65638

|

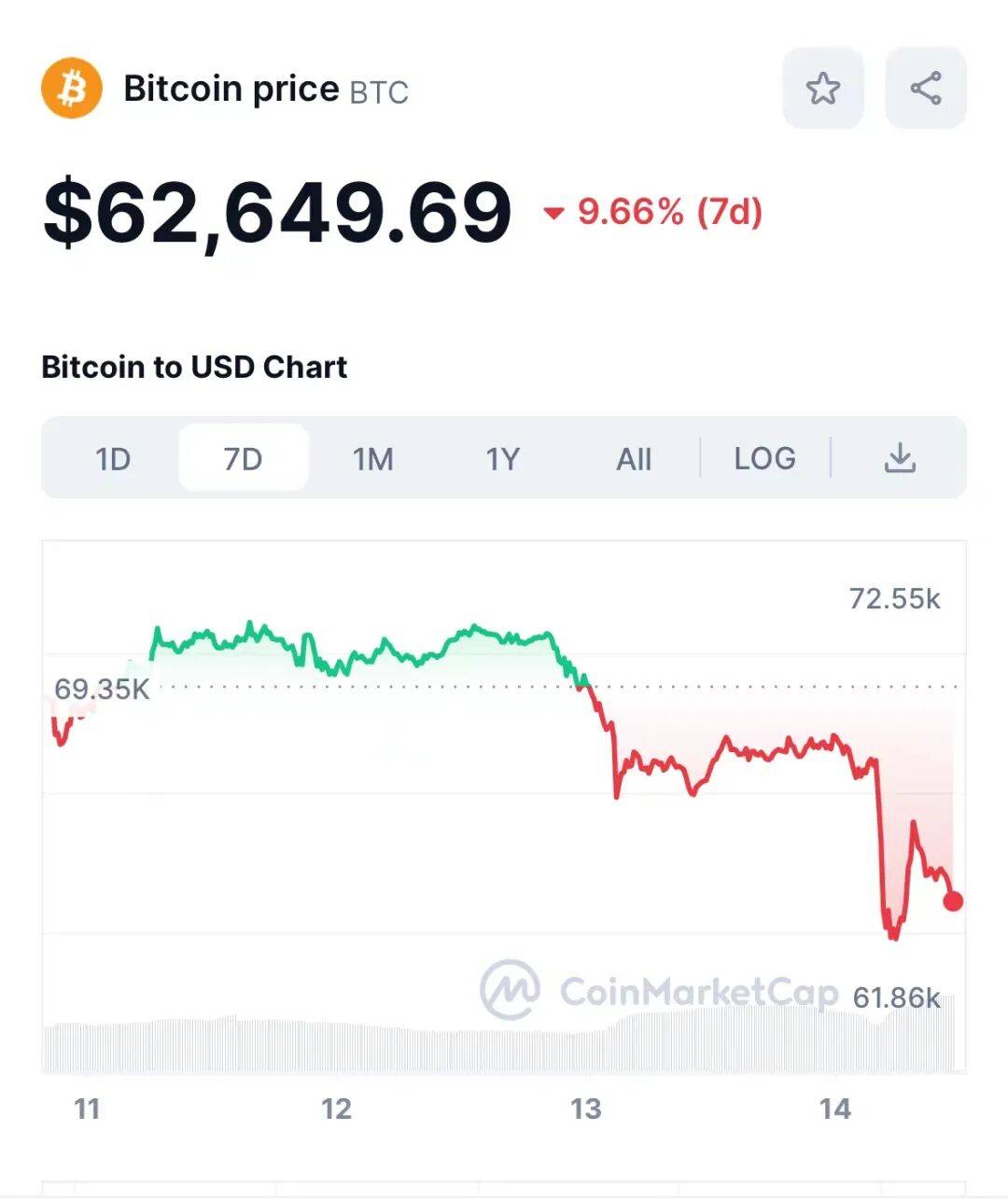

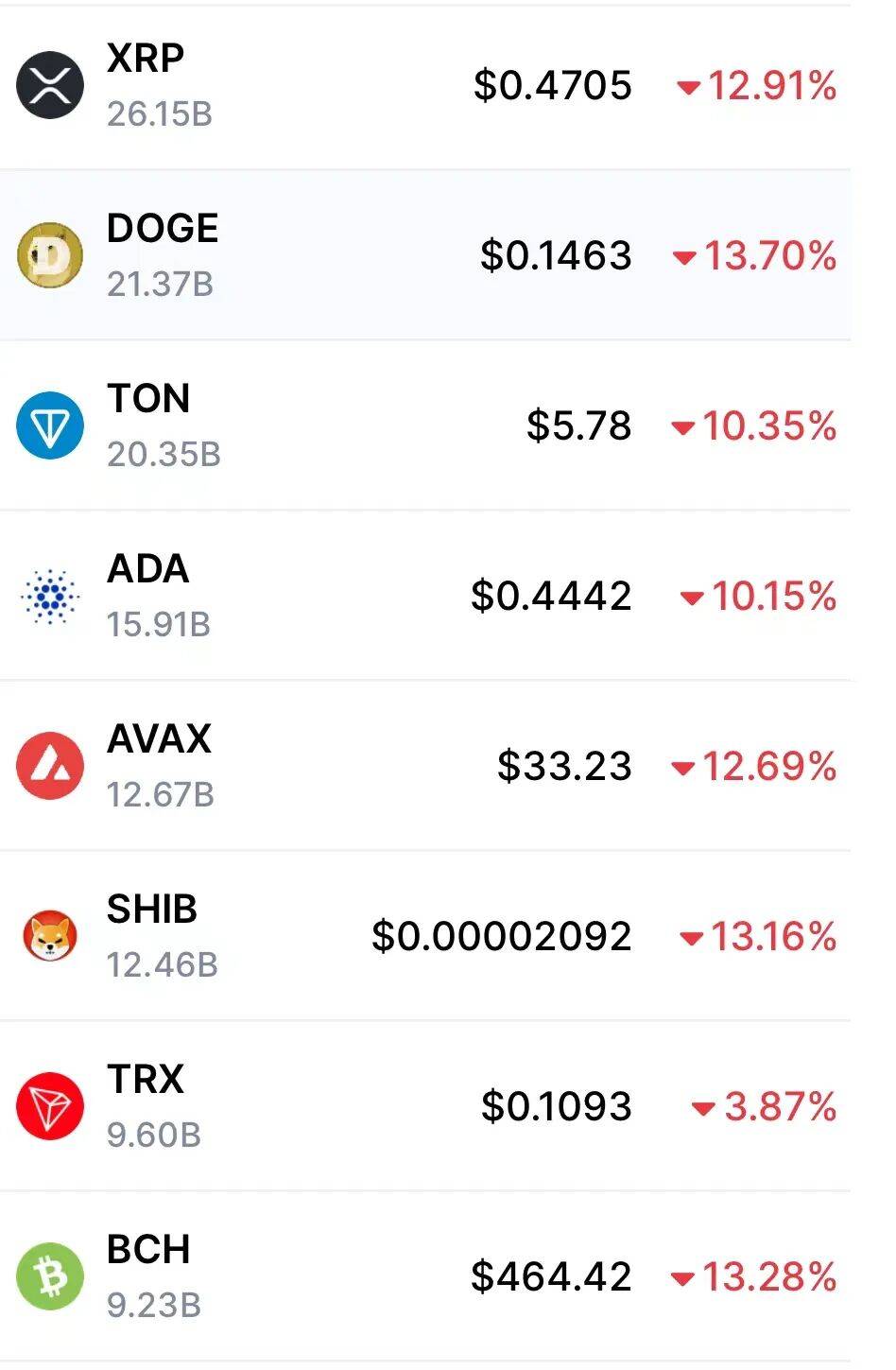

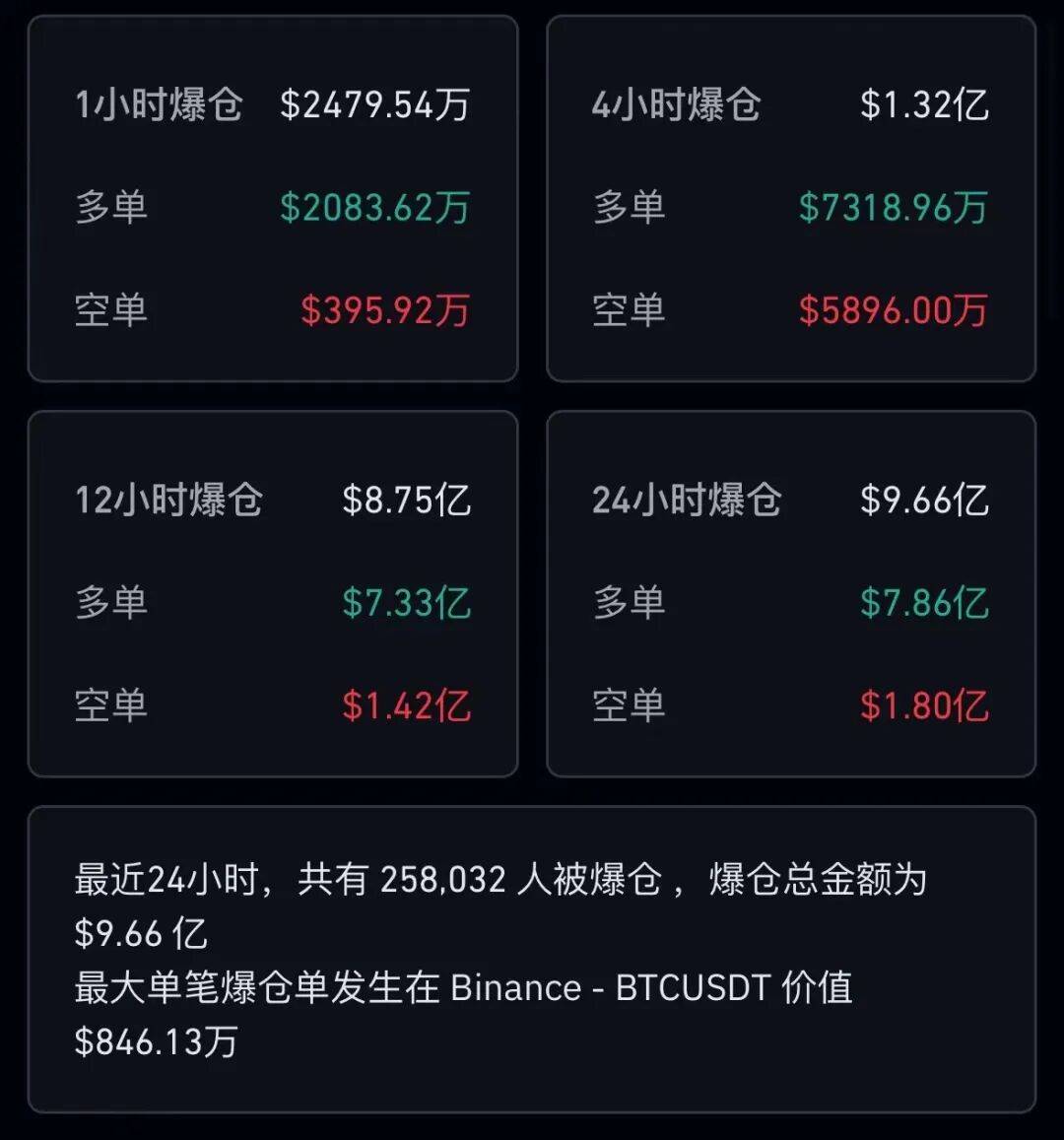

The virtual currency market staged another terrifying night. Following the severe setback in the virtual currency market on April 13, the price of Bitcoin crashed again on April 14, Beijing time, once falling below the $60,000/coin mark, with a 24-hour drop of more than 7%. Starting at 4 a.m. on the 14th, the most feared scene for investors in the currency circle appeared: liquidation text messages continued to appear on mobile phones, and the price of Bitcoin instantly plummeted by US$5,000 (approximately RMB 36,187) within 15 minutes, causing a large number of investors who were bullish on contracts to liquidate their positions. A person who was exposed to extreme market conditions said: “Bitcoin has been repeatedly switching between surges and plunges recently. Excessively high prices make Bitcoin dangerous. Reversals in market sentiment often occur in an instant, and money evaporates faster than water. ” As of press time, the price of Bitcoin continues to fluctuate, temporarily trading at $62,649 per coin, with a 24-hour drop of more than 9%.  Image source: CMC Bitcoin suddenly plummets In the early morning of April 14th, Beijing time, Bitcoin suffered a large-scale sell-off, and the price dropped rapidly, reaching as low as $59,968 per coin, and then briefly stopped falling and rebounded. Since 11 a.m., the price of Bitcoin has once again plunged sharply downward, falling below the integer mark of US$63,000 per coin. Other currencies in the virtual currency market have plummeted. Ethereum fell by more than 8.5% in 24 hours, and Dogecoin fell by 13.72% in 24 hours. CoinGecko data shows that the total market value of virtual currencies is US$2.4 trillion, with a 24-hour decline of 5.8%.  Image source: CMC According to Coinglass data, in the past 24 hours, a total of 258,000 people liquidated their positions in the virtual currency market, with a total liquidation amount of US$966 million (approximately RMB 6.99 billion), of which long positions liquidated US$787 million and short positions liquidated US$179 million.  Image source: Coinglass Bitcoin has experienced multiple flash crashes this week. For example, on April 13, Beijing time, the price of Bitcoin once fell by more than US$2,000, from US$67,100 per coin to below US$65,000 per coin. Bitcoin spot ETF capital inflows have also continued to decrease this week. SoSoValue data shows that on April 12, Eastern Time, Bitcoin spot ETF funds had a net outflow of US$55.07 million. Grayscale GBTC had a net outflow of US$166 million in a single day. The Bitcoin spot ETF with the largest single-day net inflow was BlackRock IBIT, with a net inflow of approximately US$111 million. As of April 12, the total net asset value of Bitcoin spot ETFs was US$56.22 billion. Industry insiders said that Bitcoin's sluggish performance this week was mainly due to the intensification of geopolitical uncertainty and the market's risk aversion sentiment spreading to virtual currency assets. Iran launches missile and drone attacks on IsraelBiden: The United States will not participate According to the news, in the early morning of the 14th local time, Iran’s Islamic Revolutionary Guard Corps began launching large-scale missile and drone attacks on Israeli targets. On the 14th local time, Iran’s Permanent Mission to the United Nations posted on social media that Iran’s attack on Israel can be considered “over.” According to the latest report from The Times of Israel, after the attack, Israeli Prime Minister Netanyahu posted on the social media platform X, saying, “We intercepted, we blocked, and we will win together. ”This was Netanyahu's "first public comment" since Iran launched attacks on Israeli targets. According to news from the Israel Airports Authority on the 14th local time, Israeli airspace has reopened at 7:30 local time (12:30 Beijing time). According to Israeli media reports on the 14th local time, Biden stated in a phone call with Netanyahu that the United States will oppose any Israeli counterattack against Iran and will not participate in it. The important “halving” event is approaching In addition, industry insiders said that investors' high expectations and speculation about Bitcoin's "halving" event may push up prices before the "halving". Once these expectations are not met, a large number of investors may be inclined to take profits, causing the currency price to plummet. The Bitcoin “halving” event refers to the halving of the rewards received after the production of new blocks, which occurs approximately every four years. The specific time depends on the Bitcoin network's block generation rate, which will reduce the supply of Bitcoin. The halving of block rewards means that it will take longer for all Bitcoins to enter circulation. Recently, a report from JPMorgan Chase pointed out that the Bitcoin “halving” event may have a serious negative impact on the profitability of Bitcoin miners. The report warns that the price of Bitcoin may plummet to $42,000 per coin as a result, a potential fall of more than 36% from the current price. Bitcoin has been on a meteoric rise this year. The latest report released by Messari Company shows that Bitcoin achieved a 69% increase in the first quarter of this year. The Bitcoin spot ETF was the driving factor driving the price increase, with capital inflows exceeding US$12 billion in the first quarter. The Spot Bitcoin ETF currently holds 831,000 Bitcoins, worth approximately $59 billion. It is worth noting that after Bitcoin prices broke through all-time highs, some long-term holders began to choose to cash out. Glassnode data shows that since the price of Bitcoin exceeded $40,000 at the end of 2023, the positions of long-term holders (held on the chain for more than 155 days) have continued to decline, while the positions of short-term holders have increased. During this time, long-term holders sold a total of approximately 900,000 Bitcoins. Source: China Securities Journal WeChat, CCTV News Client, Xinhua News Agency Editor: Gong Wenting Reviewer: Zhou Ni Duty supervisor: Xu Qianqian Reviewer: Hu Wulong |