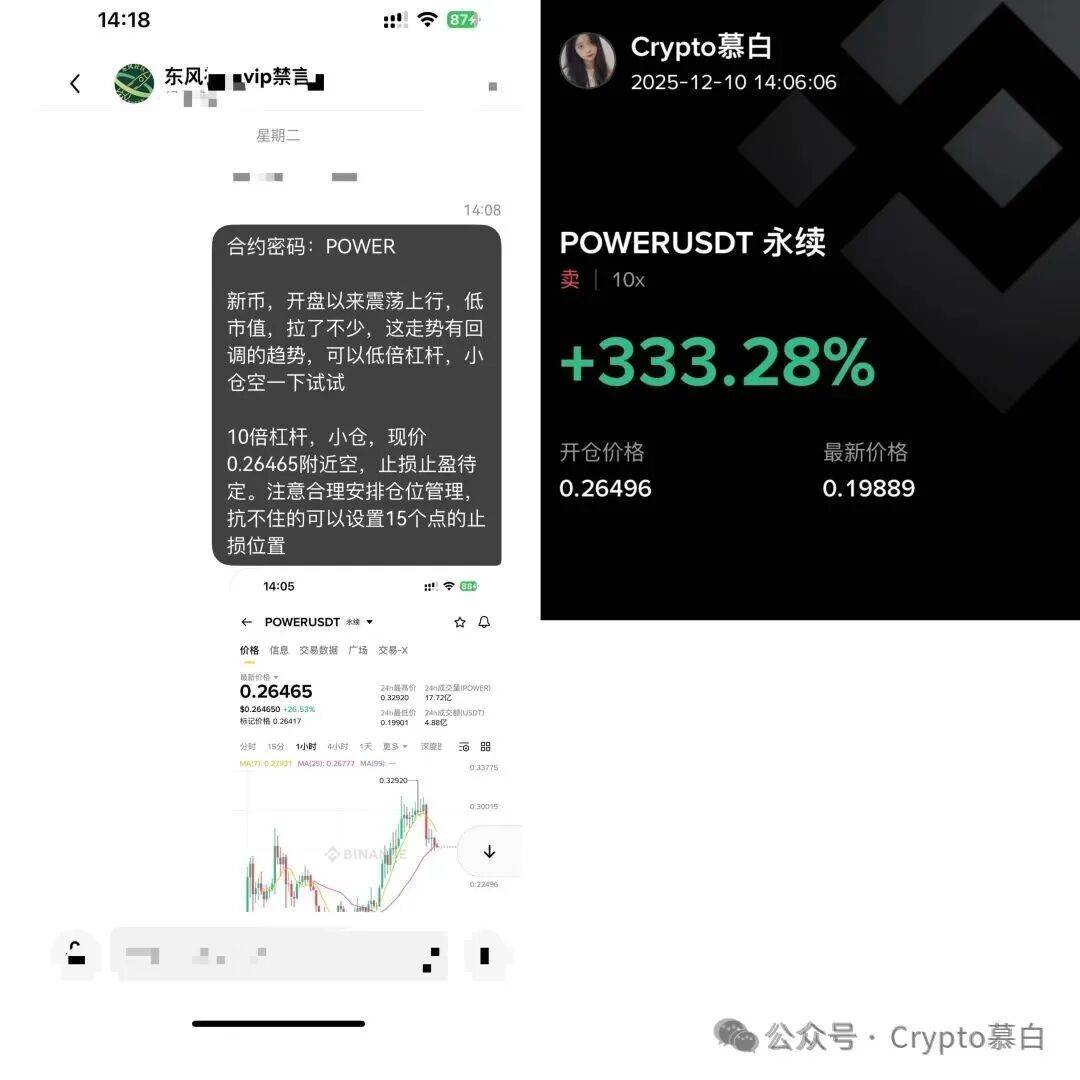

Five: Review of Dabai VIP code strategyOn December 9th, on Tuesday, Dabai vip shorted POWER with 10 times leverage near 0.26465 and gained 3 times more meat.

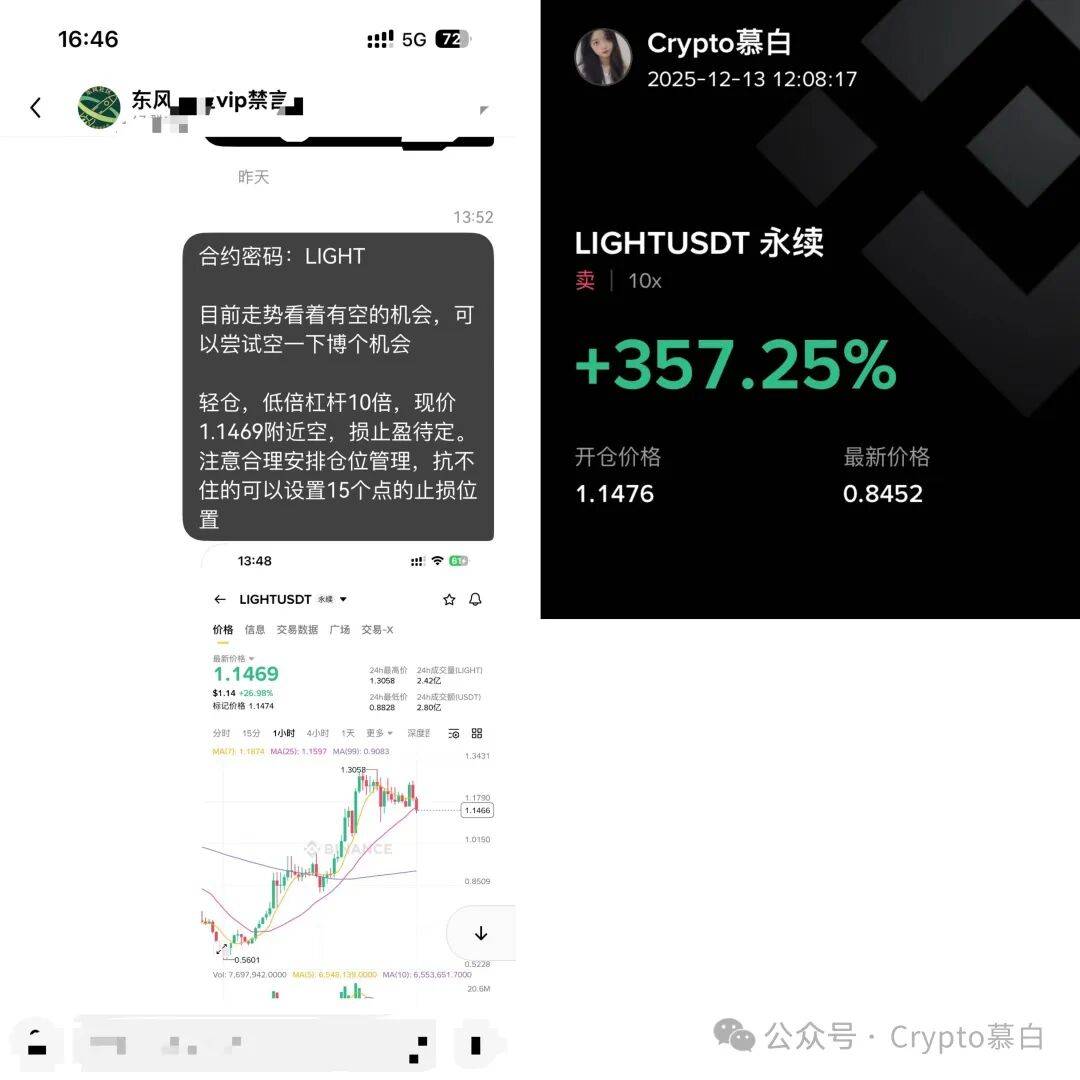

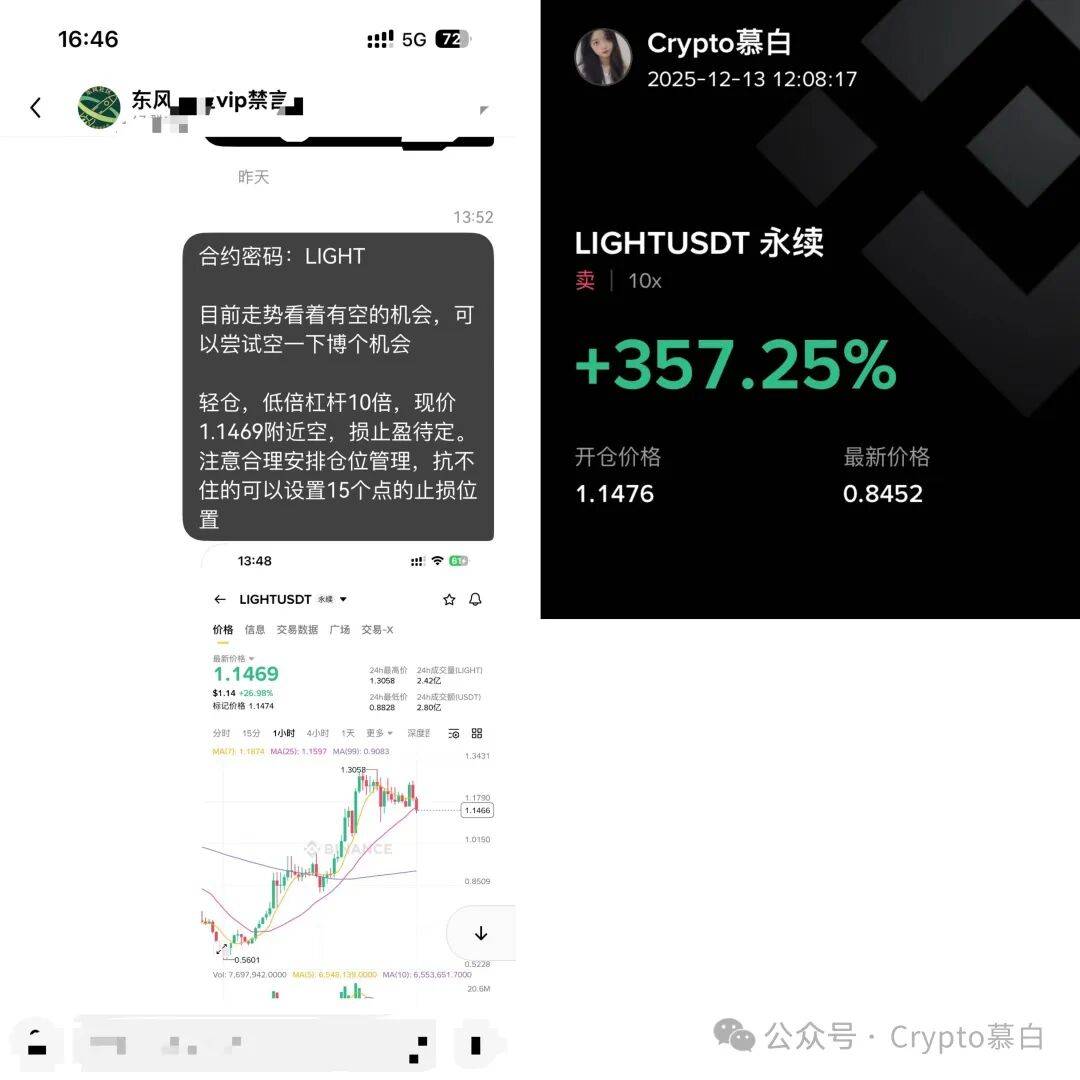

On December 12th, on Friday, Dabai vip shorted LIGHT with 10 times leverage around 1.1469 and got more than 3 times the meat. Dabai's general strategic policy is still so powerful. This is Dabai's strength, which is obvious to all. The bright cards are public and refuse to be an afterthought! If you want to keep up with Dabai's footsteps as soon as possible, come to Dabai VIP. Dabai VIP has more wealth passwords. As usual, come to Dabai VIP to get it!

The Bai family's secret cabin is open! Get on board for a limited time!

One-on-one exclusive strategy | Precision sniper contract/spot | Golden Dog News on the chain

privilege:

✅ Dabai personally brings orders and interprets orders in real time

✅ High winning rate password, precise ambush

✅ Spot/contract/on-chain golden dog, full coverage

How to join?

1️⃣ Private chat with Dabai (QQ: 3328675755 (can be added repeatedly if exceptions occur)

| Telegram: mubai1015)|

2️⃣ Bring screenshots of holdings (capital verification is priority)

3️⃣ Scan the QR code to join the group and eat meat without getting lost!

Seats are limited, first come first served! Never miss it again!

#Currency Circle #Blockchain #BTC #ETH

|