8655

|

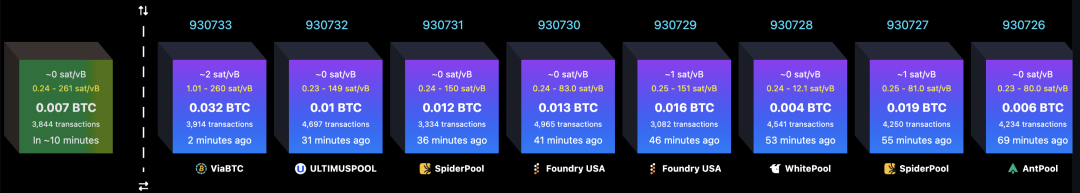

Click on the blue text Follow us DAILY NEWS Web3 Featured  All fresh information is here  DAILY NEWS News hot spots at a glance BTC The answer is still in time…   On January 3, 2009, Bitcoin was first launched on a host in Helsinki, Finland. From that moment on, a dividing line seemed to have been quietly drawn in the history of human civilization. On one side, there was the "prehistoric era" before the emergence of Bitcoin.”; On the other side is the "new era" after it came to the world. The person who started Bitcoin used a pseudonym that has not yet been revealed: Satoshi Nakamoto. Five days later, on January 8, 2009, he officially released the Bitcoin v0.1 version on the cryptography mailing list hosted at metzdowd.com.  From 2009 to 2026, time flies, 17 years have passed in the blink of an eye. If the life of Bitcoin is compared to the growth trajectory of a person, then at the age of 17, he is standing on the dividing line between teenagers and adults - the end of youth has not yet dissipated, but responsibility has quietly approached. In another year, Bitcoin will turn 18; 2028, 19 years old; 2029, 20 years old; 2030, 21 years old. Pushing back 20 years from 2030, the time happens to be back to 2010. That year, on February 14, 2010, Satoshi Nakamoto wrote something that was later quoted repeatedly: “I’m sure that in 20 years, there will either be a very huge transaction volume or no transaction volume at all. 」 This sentence is not a judgment on the price, but a deduction of the long-term operating mechanism of Bitcoin - when the block rewards gradually decrease until they are close to disappearing, transaction fees will become the main source of income to support the operation of nodes.  So, looking back at the node of 2026, is the current reality of Bitcoin moving closer to this vision? Judging from on-chain data, a Bitcoin block is currently filled with about 4,000 transactions on average, but the corresponding handling fee is only about 0.015 BTC. Calculated at the current price of approximately US$90,000, this fee income is only approximately US$1,000. From the cost side of miners, the situation is completely different. According to data from MacroMicro, on January 2, 2026, the average BTC mining cost across the entire network was approximately $103,664/BTC. The current main income of each block still comes from the block reward of 3.125 BTC, plus a small amount of handling fees, totaling about 3.14 BTC. From this we can roughly calculate: The combined cost of mining a block is ≈ 103,664 × 3.14 ≈ $325,500. In other words, miners paid a cost of more than 300,000 US dollars, but the return from handling fees was only more than 1,000 US dollars. If one day in the future only fee income is left, this amount will obviously not even be able to "fill the gap between teeth".

From a user experience perspective, the current fee for an ordinary SegWit address chain transfer at medium priority (0.5 sat/vB × 140 vB) is approximately US$0.06. Even if this cost is magnified 200 times (corresponding to $20 million / $100,000), it is only about $12, which does not seem completely unacceptable. The time dimension cannot be ignored either. From the current age of 17 to the age of 21, Bitcoin only has 4 years left. Of course, after 4 years, the block reward will not immediately return to zero, but will continue to be halved to 1.5625 BTC. But it should be noted that this production halving mechanism every four years was originally designed by Satoshi Nakamoto. He couldn't have been clearer when he wrote that sentence in 2010: After 20 years, there will still be a block reward of 1.5625 BTC for each block. So, back to this point in time today - when the block is filled with transactions, it cannot provide enough fee income.; When the "quantity" of transactions exists, it has not yet been converted into the economic foundation that supports the network. ; Which state is the Bitcoin network at this moment closer to that Satoshi Nakamoto said back then? Is it "a very large transaction volume"? Or "no trading volume at all"? Perhaps there is no rush to get an answer to this question. But in the years since Bitcoin has entered adulthood, it can no longer be ignored. Bitcoin has never been a "finished" system. It is more like an experiment that is deliberately stretched out for decades - the parameters are hard-coded, the path is made public, but the result is left to time and the participants to decide together. 17 years ago, what Satoshi Nakamoto left behind was not just code, but also a set of assumptions about incentives, costs, and human nature. Block rewards will gradually disappear, and handling fees will take over.; If the transaction volume is large enough, the network can be self-sustaining; If not, it will naturally lead to the end. Looking back in 2026, what we see is a network that is continuously used, but has not yet completed its most critical "handover." The block is filled, but the value is not yet equal; Deals are happening, but incentives still rely on subsidies. In the next few years, Bitcoin will not provide an immediate answer. It will only continue to move forward through halving, gaming, expansion and compromise. This is not a judgment of success or failure; Rather, it is a record of reality. The answer is still on the way.  Past Expect push recommend # A picture to recall the ups and downs of the crypto world in 12 months this year # Why was Zhao Changpeng pardoned? The reason is... #The "Manhattan Project" in the United States was launched, and 24 giants including OpenAI, Google, and others started the "War on Technology Pearl Harbor"」 # Hyperliquid Crossroads: Follow Robinhood, or continue the Nasdaq economic paradigm? |