25908

| Boson Technology Quantification | Boson Technology official website: www.bosen0369.com  1. Market ObservationsThe previous partial government “shutdown” caused by disputes over immigration enforcement was temporarily resolved when Trump signed the funding bill. However, the funds allocated to the Department of Homeland Security will only last until February 13, leaving uncertainty regarding future negotiations. Meanwhile, Federal Reserve Governor Mario Draghi has resigned from his role as chairman of the White House Economic Advisory Committee. In terms of geopolitics, relations between the United States and Iran remain tense. The U.S. military downed an Iranian drone near the aircraft carrier USS Lincoln, and there have been reports of Iranian speedboats harassing American oil tankers. Although Trump stated that negotiations are ongoing, White House spokesperson Sarah Huckabee-Levitt emphasized that military options would still be considered if diplomacy fails. Duan Shaofu, deputy secretary-general of the China Nonferrous Metals Industry Association, revealed that China is considering including copper concentrate in its national strategic reserves in order to address supply pressures and enhance its influence within the industrial chain. Funds have flocked into safe-haven assets. Although spot gold once tumbled by more than 20%, falling as low as $4,402 per ounce, its price has now rebounded above the $5,000 mark, with gains of up to 2.3% during the day. Goldman Sachs still maintains its forecast that the price of gold will reach $5,400 by December 2026. Deutsche Bank continues to target $6,000, while JPMorgan Chase also remains bullish on gold, raising its target for the end of 2026 to $6,300. JPMorgan believes that despite the recent market volatility sparked by the nomination of the new Federal Reserve chairman, the long-term upward trend of gold has not changed. The main driving force behind the increase in gold prices comes from the continuous demand for gold purchases by central banks around the world, as well as investors seeking to diversify their investment portfolios. Compared to gold, the bank is more cautious about the short-term prospects for silver. After experiencing a plunge of over 40%, the silver market has now rebounded by more than 20%, resulting in significant losses for individual investors. In January, retail investors made record amounts of investments in silver ETFs. However, leveraged ETFs such as AGQ saw a sharp 60% decline. In the domestic silver investment market, the Guotou Silver LOF has been hitting the daily limit down for three consecutive days, and its premium rate has dropped to 64.6%. Affected by AI technology, the S&P North American Software Index plummeted by 15% in January, marking the largest single-month decline since 2008. Anthropic’s launch of its AI tool further fueled market panic, leading to the worst sell-off in software stocks since April last year. Stocks of companies like Thomson Reuters and LegalZoom tumbled by more than 20% as investors feared that the competitive advantages of traditional software companies were being eroded. Analysts at Jefferies described the current situation as the “end of SaaS,” while Morgan Stanley’s Toni Kaplan noted that it signifies intensified competition in the industry. Despite Palantir’s 7% surge against the trend, the stock prices of private credit firms with significant software holdings, such as Blue Owl, suffered. Strategists at UBS even warned that if AI developments proceed too aggressively, the default rate on private credit in the United States could soar to 13%. As gold and silver rebounded, Bitcoin continued to fall, its price once dropping below $73,000—erasing all the gains it had made since Trump was re-elected. David Duong, Head of Global Investment Research at Coinbase, explicitly stated that the prevailing narrative in the market—that an increase in the price of gold will drive up the price of Bitcoin—is incorrect. Adam also used the Engle-Granger test to demonstrate that there is no cointegration relationship between Bitcoin and gold. Santiment data shows that although retail investors are panicked by Bitcoin prices below $60,000, this could potentially create an opportunity for a short-term rebound. Alex Thorn, head of research at Galaxy Digital, noted that 46% of the total Bitcoin supply is currently at a loss, and the price could drop to around $58,000, which corresponds to the 200-week moving average, or even test the $56,000 level. However, he believes that this would typically represent an excellent entry point for long-term investors. Analysts at Compass Point believe that the bear market is entering its final stage, with the bottom likely lying between $60,000 and $68,000; Meanwhile, Killa predicts that the bottom will occur in Q3, and plans to buy in batches at prices ranging from $69,000 to $45,000. Sykodelic views this as a mid-term peak and a massive bear trap, but is optimistic about a subsequent rebound. Nevertheless, Matt Hougan, the chief investment officer at Bitwise, believes that the “crypto winter” is coming to an end, and the market is more on the verge of recovery than of further decline. The Ethereum market is also facing significant deleveraging pressures; prices are on the verge of falling below $2,100, and the funding rates have turned negative, indicating extreme market panic. On-chain data shows that since February 1st, Trend Research has reduced its ETH holdings by $352 million and repaid loans to reduce its leverage. The liquidation price range for its remaining borrowed positions is concentrated between $1,685 and $1,855, with the majority falling around $1,800. If prices drop within this range, these positions could face liquidation risks. According to Ali Charts analysis, Ethereum’s historical lows typically occur below the 0.80 MVRV range, which is around $1,959. Despite the pessimistic short-term indicators, Trend Research founder Yi Lihua remains firmly optimistic about the future of a major bull market and maintains his expectation that ETH will exceed $10,000. He believes that the current time is the best opportunity to buy into spot ETH. According to an analysis by Cointelegraph, while a negative turn in futures funding rates is usually considered a buy signal, its effectiveness may be significantly diminished given the current weak macroeconomic conditions in the United States and the recent pullback in technology stocks. In the world of altcoins, Geoff Kendrick, head of cryptocurrency research at Standard Chartered Bank, has lowered his price forecast for SOL in 2026 to $250, but he remains optimistic about its long-term potential, expecting it to reach $2,000 by 2030. From a technical perspective, Ali Charts warns that if SOL falls below its support level, the next targets could be $74.11 or even $50.18 ; However, some analyses suggest that SOL could form the bottom of a V-shaped reversal around the $100 level. If it manages to regain the 20-day EMA at $106, it is expected to rebound to the $120–$150 range, and in the long term, could even reach $260. Additionally, both the TVL and daily trading volume of the Solana network have recently reached new highs. 2. Key data (as of 13:00 HKT on February 4)(Data source): CoinAnk, Upbit, SoSoValue, CoinMarketCap

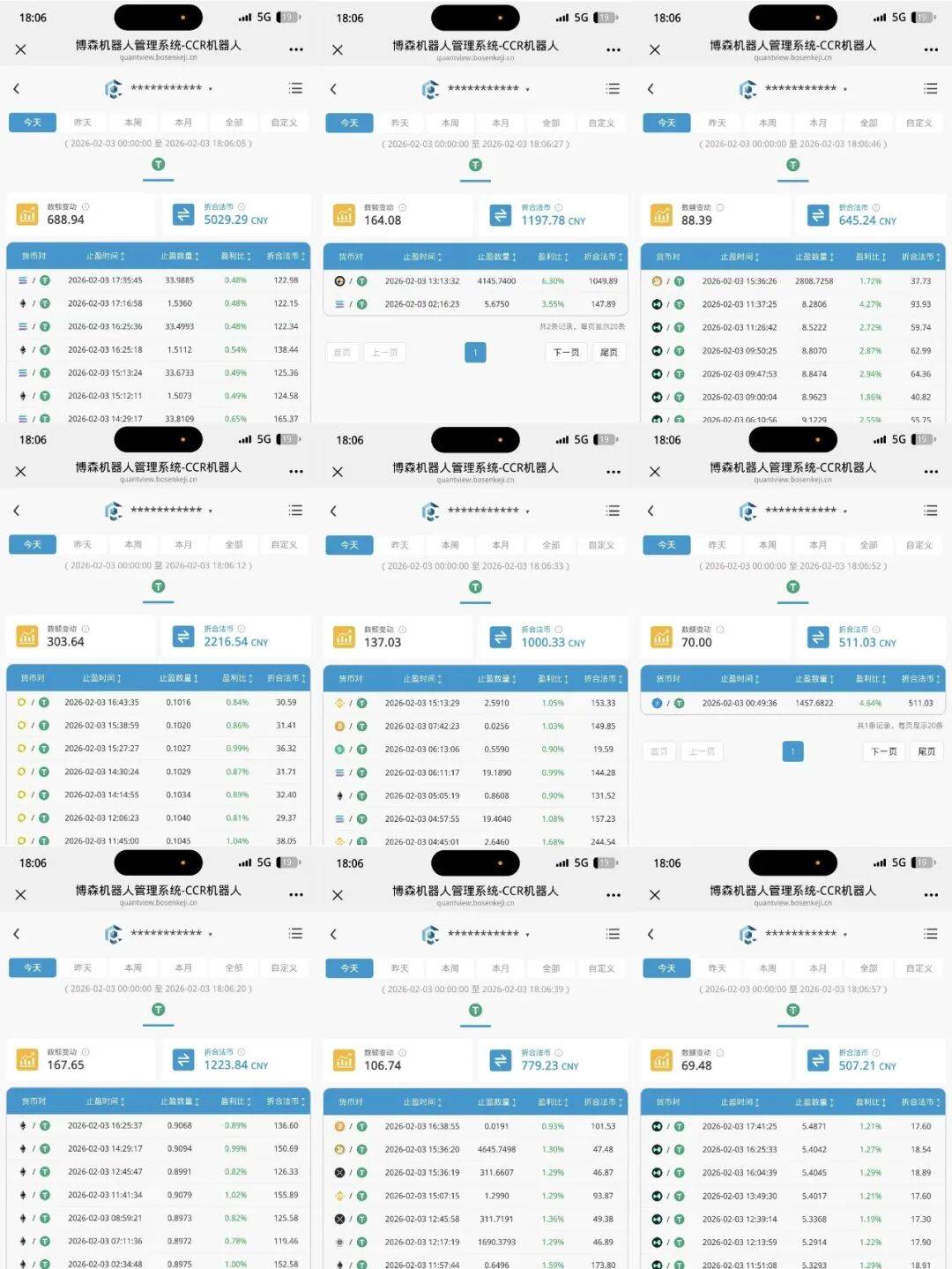

24-hour margin call data: A total of 123,352 people around the world experienced margin calls, resulting in a total loss of $515 million. Specifically, $205 million was lost in BTC, $178 million in ETH, and $20.87 million in SOL  Kind reminder Cryptocurrencies are highly speculative and subject to significant mood swings. For making prudent investments, it is essential to establish a risk management system that is independent of prices. Attaching importance to one's own investment philosophy, rather than making blind guesses, is a key quality of successful investors. Quantitative trading magic tool  What is quantitative trading? Quantitative trading refers to the use of advanced mathematical models to replace human subjective judgment. By leveraging computer technology to analyze vast amounts of historical data, it identifies various events with a high probability of generating excess returns and uses these insights to develop trading strategies. This approach significantly reduces the impact of emotional fluctuations among investors and helps them avoid making irrational investment decisions in times of extreme market enthusiasm or pessimism.  In the era of spot investment, the substantial profit margins have attracted many people to join this competitive battle. However, faced with these complex rules, many novice investors decided to back out. We have to consider that it would be great if there were a “robot” that could intelligently track bull markets, analyze different cryptocurrencies, and use advanced computational systems to help us generate profits. Is there really such a good thing? Yes. This is the CCR robot that was developed by integrating intelligent quantitative technologies.   Revenue  2.3 Evening Progress Report #ccr Spot Robots  Disclaimer: This article is intended solely for informational and educational purposes and does not constitute any financial, investment, or legal advice |

2026-02-07